In the event you’re not a fund supervisor who has amassed over $1 billion in private wealth, there’s most likely a factor or two you’ll be able to study from the handful of parents who’ve. Somewhat expertise goes a good distance in relation to investing, and there aren’t many on the market with extra expertise than Stanley Druckenmiller.

In 2010, Druckenmiller closed down the Duquesne Capital fund, which had posted a median annual return of round 30% for 30 years. He at the moment manages a comparatively small household workplace, however that does not imply you’ll be able to’t observe his buying and selling methods.

The Securities and Alternate Fee requires all these managing greater than $100 million in belongings to reveal their buying and selling exercise each three months. From stated disclosures, we will see Druckenmiller opened a brand new Citigroup (C 1.88%) place within the third quarter of 2024.

Druckenmiller is not the one billionaire affectionate for the massive U.S. financial institution. On the finish of September, Warren Buffett’s holding firm, Berkshire Hathaway, was holding greater than 55 million Citigroup shares.

Retail traders like us can study quite a bit by watching profitable fund managers. That stated, it is necessary to understand that not each commerce they make will work out as meant. This is a better have a look at what’s attracting billionaires to this dividend payer to see if it may very well be a wise addition to your portfolio.

An neglected discount?

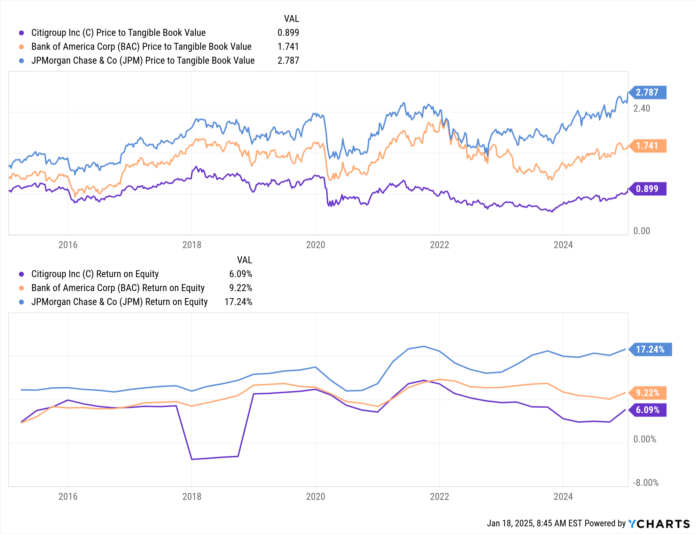

Over the previous decade, Citigroup inventory has underperformed friends Financial institution of America and JPMorgan Chase. Because of this, it is buying and selling at an ultra-low valuation of simply 0.9 occasions its tangible ebook worth. In different phrases, you should buy $1 price of this financial institution’s belongings, minus its liabilities, for $0.90 at current costs.

If tangible ebook worth informed a financial institution’s complete story, we might all get wealthy by buying financial institution shares which are buying and selling under ebook worth. Nevertheless it’s a bit of extra sophisticated than that, as a result of some banks are higher at squeezing revenue from their fairness base than others.

C Value to Tangible Ebook Worth information by YCharts

A lackluster return on fairness over the previous a number of years is why traders proceed to miss Citigroup inventory regardless of its shockingly low ebook worth.

Many traders blame an inefficient, sprawling group for Citigroup’s lackluster earnings efficiency. Just lately, although, the financial institution has trimmed underperforming worldwide operations, and the progress is displaying up in quarterly earnings experiences.

Citigroup lately reported fourth-quarter earnings that reached $1.34 per share, which was $0.10 above consensus expectations. Along with returning $2.1 billion to traders by dividends and share repurchases, the financial institution introduced a brand new plan to repurchase $20 billion price of its inventory over the subsequent a number of years.

After just a few years of holding its dividend regular, Citi raised its payout in 2023 and once more final 12 months. At current costs, the inventory affords a 2.8% yield. That is not an enormous yield, however it’s greater than double the quantity you’d obtain from the common inventory within the S&P 500 index.

A brand new Citigroup?

Citigroup’s current CEO, Jane Fraser, took the helm in 2021 with a multiyear technique to simplify and modernize the financial institution. Final December, the financial institution took a giant step ahead with the separation of its institutional banking enterprise in Mexico from Banamex, a group of shopper, small-market, and middle-market companies.

The institutional banking separation paves the way in which for a proposed preliminary public providing (IPO) of Banamex. Timelines for the sophisticated IPO aren’t set in stone but. Odds are good, although, that Buffett, Druckenmiller, and the remainder of Citigroup’s shareholders can have new shares of Banamex of their portfolios by the top of 2025.

Citigroup has made numerous progress since asserting a plan to exit shopper banking in 14 markets across the globe in 2021. The financial institution has since closed operations in 9 of these markets, and a gross sales course of is beneath means in Poland. Plus, the corporate is almost completed winding down consumer-focused operations in China, South Korea, and Russia.

A purchase now?

Along with a brand new $20 billion share-reduction program, Citigroup shareholders can sit up for important payout raises over the subsequent few years. The financial institution earned $5.94 per share final 12 months, which is heaps greater than it wants to fulfill a dividend obligation at the moment set at an annualized $2.24 per share.

It appears as if years of lackluster returns associated to a sprawling operation are almost over. Citigroup reported a return on tangible widespread fairness that rose 2.1% 12 months over 12 months to 7%, and the features aren’t anticipated to cease there. Administration expects this metric to succeed in a spread between 10% and 11% in 2026 and proceed rising.

Some dividend-focused traders would possibly keep away from Citigroup inventory as a result of it is yielding lower than 3% in the intervening time. With profitability metrics shifting in the proper course, avoiding this inventory due to a lackluster dividend looks as if a foul thought. With loads of further revenue to cut back its share depend and lift its payout, including some Citigroup shares to a diversified portfolio now appears like a wise transfer for many traders.

JPMorgan Chase is an promoting associate of Motley Idiot Cash. Citigroup is an promoting associate of Motley Idiot Cash. Financial institution of America is an promoting associate of Motley Idiot Cash. Cory Renauer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America, Berkshire Hathaway, and JPMorgan Chase. The Motley Idiot has a disclosure coverage.