Based mostly on on-chain information, the Head of Analysis on the analytics agency CryptoQuant has defined how Bitcoin has been wanting much less bullish not too long ago.

Bitcoin Bull-Bear Market Cycle Indicator Has Seen A Decline Not too long ago

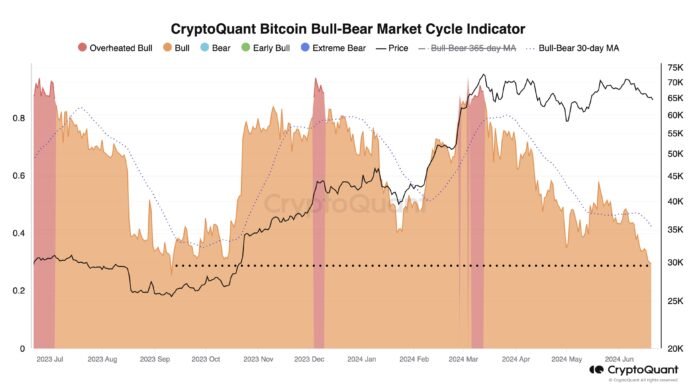

In a brand new publish on X, CryptoQuant Head of Analysis Julio Moreno shared what the newest pattern within the Bitcoin Bull-Bear Market Cycle Indicator has been wanting like. This indicator relies on one other metric developed by the analytics agency: the P&L Index.

The P&L Index is a valuation indicator for Bitcoin that will decide whether or not the coin’s value is undervalued or overvalued. This metric combines the information of three standard indicators associated to revenue and loss to seek out its worth (MVRV Ratio, NUPL, and SOPR).

Traditionally, the P&L Index’s interactions with its 365-day shifting common (MA) have carried some significance for the cryptocurrency. A cross for the indicator above this line has signaled a shift to a bull part, whereas a drop beneath has meant a transition to a bearish regime.

Now, what the Bitcoin Bull-Bear Market Cycle Indicator, the precise metric of curiosity right here, does is that it takes the P&L Index and measures its distance from this essential MA.

When the worth of this indicator is bigger than zero, it suggests BTC is in a bull market, because the P&L Indicator is above its 365-day MA. Equally, the metric assuming a adverse worth implies an lively bear market.

Under is the chart for this CryptoQuant indicator over the previous yr:

The worth of the indicator seems to have been happening over the previous couple of months | Supply: @jjcmoreno on X

The above graph reveals that the Bitcoin Bull-Bear Market Cycle Indicator shot excessive in the course of the rally, resulting in a new all-time excessive (ATH).

Typically, the upper the metric’s worth, the extra overpriced the asset may very well be thought of. Throughout the ATH break, the indicator attained ranges related to an “overheated bull,” which can be why the cryptocurrency hit a prime again then.

Because the cryptocurrency has consolidated, the indicator’s worth has cooled off. It’s nonetheless above the zero degree, implying that BTC is in a bull market, however the coin has change into much less sizzling. “The Bitcoin market is the least bullish since September 2023,” notes Moreno.

In September 2023, the asset was shifting sideways round lows, and this consolidation ultimately led to contemporary bullish momentum. As such, the indicator cooling off will not be unhealthy for the asset.

It stays to be seen, although, whether or not the indicator has completed its drawdown or if it’ll cross into the adverse territory. In such a state of affairs, the market would have transitioned in direction of a bearish one as a substitute.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $61,600, down greater than 5% over the previous week.

Seems to be like the value of the coin has been sliding off in current days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com