The Diamba Sud mine in Senegal comprises an estimated 724,000 ounces of gold, 53% increased than final yr’s estimate.

It is presently a golden period for gold.

The yellow steel has soared to new all-time highs this yr and is dragging a gold mining inventory price watching up with it. Certainly, the value of gold is up 28% yr to this point, in contrast with about 10% for the S&P 500.

Gold is taken into account a secure haven funding that usually performs higher when danger property like shares are falling. It tends to maneuver in the wrong way of broad indexes just like the S&P 500.

However the latest run-up within the worth of gold has not been pushed by traders avoiding market danger (certainly, each gold and the S&P 500 are up considerably over the previous 52 weeks). As an alternative, the dear steel’s present rise started quickly after Russia invaded Ukraine in early 2022 and the U.S. froze Russia’s overseas trade reserves.

Pushing gold

Spooked by that sanction, the central banks of many nations, together with Russia, China, and India started large purchases of gold in an effort to diversify away from the greenback — and decrease the flexibility of the U.S. to weaponize the buck. Central banks are reportedly shopping for 80 metric tons of gold a month, about $8.5 billion at present costs.

Plus, a number of coverage actions by the Trump administration have weakened the greenback, pushing down its worth relative to different main currencies. They embody a brand new tariff regime, which has turned many worldwide traders off of dollar-based property and brought on the buck to fall, in addition to Trump’s “huge, lovely invoice,” which is able to considerably improve U.S. deficits and has despatched many traders elsewhere. In reality, Trump has repeatedly stated he desires a weaker greenback as a result of it can increase exports.

Because of this, the U.S. Greenback Index (DXY), which compares the greenback to a basket of different main currencies, is down virtually 10% yr to this point. And since gold is priced in {dollars} globally, when the greenback falls it boosts demand for gold — and consequently its worth rises.

U.S. traders trying to get in on the gold rush and construct a hedge in opposition to a possible inventory market pullback, correction, or outright bear market can look to gold-related shares in addition to the steel itself.

Shine your mild on this miner

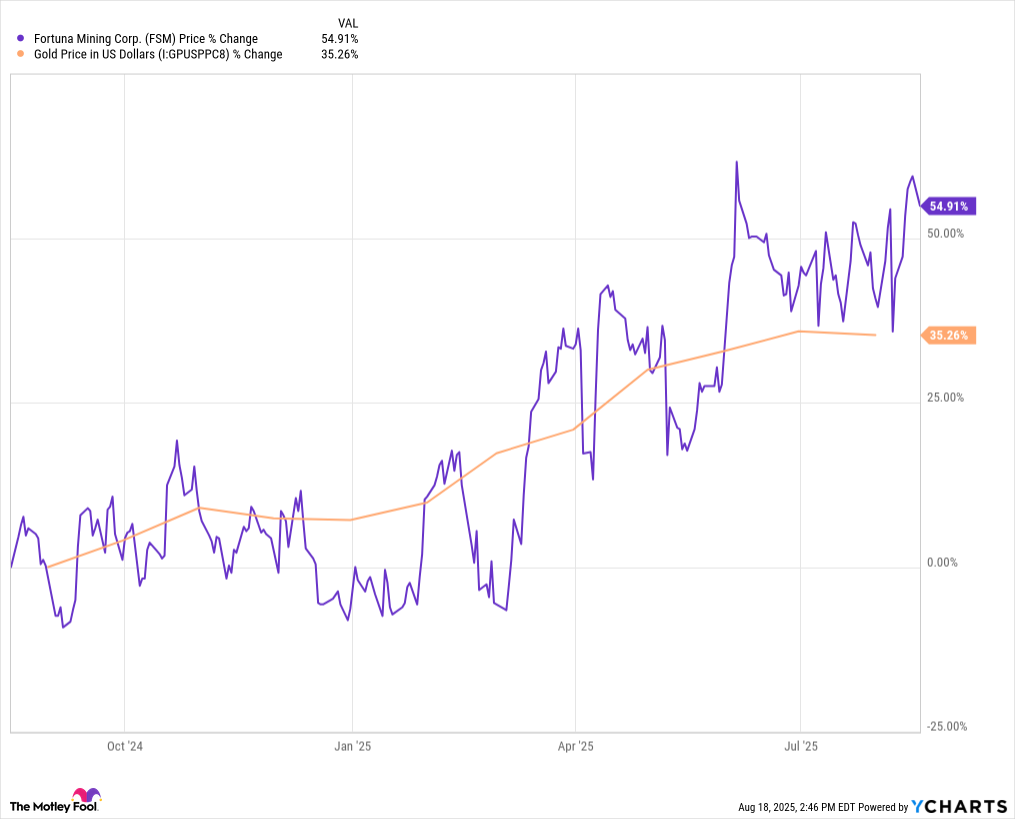

Top-of-the-line gold mining shares is Fortuna Mining (FSM -1.37%), which is up 70% yr to this point by way of Aug. 15 and about 155% over the previous 18 months.

Primarily based in Vancouver, Canada, Fortuna presently operates three mines in Cote d’Ivoire, Argentina, and Peru. And it is exploring extra websites in Senegal, Cote d’Ivoire, Argentina, Mexico, and Peru.

The corporate produced about 370,000 ounces of gold final yr, 13% greater than the yr earlier than. In the latest quarter, manufacturing from ongoing operations got here to about 62,000 ounces, 10% increased than the identical quarter final yr.

Total manufacturing has been down this yr however solely due to the corporate’s divestiture within the Yaramoko mine in Burkina Faso. That exit is taken into account a giant constructive for Fortuna, provided that the mine had only a yr of reserves remaining and civil strife within the nation threatens overseas operations.

Fortuna launched second-quarter outcomes launched on Aug. 6, and the inventory dropped 12% the subsequent day, however has since rebounded.

Picture supply: Getty Photos.

On the excellent news entrance, simply forward of its earnings report, Fortuna introduced that its Diamba Sud mine within the West Africa nation of Senegal comprises an estimated 724,000 ounces of gold, which is 53% increased than final yr’s estimate. As well as, there are probably one other 285,000 ounces within the mine that haven’t but been confirmed.

Fortuna’s inventory typically strikes on bulletins of newly found reserves and in addition rises as the value of gold does, although over the previous yr it has outpaced gold.

There are lots of gold miner shares, however Fortuna is taken into account probably the greatest resulting from operation effectivity, robust natural development and financials, and disciplined administration. Buyers will need to watch the event of its Senegal undertaking intently.

Gold is sizzling for the time being for geopolitical causes. Buyers can use gold miner shares each to hedge in opposition to a doable correction out there and to rack up some severe beneficial properties.