On-chain information suggests the Bitcoin whales might be accumulating the dip as spot exchanges have not too long ago seen their largest withdrawal of 2024.

Bitcoin Alternate Netflow Has Turned Deep Crimson Lately

As identified by an analyst in a CryptoQuant Quicktake publish, a lot of cash has left the spot exchanges not too long ago. The indicator of relevance right here is the “trade netflow,” which retains monitor of the online quantity of Bitcoin shifting into or out of the wallets hooked up to all centralized exchanges.

When the worth of this metric is unfavorable, it means the outflows are overwhelming the inflows proper now, and a web quantity is exiting the wallets of those platforms. This type of pattern may suggest the buyers need to maintain onto the long-term, which might naturally be bullish for BTC.

However, the indicator being constructive suggests the holders are making web deposits to the exchanges. The precise implication of such a pattern on the cryptocurrency is determined by which sort of trade is receiving these deposits, spot or derivatives.

Within the case of spot exchanges, inflows may be bearish for the value, as they counsel buyers could also be trying to promote. Derivatives inflows aren’t so easy, however they do result in larger volatility for the asset, as they suggest that merchants need to open extra threat positions in the marketplace.

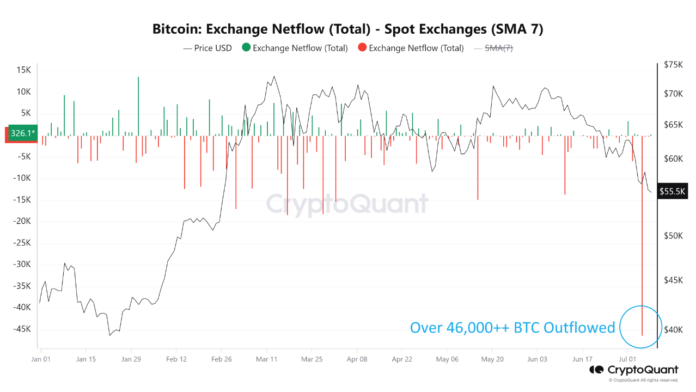

Now, here’s a chart that exhibits the pattern within the Bitcoin trade netflow, particularly for spot exchanges because the begin of the yr:

Seems like the worth of the indicator has seen a pointy purple spike not too long ago | Supply: CryptoQuant

As displayed within the graph, the Bitcoin trade netflow for the spot exchanges has seen an enormous unfavorable spike through the newest downturn within the value, doubtlessly suggesting that some massive buyers are accumulating.

In complete, this web outflow spike has corresponded to greater than 46,000 BTC leaving these platforms, equal to over $2.6 billion on the present trade price of the cryptocurrency.

Given the timing of the outflows, it’s potential that whales are banking on the value to go up from these newest lows as they’re shifting their cash off into self-custody.

It’s additionally not simply the spot platforms which are seeing this pattern, both, as one other quant has identified that the netflow for the derivatives exchanges has additionally witnessed massive unfavorable spikes.

The worth of the metric seems to have been fairly unfavorable in current days | Supply: CryptoQuant

These web outflows from the derivatives platforms may counsel the whales need to scale back their threat. However as these cash haven’t gone into spot exchanges, these derivatives customers might be planning to carry for an prolonged interval, following within the lead of the spot whales.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $57,200, down virtually 9% prior to now week.

The value of the coin appears to have general been shifting sideways throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com