This gear supplier has been a part of an integral subindustry within the growth of AI chips.

In the case of the manufacturing of superior semiconductors utilized in synthetic intelligence (AI) methods, there’s a little-known phase of the business that acts because the gatekeeper: metrology gear.

Chief amongst metrology gear suppliers is KLA Corp., whose inventory is sporting an unbelievable almost 75% achieve within the final one-year stretch. However a smaller peer, Onto Innovation (ONTO -2.43%), is up almost 105%. Why? And is it nonetheless a purchase?

A key to creating extra superior chips

Metrology (the science of measurements) and course of diagnostics and management (PDC, mainly high quality management on a producing course of) is a important stage after a chip is designed. Early within the chipmaking course of, metrology and PDC gear guarantee the brand new chip capabilities accurately and is freed from defects that affect efficiency. Corporations like Taiwan Semiconductor Manufacturing and Intel rely closely on metrology and PDC gear when creating new and extra superior manufacturing processes.

Thus, consider metrology gear as a sort of ultimate step in constructing AI methods, a sort of gatekeeper to unlocking extra highly effective computing.

Whereas KLA Corp. has acquired consideration through the years as a implausible dividend development funding, Onto Innovation is a little-known competitor. It is the product of a 2019 merger between two small metrology corporations, a transfer that helped the enterprise scale up its operations to achieve larger effectivity (larger revenue), which in flip has helped it spend money on and unveil new metrology applied sciences for its clients.

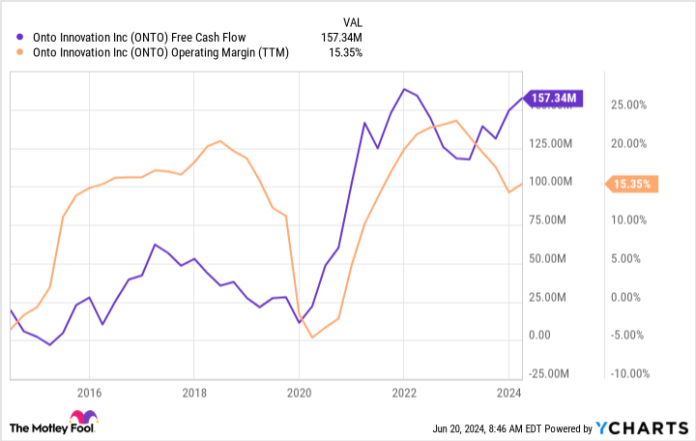

Knowledge by YCharts.

It is been an unbelievable run for Onto, and the small enterprise is not completed. It retains rolling out new gear and metrology options to handle all steps within the advanced chipmaking course of, from superior wafer inspection all the best way to the ultimate dicing of these wafers into chips and packaging them right into a computing system. A few of Onto’s latest gear bulletins are far-reaching, addressing its chip producer clients’ product roadmap years from now.

Can the Onto social gathering proceed?

After the latest run-up, Onto inventory trades for an “costly” 82 instances trailing-12-month earnings per share (EPS) based on typically accepted accounting rules (GAAP), and 72 instances trailing-12-month free money stream (FCF). Nevertheless, keep in mind that like all manufacturing-based companies, Onto is cyclical. The EPS and FCF figures from the final yr embrace the consequences of the bear market that had dramatically introduced Onto’s profitability down in 2023.

As an instance how the rebound in earnings (and thus the valuation) can change simply as dramatically to the upside, Onto reported a 4.6% quarter-over-quarter sequential improve in income in Q1 2024 versus This fall 2023, however an 11% sequential improve in adjusted EPS.

Administration is forecasting one other step-up in income and profitability in Q2, with the excessive finish of income steerage of $240 million implying one other 4.8% rise from Q1 — and a 7% sequential improve, and 59% year-over-year improve, in adjusted EPS. Suffice to say the valuation might not be as costly because it seems on the floor.

Moreover, there are dozens of latest chip fab (a facility that makes semiconductors) building initiatives underway across the globe, and dozens extra of current fab updates. Trade group SEMI.org predicts superior wafer fab gear, like what Onto supplies for AI chipmakers, will attain file ranges in 2025 and proceed hitting new highs by way of 2027, rising at a low- to mid-teens proportion. The market is predicted to start heating up within the second half of this yr. Onto’s gross sales are poised to comply with an analogous trajectory.

I do not count on Onto Innovation’s inventory to carry out in the identical distinctive vogue because it has during the last 12-month interval. Nevertheless, there could possibly be loads of upside left on this smaller metrology gear and under-the-radar AI inventory. I am more than pleased to proceed holding my place.

Nicholas Rossolillo and his purchasers have positions in KLA and Onto Innovation. The Motley Idiot has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.