These two household-name dividend shares are must-haves in your portfolio — particularly at at the moment’s modest inventory costs.

Starbucks (SBUX -2.44%) and Coca-Cola (KO -0.43%) have so much in frequent. Apart from serving up caffeinated drinks to a thirsty world, each corporations even have shareholder-friendly dividend insurance policies — and their shares have underperformed the inventory market over the past 12 months. Coca-Cola’s complete return over that interval is simply 8.7%, whereas Starbucks noticed a 20.5% worth drop as an alternative, and the S&P 500 gained 28.6%.

In different phrases, these family names include robust dividend yields and the promise of continued payout boosts for years to return. And in my eyes, the rumors of Starbucks’ and Coke’s demise have been enormously exaggerated. The highest-shelf high quality shares are on fireplace sale proper now.

In case you’re in search of an excellent dividend inventory to purchase at the moment, it’s best to contemplate doubling down on Coca-Cola and Starbucks. This is why.

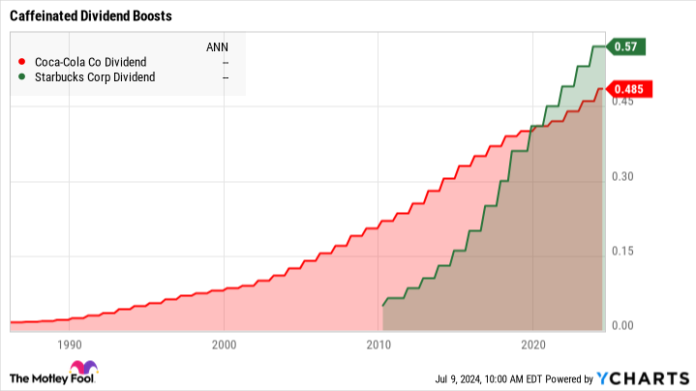

KO Dividend knowledge by YCharts

A shared historical past of dividend will increase

As you may see within the chart above, Starbucks and Coca-Cola are within the behavior of accelerating their dividend payouts yearly.

Coca-Cola’s dividend development historical past is considerably longer, spanning a number of many years. This long-term development supplies buyers with a way of safety and predictability, which is especially interesting for these in search of steady earnings. If Coke has raised its payouts by means of thick and skinny for 63 years (which it did), the corporate appears more likely to proceed boosting these quarterly dividend checks no matter downturns and enterprise challenges sooner or later.

In distinction, the inexperienced Starbucks line could also be shorter but additionally comes with a a lot steeper development trajectory. After beginning its dividend funds within the spring of 2010, Starbucks has quickly elevated its payouts. This vibrant coverage development displays the corporate’s dynamic development and powerful monetary well being.

Coca-Cola affords a extra constant and traditionally dependable dividend, which could be preferable for conservative buyers who search for long-term stability above all else. Alternatively, Starbucks’ greater dividend development charge can enchantment to buyers who’re prepared to tackle a bit extra danger for the potential of upper returns.

KO Free Money Stream knowledge by YCharts

Sturdy free money flows supporting the payouts

The chart above exhibits you the sturdy free money flows behind these inviting dividend payouts. It is nice to see dividends financed by robust money flows, and these nice corporations ship that high quality with gusto. Coca-Cola spent 79% of its free money flows on dividend funds over the past 12 months, and Starbucks’ cash-based payout ratio stopped at 63%.

Now, each Starbucks and Coca-Cola are dealing with vital enterprise challenges. Shifting shopper preferences are at all times a priority, together with a endless inflow of latest rivals.

Nevertheless, these corporations deal with their challenges in very other ways. Starbucks is doubling down on its premium picture, increasing its high-end Reserve shops and personalised digital experiences. As a part of the digital technique, the corporate is utilizing its loyalty program to extend buyer engagement and retention.

Coca-Cola, alternatively, is diversifying its product portfolio, shifting past sugary sodas right into a broad vary of more healthy choices like bottled water, teas, and plant-based drinks. It is also investing closely in sustainable packaging options to deal with rising environmental considerations.

Each corporations are actively adapting to the altering panorama, however their methods replicate their distinctive strengths and ultra-familiar model identities.

Fizzy dividends for the lengthy haul

With their hefty money flows and sensible methods, each Coca-Cola and Starbucks are set to maintain these dividend funds flowing for years to return. These corporations have sturdy free money flows that not solely cowl their dividends but additionally go away loads of room for development and innovation.

With its decades-long historical past of steady dividends, Coca-Cola is sort of a dependable buddy who’s at all times there while you want them. You may depend on it to maintain delivering these quarterly checks, come rain or shine.

Starbucks is an brisk relative newcomer with a fast development development. It is on a roll, shortly boosting its payouts and displaying no indicators of slowing down.

These corporations are masters of coping with enterprise challenges and taking part in to their strengths. For dividend buyers, the longer term with Coca-Cola and Starbucks appears to be like vibrant and safe — and their shares ought to quickly get well from this 12 months’s worth dip. It is excessive time to take motion and purchase some shares of those discounted business titans at the moment.