A number of corporations may look to duplicate Nvidia’s post-split success.

Synthetic intelligence (AI) celebrity inventory Nvidia (NVDA 1.75%) introduced a inventory break up on Could 22 this yr. Share costs have climbed 36% since then. The wild success may have another AI corporations on Wall Avenue considering following swimsuit (even when the break up is not essentially the only purpose behind the inventory’s efficiency).

Keep in mind, a inventory break up would not change something concerning the underlying enterprise or the inventory’s fundamentals. It simply divides the inventory into extra shares with proportionally decrease costs and per-share financials. Firms break up their inventory for quite a few causes, together with making shares simpler to purchase and promote for workers (who would possibly get them as inventory choices in lieu of fee) and traders.

With Nvidia finalizing its inventory break up on June 10, the query that naturally follows is: Which AI corporations is likely to be subsequent for a inventory break up? Three Idiot.com contributors recognized Microsoft (MSFT 0.22%), Meta Platforms (META 0.11%), and Tremendous Micro Pc (SMCI -3.05%) as these most definitely AI shares to separate subsequent.

Right here is why.

This venerable tech big seems primed for a break up

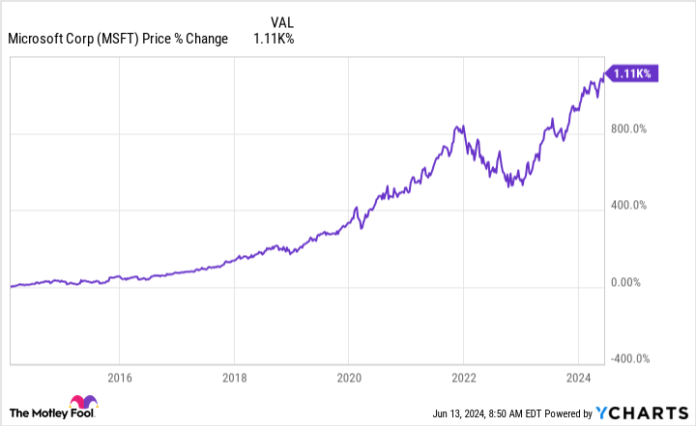

Will Healy (Microsoft): As the corporate that till very just lately had the world’s Most worthy market cap, Microsoft isn’t a stunning candidate for a inventory break up. Contemplating how a lot inventory value appreciation it has seen previously few years, the stunning factor about Microsoft’s inventory is that it has been greater than 21 years since Microsoft final break up its inventory.

Between the late Eighties and early 2000s, when Microsoft was the dominated PC working system firm, inventory splits have been way more widespread. Throughout that interval, the inventory break up 9 instances.

Nonetheless, the Dot-Com market crash after which the rise of Apple chipped away at Microsoft’s management over time, significantly after it launched the iPhone in 2007. Between 2000 and 2014, when Steve Ballmer was CEO, Microsoft inventory misplaced 37% of its worth.

The state of the corporate lastly improved when Satya Nadella took the CEO place in 2014. He redefined Microsoft as a cloud firm and, later, a frontrunner in AI. Over Nadella’s 10-year tenure, Microsoft inventory has risen greater than 1,110%, taking it to $440 per share as of this writing.

Provided that stage of inventory value progress, the necessity for a break up grew as effectively. The corporate’s progress means that inventory value appreciation is prone to proceed. Within the first three quarters of fiscal 2024 (ended March 31), internet revenue elevated by 26% yr over yr. The corporate’s outlook for the remainder of the fiscal yr factors to double-digit share income progress as effectively.

One other issue pointing to a inventory break up entails Microsoft being a part of the Dow Jones Industrial Common. For the reason that Dow is price-weighted, Microsoft will most likely want to separate its inventory in order to not have an outsized impact on the index’s motion. That ought to make sure that the 21-year inventory break up drought lastly involves an finish.

