Simply because a inventory has superb progress prospects does not imply it is best to ignore its valuation.

A enterprise can look to be in stable form however nonetheless not essentially be an ideal funding general. An excellent instance of that’s Viking Therapeutics (VKTX -0.15%). The corporate has been doing quite a lot of issues nicely recently, and there is quite a lot of hope and optimism across the enterprise.

However all that is probably not sufficient of a motive to spend money on Viking Therapeutics. Whereas the inventory could look nice to some traders proper now, this is why it isn’t price shopping for.

The GLP-1 market may get crowded

The bullish case round Viking’s inventory has to do with a promising drug it has in improvement, which traders are hopeful could generate billions in income for the enterprise in the long term. VK2735 is a glucagon-like peptide 1 (GLP-1) receptor agonist which has proven in scientific trials that it could assist individuals lose as a lot as 15% of their physique weight, on common. And the tablet model has additionally been attaining promising leads to early trials.

However even when the drug obtains approval in just a few years and involves market, the GLP-1 weight-loss market might be crowded by then. Not solely are there large names akin to Eli Lilly and Novo Nordisk to deal with, which have already got accredited weight-loss medication akin to Zepbound and Wegovy, however different notable healthcare firms are additionally vying for a bit of the market:

- Amgen could have one of many extra promising medication on the market, which may pose the most important danger for Eli Lilly and Novo Nordisk. That is as a result of Amgen’s drug, MariTide, could solely must be taken month-to-month (as a substitute of weekly, which is the case for a lot of of those remedies) whereas nonetheless attaining comparable outcomes.

- Roche not too long ago unveiled encouraging outcomes from a trial involving its GLP-1 drug, CT-338. It helped sufferers lose 18.8% of their weight in comparison with a placebo. It was a phase-one trial however an encouraging one nonetheless.

- AstraZeneca has proven curiosity within the area as nicely. Final 12 months, it agreed to pay as much as $2 billion to license an experimental weight-loss drug from Eccogene, a Chinese language-based firm. The drug could have fewer unwanted effects than different GLP-1 remedies.

That is nonetheless only a small pattern of the variety of firms Viking could have to combat with for market share within the GLP-1 market sooner or later. If it will get an accredited product to market, that might be an ideal improvement for the enterprise, and it appears to be like like it might be on observe for that. However that does not imply it is going to generate billions in income for the corporate instantly.

Viking’s valuation is simply too wealthy

It will be one factor if Viking was a small-cap inventory with quite a lot of upside, however Viking’s already nicely above that threshold — its market cap is north of $6 billion. For a corporation with no income, many traders appear to already be pricing in quite a lot of progress into the enterprise. It was solely a 12 months in the past that the inventory was price lower than $2 billion.

The hype round its GLP-1 drug has despatched the healthcare inventory hovering. And that signifies that if it falters or traders turn out to be much less optimistic about VK2735’s progress prospects, shares of Viking may shortly come beneath stress.

The inventory’s volatility is prone to proceed

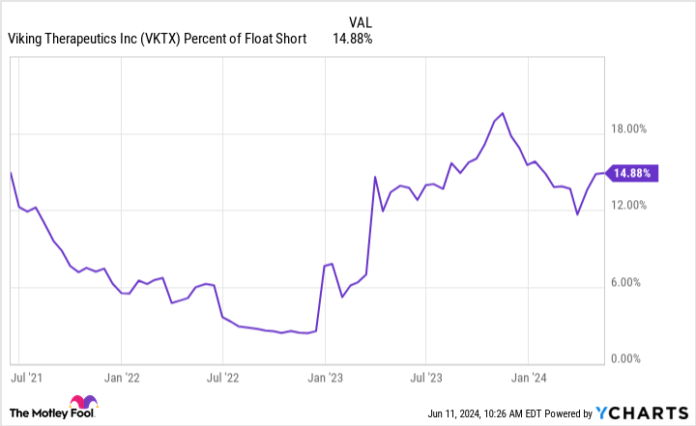

There’s additionally the priority about Viking’s quick curiosity, which is how many individuals are betting in opposition to the corporate and anticipating it to fail. Brief curiosity, as a share of float, stays excessive at round 15%. And if the corporate offers traders with any extra causes to be skeptical and anxious concerning the enterprise, that quick curiosity may rise and put downward stress on the inventory.

VKTX P.c of Float Brief knowledge by YCharts.

On the flip aspect, if the corporate posts sturdy outcomes from scientific trials, there might be a quick squeeze which sends its shares skyrocketing. Both method, the inventory appears to be like like a chance proper now and is prone to stay extraordinarily risky given its excessive price ticket and the expectations which might be baked into its valuation.

Viking Therapeutics is a extremely speculative funding

Making an attempt to foretell the winners of a hotly contested GLP-1 drug market is not any straightforward activity. Viking’s drug could dominate or it might get misplaced within the mixture of a boatload of different GLP-1 weight-loss medication. It’s miles too early to inform which medication will have the ability to compete with Wegovy and Zepbound. Viking nonetheless has an unproven enterprise with no income, and its losses will proceed to build up till that modifications.

Traders who purchase Viking’s inventory at its present ranges are successfully betting on the success of its GLP-1 drug, and that is a extremely dangerous place to take because the inventory may have quite a lot of room to fall if the drug fails to acquire approval or if different merchandise look extra promising.

That is why that is an funding which is barely appropriate for traders with a high-risk tolerance and who’re OK with the chance that they could incur vital losses. Different traders are higher off staying away from the inventory.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.