Here is the case for why Dutch Bros is likely to be my favourite progress inventory in the marketplace at this time.

Dwelling to 912 hand-crafted, quick-service beverage outlets throughout the western and southern parts of the USA, Dutch Bros (BROS 5.31%) has quietly turn out to be one of many extra thrilling progress shares in the marketplace.

Regardless of practically doubling its retailer rely since 2021, when the corporate debuted on the general public markets, its share worth has declined roughly 59% from its all-time highs. Moreover, Dutch Bros has rapidly established itself as a cash-generating powerhouse, sporting a 17% cash-from-operations margin.

This mixture of retailer rely growth, sturdy money era, and declining share worth makes Dutch Bros certainly one of my favourite progress shares at this time and a possible once-in-a-generation funding. Greatest but, with administration aiming to quadruple the espresso, power drink, and smoothie chain’s retailer rely over the subsequent 10 to fifteen years, this progress story may nonetheless be in its first few chapters.

Why Dutch Bros’ rising money from operations is so essential

Centered on its three core values of high quality, pace, and repair, Dutch Bros is tailored to run as effectively as doable. This effectivity performs a outstanding position in serving to the corporate generate the spectacular 17% money from operations (CFO) margins talked about earlier. In easiest phrases, CFO is the precise money the corporate generates from its day-to-day operations earlier than it spends something on capital expenditures for retailer maintenance or new retailer openings.

I hone in on this particular metric for Dutch Bros as a result of I imagine it offers us the very best shot at adequately valuing the corporate in comparison with its friends by means of a price-to-CFO (P/CFO) ratio. For the reason that firm stays in high-growth mode, it might be cheap for buyers to imagine that Dutch Bros’ P/CFO ratio is sky-high.

But that is not the case. Contemplate Dutch Bros’ P/CFO of 18 and 30% gross sales progress fee in comparison with a handful of its meals and beverage friends.

|

Corporations |

Worth-to-CFO Ratio | Final Quarter’s Gross sales Development |

|---|---|---|

|

Dutch Bros |

18 | 30% |

|

Starbucks |

17 | (1%) |

|

Celsius |

26 | 23% |

|

Chipotle |

43 | 18% |

|

Cava |

112 | 35% |

Information from YCharts.

Presently, Dutch Bros has nearly the identical P/CFO ratio as its mega-peer Starbucks (SBUX 1.78%), but the latter has struggled to ship any progress during the last 12 months. In the meantime, firms like Celsius, Chipotle, and Cava sport related progress charges as Dutch Bros however commerce at a lot frothier valuations.

This moderately priced progress is what makes an funding in Dutch Bros leap off the display at me at this time. However that is solely half the story.

To fund this progress up to now, the corporate needed to lean upon secondary inventory choices to boost money, which might dilute shareholder worth by including extra excellent shares. Nevertheless, these choices might be coming to an finish, as Dutch Bros could be very close to changing into able to self-funding its progress ambitions.

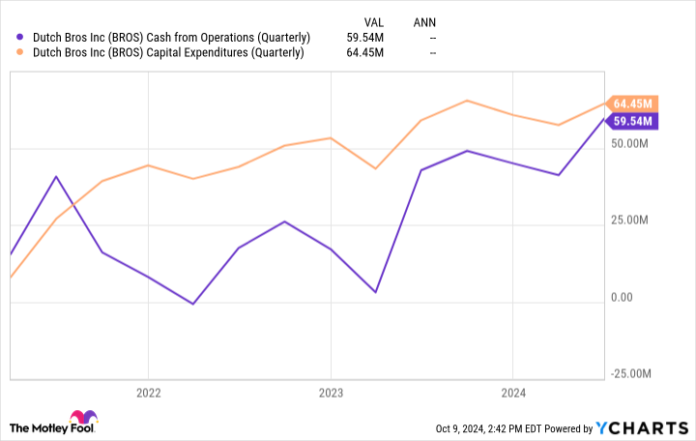

BROS Money from Operations (Quarterly) knowledge by YCharts

Steadily narrowing the hole between what it generates in CFO with what it spends on new retailer progress prices (capex), Dutch Bros is this shut to funding its progress in-house. Ought to the corporate attain this breakeven level and put an finish to diluting shareholder worth with its traditionally rising share rely, Dutch Bros’ share worth would (theoretically) modify to mirror these constructive developments.

So, with the opportunity of the corporate quickly with the ability to self-fund its growth throughout America, that leaves us with the query — how far more can Dutch Bros develop?

A protracted progress runway forward for Dutch Bros

Whereas administration’s purpose to achieve 4,000 shops over the subsequent 10 to fifteen years might sound like a stretch, the corporate has opened not less than 30 shops in every of the final 12 quarters, displaying that this is not a fever dream. With its purpose of opening round 150 new shops this 12 months, Dutch Bros’ growth may actually speed up if it proves able to funding its personal progress as its youthful shops mature into extra strong profitability.

One important purpose that I am optimistic these new shops will show to be extremely worthwhile over the lengthy haul is that the corporate already generates roughly 67% of its transactions from its 2.3 million Dutch Rewards members. These sticky gross sales from loyal, repeat clients are critically essential for 2 causes.

First, they present that older shops ought to stay robustly worthwhile, as the corporate has already confirmed efficient at launching distinctive drink concepts and promotions to drive visits. In the meantime, it additionally implies that new places will be capable to lean on the profitable program to transform first-time clients into loyal members, utilizing these promotions to convey new clients into their ecosystem.

With roughly two-thirds of the corporate’s shops in simply 5 states — and no shops at the moment additional north of Missouri or east of Tennessee — Dutch Bros’ growth potential has a long time of progress forward of it. Buying and selling with the most cost effective valuation amongst its peer group and shortly with the ability to self-fund its growth plans, Dutch Bros’ progress story may show to be a once-in-a-generation alternative.

Josh Kohn-Lindquist has positions in Celsius, Chipotle Mexican Grill, Dutch Bros, and Starbucks. The Motley Idiot has positions in and recommends Celsius, Chipotle Mexican Grill, and Starbucks. The Motley Idiot recommends Cava Group and Dutch Bros and recommends the next choices: quick December 2024 $54 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.