After a double-digit rally final month and continued momentum in July, Nvidia inventory now could be up 159% this yr.

Nvidia (NVDA 1.88%) inventory continued to advance in final month’s buying and selling. The factitious intelligence (AI) chief’s share worth closed out June’s buying and selling up 12.7%, in accordance with knowledge from S&P International Market Intelligence. It is now up roughly 159% yr up to now.

Nvidia inventory has been on an unbelievable rally due to robust earnings outcomes and pleasure about untapped AI alternatives on Wall Avenue. The inventory continued to obtain a valuation enhance due to favorable analyst protection in June. Shares additionally benefited from bullish momentum for the broader market within the interval.

Nvidia climbs on bullish market backdrop, analyst protection, and AI alternatives

The S&P 500 index’s stage closed out June’s buying and selling up roughly 3.5%, and Nvidia’s share worth additionally climbed at the side of the bullish pattern. Notably, there wasn’t a lot in the way in which of dramatic, business-specific information for the corporate final month. However an array of analysts issued upward price-target revisions for the inventory, and general demand indicators within the AI house continued to look promising.

Truist revealed a observe on June 27, elevating its one-year worth goal on Nvidia inventory from $128 per share to $140 per share. The agency maintained a purchase ranking on the inventory. The day earlier than, Citigroup analyst Atif Malik revealed a observe sustaining a purchase ranking on the inventory and growing his one-year goal on the inventory from $126.

In the meantime, Rosenblatt was much more effusively bullish earlier within the month. The agency raised its one-year worth goal from $140 per share to $200 per share due to the power of its current and upcoming processor platforms. If the inventory had been to hit Rosenblatt’s goal, that may counsel upside of roughly 56% in comparison with the inventory’s closing worth.

Nvidia is the main supplier of graphics processing items (GPUs) which are used to energy superior synthetic intelligence purposes. As demand for AI providers and different cloud computing applied sciences have surged, Nvidia has seen unbelievable gross sales and earnings development. In flip, this has helped energy large development for the corporate’s valuation. Nvidia at the moment has a market cap of roughly $3.04 trillion and ranks because the world’s third Most worthy firm, trailing behind solely Microsoft and Apple.

What comes subsequent for Nvidia inventory?

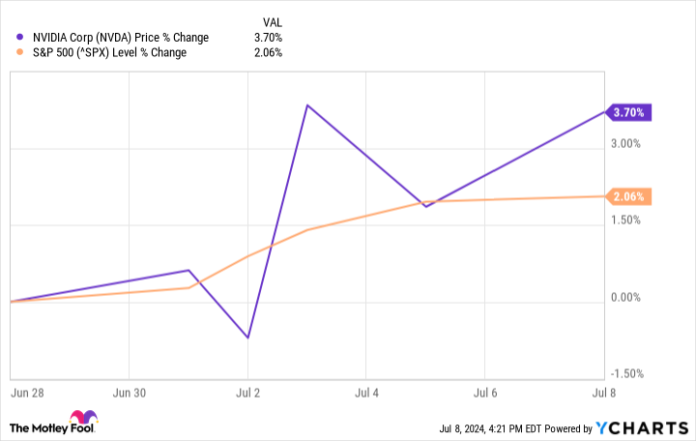

Nvidia inventory has continued to achieve floor early in July’s buying and selling. The corporate’s share worth is up 3.7% within the month to date. In the meantime, the S&P 500 index’s stage is up roughly 2.1%.

For the second quarter of its present fiscal yr, which concludes on the finish of this month, Nvidia is guiding for income of roughly $28 billion. If the processing specialist had been to hit that concentrate on, it might imply delivering development of roughly 107% in comparison with leads to the prior-year interval. It will additionally imply delivering sequential quarterly development of roughly 8% in comparison with the $26 billion in gross sales the enterprise posted within the first quarter of the present fiscal yr.

Nvidia is the clear-cut chief within the superior GPU market, and it appears to be like poised to take pleasure in robust demand tailwinds and retain prime place within the AI processor house for the foreseeable future.

Citigroup is an promoting accomplice of The Ascent, a Motley Idiot firm. Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, Nvidia, and Truist Monetary. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.