Wish to enhance your earnings with Nike dividends? This is how a lot you want to make investments with a purpose to attain a selected earnings goal.

In the event you’re eyeing $1,000 in annual dividend earnings from Nike (NKE 1.72%) inventory, you are doubtless interested in how a lot you want to make investments. To start with, congratulations on setting a selected funding purpose! Now let’s have a look at how reachable it is likely to be.

Primarily based on the athletic shoe and attire large’s most up-to-date dividend bulletins, I can calculate a forward-looking dividend yield to assist reply that query.

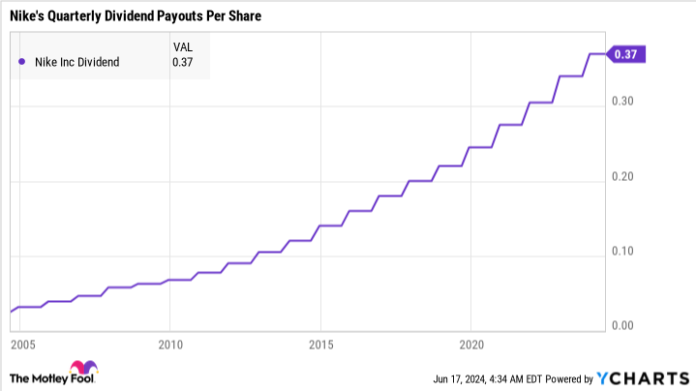

Nike’s dividend historical past

Nike’s quarterly dividend is presently $0.37 per share. That is up from $0.34 per share a 12 months in the past, a part of Nike’s constant payout will increase over time:

NKE Dividend information by YCharts

Let’s do the forward-looking dividend yield math

To determine the forward-looking dividend yield, begin by annualizing the newest quarterly dividend. The contemporary dividend quantity of $0.37 is multiplied by 4, since there are 4 quarters in a 12 months. This works out to an annual dividend of $1.48 per share.

Subsequent, take into account Nike’s present inventory value. As of June 17, 2024, Nike’s inventory is buying and selling at $94 per share. This data exhibits the dividend yield by dividing the annual dividend by the inventory value. On this case, the yield comes out to about 1.57%.

How a lot to spend money on Nike for $1,000 in yearly dividend earnings

To realize $1,000 in annual dividend earnings, the required funding follows this equation:

- Required funding = $1,000 / ahead dividend yield

Nike’s present ahead dividend yield is 1.57%; $1,000 divided by 1.57% (or 0.0157 in decimal phrases), leads to $63,694. Therefore, to earn $1,000 in dividend earnings yearly from Nike inventory, you would wish to speculate roughly $63,694 as we speak.

It must be famous that Nike’s dividend yield is unusually excessive for the time being. The endless payout will increase have met decrease share costs because the begin of the inflation-based economic system disaster.

For comparative functions, the ahead yield stopped at 1.17% a 12 months in the past. At that time, securing a $1,000 annual dividend earnings would have required a Nike funding of $85,470.

Assuming that Nike can get again on its proverbial ft after this inflation-powered stumble, it’s best to take into account locking in Nike’s modest buy-in value and beneficiant dividend yield whereas the getting is sweet.

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.