Traders are anxious about slowing gross sales and well being dangers. That is what they have been anxious about greater than a decade in the past, too.

Power drink firm Celsius Holdings (CELH -3.86%) was the belle of the inventory market ball lately. From the beginning of 2019 by way of the tip of 2023, shares have been up greater than 4,600%, turning a $10,000 funding into greater than $470,000. However in 2024, Celsius inventory is down about 4%, and it is down 45% from this yr’s highs.

This is not only a case of inventory market volatility. Quite the opposite, traders are digesting a number of headline points that paint a bearish image for the outlook of Celsius’ enterprise.

For starters, traders are taking a look at gross sales information that exhibits slowing progress. Traders already know that progress for Celsius is slowing — income within the first quarter of 2024 was solely up 37% yr over yr, in comparison with 95% progress within the prior-year interval. However traders and analysts who monitor gross sales tendencies for the business imagine progress is slowing even additional, prompting some analyst to decrease value targets for Celsius inventory.

There are additionally health-related considerations with Celsius making the rounds on social media. Many traders are beginning to imagine that there are well being dangers with vitality drinks. Additionally they assume that individuals are changing into extra conscious of the dangers and have consequently reduce the merchandise from their purchasing routines.

Many readers are probably too younger to recollect what was occurring with the inventory market in 2012. However a few of us (ahem, me) are sufficiently old to recollect a really related scenario with Monster Beverage (MNST 0.46%). This is what occurred again then and the way it may apply to Celsius’ shareholders at the moment.

When Monster inventory crashed exhausting

Within the decade main as much as 2012, Monster inventory was one of many biggest investments of all time. I am not exaggerating. If you happen to had invested $10,000 in Monster inventory at the beginning of 2002, you’ll have had $1.76 million at the beginning of 2012. In brief, progress was extraordinary and traders have been rewarded.

However 2012 introduced one thing completely different for Monster’s shareholders. The headlines have been chock-full of tales concerning the hazard of sugar. For instance, New York Metropolis’s then-mayor Michael Bloomberg proposed portion controls on sugary drinks that yr — it was an enormous deal.

The headlines additionally bombarded traders with tales in regards to the risks of vitality drinks, not not like at the moment with Celsius.

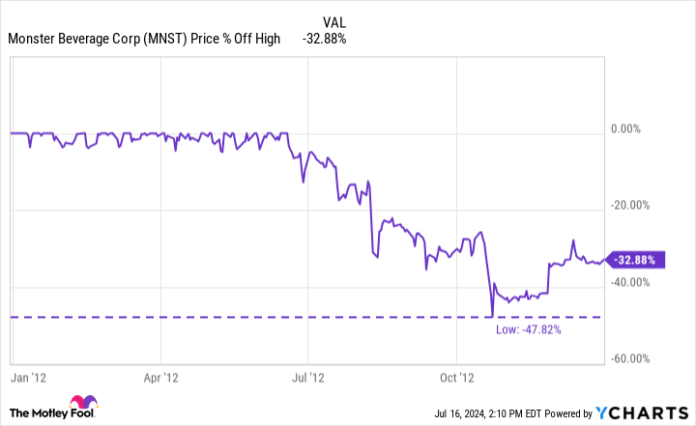

Do not misunderstand: Gross sales for Monster did sluggish to a crawl on account of this stuff. Many traders thought that this inventory’s magnificent run was over. As they moved on from their positions in Monster, shares fell 48% from its 2012 highs.

The 2012 low for Monster inventory got here over the past week of October, and it was a good time to purchase, though bearish sentiment was reaching a fever pitch. Since then, Monster inventory is up greater than 600%, in contrast with only a 300% return for the S&P 500.

What does this must do with Celsius?

Returns for Monster inventory in 2012 and returns for Celsius inventory in 2024 illustrate an necessary investing fact: Over quick time intervals, emotions can affect returns. As the information cycle turned bearish on each firms, each shares fell.

Nonetheless, with Monster, the information cycle could not maintain the inventory down as a result of the enterprise outcomes lifted it again up. During the last 10 years, the corporate’s income has tripled, and earnings per share (EPS) have practically quadrupled. It is exhausting to maintain a inventory down when that is the case.

For Celsius, the questions traders ought to ask are whether or not it is poised for extra progress and whether or not it may well do it profitably. If it may well, then traders could have fully forgotten what they have been anxious about in 2024 by the point 2034 rolls round.

One factor that Celsius has in its favor is a robust relationship with PepsiCo, one of many largest consumer-packaged items firms on the earth. Pepsi does not simply assist with distribution –it additionally has an fairness stake. It is good to have a robust ally in a aggressive area.

One other factor in Celsius’ favor for the long run is its comparatively small dimension. It is grown by leaps and bounds lately. However with annual revenues solely not too long ago crossing $1 billion, it nonetheless has loads of upside potential. For perspective, Monster generates over $7 billion in annual income.

The nice factor right here is that Celsius has targeted on progress over optimum profitability. However now that progress has slowed, it may well make some operational enhancements to maximise increased earnings. Subsequently, there’s an opportunity for increased revenues and earnings.

I am not saying that there are not any considerations forward for Celsius. Traders will wish to monitor gross sales and the general public notion of its merchandise. However as a rule, traders overreact within the quick time period, which creates nice alternatives for these with a long-term mindset.