This software program design platform is on the coronary heart of the AI motion, and plenty of buyers nonetheless do not even realize it.

Nvidia rightfully instructions the highlight in terms of generative synthetic intelligence (AI) proper now. However behind these highly effective Nvidia chips spawning new software program options, enterprise automation, and accelerated computation, there is a suite of design software program instruments utilized by the engineers to make all of it attainable: digital design automation (EDA).

Synopsys (SNPS 0.63%) is the chief in EDA software program, boasting a big portfolio of mental property and patents — completely foundational stuff to the semiconductor trade and to AI growth. Here is why the inventory is, on the very least, worthy of your consideration.

A guess on chip and AI analysis and growth progress

Synopsys is a robust platform enterprise. Like a choose few different EDA companies (together with Cadence Design Techniques, the second-largest participant), Synopsys combines numerous software program instruments and specialised {hardware} for engineers to design and confirm chip and computing programs. Be it Nvidia, an information heart buyer, or one of many many different semiconductor and computing companies, it is extremely probably Synopsys’ instruments are being utilized in engineering groups’ design work.

Given its broad suite of software program and patent portfolio on important elements and items to a contemporary computing system, Synopsys has develop into a kind of guess on total semiconductor and AI analysis and growth (R&D) progress. Semiconductor and information heart companies have a tendency to carry their R&D expense progress pretty steady, whatever the regular gross sales cycle inherent with {hardware}. The explanation? If an organization lets its foot off the fuel in R&D, it might fall behind its friends technologically, which may have a detrimental influence on future gross sales and profitability.

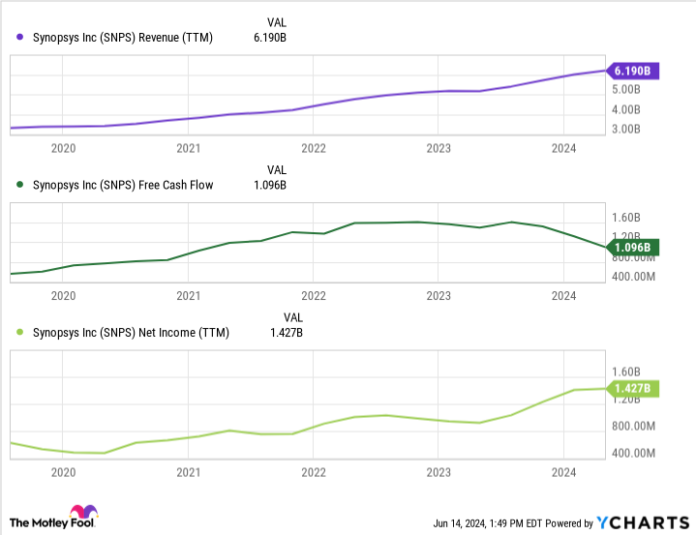

Consequently, Synopsys has been reporting constant income progress for years. To date in its present fiscal yr, income is up almost 19% from the yr prior. Web revenue and free money circulate might be lumpy (owing to the timing of a few of its buyer tasks), however by and huge, this can be a extremely worthwhile software program platform, too.

Information by YCharts.

Synopsys as a secret AI inventory

Many buyers might have develop into conscious of Synopsys in 2024 attributable to two occasions.

First, Nvidia introduced (initially in 2023) that Synopsys and main chip fab Taiwan Semiconductor Manufacturing would combine Nvidia’s AI-fueled cuLitho generative AI algorithm to assist speed up chip growth and manufacturing. Rating one for Nvidia.

And second, Synopsys introduced a mega-acquisition again in January, of system design and physics simulation software program big Ansys. The deal continues to be pending regulatory evaluate, however the proposed tie-up underscores how chip and AI designs have gotten more and more pervasive in all elements of the financial system. Be it information facilities or extra “conventional financial system” programs like industrial tools, manufacturing amenities, or automobiles, digital designs are starting to merge with mechanical ones. Synopsys buying Ansys would assist it additional its lead in EDA software program because of this (and has set off a spherical of different acquisitions within the trade as effectively).

Is Synopsys inventory a purchase?

Given its regular and worthwhile progress, all deeply tied into the burgeoning AI trade, Synopsys might be a high funding within the years forward. It does include a steep price ticket, although — 64 instances trailing-12-month earnings per share (EPS), or 45 instances EPS primarily based on Wall Avenue analysts’ present yr expectations.

That is close to the excessive finish of the place the inventory has traded over the long run, as extra buyers catch on to the important thing function Synopsys performs within the AI race. The excessive price ticket may mirror some optimism surrounding the potential Ansys takeover, ought to that happen early in 2025.

To assist with the premium worth, buyers fascinated about Synopsys may think about using a dollar-cost common plan to construct a place over time. Automating purchases, maybe on a month-to-month foundation, might lock in some buys when there is a dip in share worth.

At any charge, given Synopsys’ place within the AI revolution, this can be a enterprise value protecting tabs on, as it’s behind the scenes serving to corporations like Nvidia make speedy advances in computing know-how.

Nicholas Rossolillo and his purchasers have positions in Cadence Design Techniques, Nvidia, and Synopsys. The Motley Idiot has positions in and recommends Cadence Design Techniques, Nvidia, Synopsys, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Ansys. The Motley Idiot has a disclosure coverage.