Meta Platforms has by no means issued a inventory break up, however the time might lastly be right here

Jake Lerch (Meta Platforms): All in all, 2024 has been an awesome yr for the “Magnificent Seven” shares. Certainly, six of the seven (Tesla being the one exception) have recorded double-digit share beneficial properties yr up to now. But of those shares, just one has by no means break up its shares: Meta Platforms. The time for that first-ever break up has arrived. This is why.

First off, the inventory is dear. A Meta share trades for round $504 — putting the inventory past the attain of many retail traders. By implementing a 3-for-1 and even 5-for-1 inventory break up, Meta may considerably decrease its share value and make the inventory extra accessible to retail traders who may not be capable to purchase fractional shares, doubtlessly decreasing the value to a extra affordable vary of $100 to $175.

A current examine from Financial institution of America revealed one other compelling purpose for Meta to separate its shares: outperformance. The examine, which examined inventory splits since 1980, discovered that shares that have been break up beat the S&P 500 through the 12 months that adopted the break up. This was true in every of the final 4 a long time (see chart beneath).

Picture supply: Statista

Whereas many traders would seemingly cheer a Meta inventory break up, it is from a given. Meta’s administration is not a fan of inventory splits. In its 12 years as a public firm, Meta has by no means carried out a inventory break up. That is in stark distinction to different tech megacaps like Adobe and Microsoft, who break up their shares 4 and 7 instances, respectively, within the first 12 years of their existence as public corporations.

At any fee, traders ought to hold a detailed eye on Meta Platforms. Inventory break up or not, the corporate stays one of many top-performing tech shares because of its profitable digital promoting enterprise. With its Q1 income rising at 27% yr over yr and earnings hovering 127%, long-term traders could be clever to think about Meta as a buy-and-hold candidate.

Tremendous Micro Pc may choose to refuel its rally with a inventory break up

Justin Pope (Tremendous Micro Pc): For some time, Tremendous Micro Pc was seemingly the AI model of Robin to Nvidia’s Batman. However share costs have stalled and declined after topping out at $1,229. In the meantime, Nvidia retains climbing to new highs. Right here is why Tremendous Micro Pc, or Supermicro as it is also identified, may nonetheless get again on monitor, necessitating a inventory break up.

The corporate sells modular server methods for knowledge facilities. That is nice for corporations that do not have the experience or time to custom-build their very own and simply need to deploy compute as rapidly as potential. Like Nvidia, Supermicro has change into a “go-to” selection as AI spending surges. You possibly can see beneath how income progress has accelerated to 200% yr over yr, and administration has underlined this by noting that demand for its merchandise is dramatically outpacing the broader business.

SMCI Income (Quarterly YoY Progress) knowledge by YCharts

Proof means that Supermicro may gain advantage from knowledge middle tailwinds for a while. In keeping with Newmark, AI will drive sufficient knowledge middle demand to double its energy consumption by 2030 from present ranges. Supermicro has accomplished almost $12 billion in trailing-12-month income; analysts imagine annual income may double to over $23 billion by subsequent June.

In the meantime, the corporate has a wholesome outlook for earnings progress. Analysts imagine earnings per share will develop by a mean of 52% yearly for the following three to 5 years. In different phrases, AI tailwinds stay intact, and elementary energy ought to finally push shares larger. At present, the inventory trades at a ahead P/E of 33, making it a cut price if Supermicro realizes such robust earnings progress. These catalysts may drive Tremendous Micro Pc larger, an thrilling prospect for traders.

So why break up the inventory?

The corporate has by no means break up its inventory regardless of shares appreciating over 9,400% since its IPO. Now, buying and selling at over $800 per share, the inventory is tougher to purchase and promote (much less liquid). It is tougher for traders to slowly purchase shares over time with out having a ton of cash. Staff sitting on worthwhile fairness within the firm should promote in chunks when shares commerce at such a value. Splitting the inventory lowers the share value and alleviates these issues. Plus, the optimistic consideration a inventory break up often generates may assist transfer the share value once more after shares have stalled in current weeks. It is a potential win-win for everybody.

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Adobe, Nvidia, and Tesla. Justin Pope has no place in any of the shares talked about. Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe, Apple, Financial institution of America, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.