Roku has been pivoting extra towards units in recent times — however is {that a} transfer that may repay in the long term?

Roku (ROKU 1.07%) has made balancing a number of streaming providers a lot simpler over time. Merely plug one among its streaming sticks into your TV, and you’ll shortly entry content material from a variety of streaming providers. Its Roku channel additionally supplies customers with a great deal of free content material.

However the firm faces a frightening street forward. There are extra good TVs than earlier than with their very own applied sciences, lessening the necessity for one among its streaming sticks. And with Walmart within the strategy of buying good TV maker Vizio, Roku’s software program may face an uptick in competitors in that area.

All of because of this the enterprise might must pivot — drastically.

Roku has been increasing into different units

Lately, Roku has been increasing its line of merchandise to transcend simply promoting streaming sticks. It additionally provides audio merchandise and good dwelling units, together with doorbells. The corporate is even making its personal TVs. Beforehand, it relied on different producers.

5 years from now, the corporate may increase into extra units and have an excellent wider array of merchandise. By doing so, it will possibly open up extra development alternatives for the enterprise. That would imply a major change in its income combine as properly.

The corporate at the moment generates about 14% of its income from units, versus 86% from its platform section, which incorporates digital advert gross sales. Between the headwinds from a doubtlessly extra aggressive good TV market and an even bigger transfer into units, I’d anticipate units to make up a considerably bigger portion of income for the enterprise sooner or later.

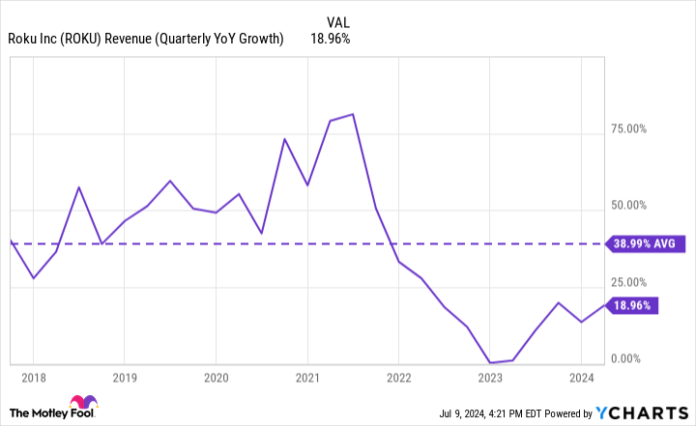

So far, diversifying has been paying off for the enterprise’ high line. Roku’s development price has been selecting up in latest quarters though it nonetheless stays under its long-run common.

ROKU Income (Quarterly YoY Development) information by YCharts.

A extra problematic development is the underside line

Igniting its income development through extra machine choices would definitely be a constructive, however my concern is that it might not assist Roku’s sluggish backside line. As the corporate has dived deeper into {hardware} merchandise, which generate decrease margins for the enterprise, there’s been a notable drop in earnings. Roku has gone from being persistently round breakeven to now recurrently being within the pink.

ROKU Internet Earnings (Quarterly) information by YCharts.

If the corporate continues on its transition towards development and having a broader array of merchandise in its portfolio, that may assist its development price, nevertheless it may come at a a lot higher value: worsening margins. Roku has incurred a gross loss on its units in every of the previous 4 quarters.

The gross margin it generates from its platform enterprise has been the one motive Roku’s total gross revenue has been capable of stay constructive.

Roku is a inventory that might sink a lot additional

Shares of Roku took off throughout COVID-fueled lockdowns, however the inventory has been struggling ever since. In simply the previous three years, it has nosedived by an unimaginable 85%. Sadly, with an unsure future — notably with Vizio doubtlessly being a a lot higher risk now that it might have Walmart serving to fund its development — issues might worsen for Roku within the years forward.

The inventory’s finest days could also be lengthy gone. Between a more difficult good TV market and a units section that is not even producing constructive margins, it is exhausting to stay optimistic about Roku in the long term. Traders could also be higher off different development shares.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Roku and Walmart. The Motley Idiot has a disclosure coverage.