Bitcoin is present process an interesting evolution, with numerous views on its nature. Some view it as a foreign money for on a regular basis transactions, others as a contemporary equal of gold for storing worth, and but others as a decentralized world platform for securing and validating off-chain transactions. Whereas these views all maintain some reality, Bitcoin is more and more establishing itself as a digital base cash.

Functioning akin to bodily gold as a bearer asset, inflation hedge, and offering foreign money denominations just like the greenback, Bitcoin is reshaping the idea of financial base belongings. Its clear algorithm and glued provide of 21 million models guarantee a non-discretionary financial coverage. Contrastingly, conventional fiat currencies just like the US greenback depend on centralized authorities to handle their provide, elevating questions on their predictability and effectiveness in an age of volatility, uncertainty, complexity, and ambiguity (VUCA).

This distinction is especially notable in gentle of Nobel laureate Friedrich August von Hayek’s critique of centralized financial decision-making in his work “The Pretense of Information.” Bitcoin’s clear and predictable financial coverage stands in stark distinction to the opaque and doubtlessly unpredictable nature of conventional fiat foreign money administration.

To Leverage, or To not Leverage Bitcoin

For staunch Bitcoin proponents, the immutable 21 million provide cap is sacred. Altering it might essentially alter Bitcoin itself, making it one thing completely completely different. Thus, inside the Bitcoin group, skepticism in direction of leveraging Bitcoin is widespread. Many see any type of leverage as akin to fiat foreign money practices, undermining Bitcoin’s core ideas.

This skepticism in direction of leveraging Bitcoin is rooted within the distinction between commodity credit score and circulation credit score, as outlined by Ludwig von Mises. Commodity credit score is predicated on actual financial savings, whereas circulation credit score lacks such backing, resembling unbacked IOUs. Bitcoiners view leveraging that creates “paper Bitcoin” as economically dangerous and destabilizing.

Even nuanced views inside the group are cautious about leveraging, aligning with figures like Caitlin Lengthy, who has been warning towards the hazards of leveraging Bitcoin. The collapse of leveraged-based Bitcoin lending firms in 2022, akin to Celsius and BlockFi, additional strengthened the considerations voiced by Lengthy and others concerning the dangers related to leveraging Bitcoin.

Celsius and Co. Proved the Level

The crypto market witnessed a major upheaval harking back to the Lehman Brothers collapse in 2022, triggering a widespread credit score crunch that affected numerous gamers within the crypto lending sector. Opposite to assumptions, most crypto lending actions weren’t peer-to-peer and carried appreciable counterparty dangers, as clients lent on to platforms, which then deployed these funds into speculative methods with out enough danger administration.

It was the rise of main DeFi protocols through the DeFi summer time of 2020 that supplied promising avenues for yield technology. Nonetheless, many of those protocols lacked sustainable enterprise fashions and tokenomics. They relied closely on protocol token inflation to maintain engaging yields, ensuing in an unsustainable ecosystem disconnected from basic financial ideas.

The 2022 crypto credit score crunch highlighted numerous points with centralized yield devices, emphasizing considerations about transparency, belief, and dangers akin to liquidity, market, and counterparty dangers. Furthermore, it underscored the pitfalls of centralization and off-chain danger administration processes, which, when utilized to blockchain-based “banking providers,” mimic conventional banking flaws.

So regardless of the optimism surrounding the bull market of 2020/21, many establishments because of the lack of those processes, together with Voyager, Three Arrows Capital, Celsius, BlockFi, and FTX, went below. The shortcoming to implement needed checks and balances transparently and independently typically results in over-regulation and recurrent failures and fraud, mirroring the historic challenges of conventional banking techniques. Nonetheless, the absence of regulation shouldn’t be an answer both

Bitcoin-based Yield shouldn’t be Non-obligatory

The place does this depart us? Given this 2022 episode, increasingly Bitcoiner have been posting the query: Ought to we embrace Bitcoin yield merchandise, or do they pose too nice a danger, echoing traits of the fiat system? Whereas legitimate considerations exist, it is unrealistic to count on Bitcoin-based yield merchandise to fade completely.

The query is changing into all of the extra prevalent with the newly rising Bitcoin ecosystem. More and more initiatives are constructing (or are claiming) to construct out monetary infrastructure in addition to functions on Bitcoin straight. May this create the identical points once more we already witnessed within the wider crypto sphere?

Almost definitely sure. That’s simply the character of the sport. And since Bitcoin is a permissionless protocol, everybody can construct on high of it, together with the individuals who need to construct Bitcoin-powered finance. And finance will inevitably want credit score and leverage.

It is a historic truth: In any thriving society, the need for credit score and yield naturally arises, serving as a catalyst for financial development. With out credit score, underdeveloped economies wrestle to flee the confines of subsistence residing. It is solely via entry to credit score {that a} extra refined and productive financial construction can emerge.

To appreciate the imaginative and prescient of a Bitcoin-based financial system, proponents acknowledge the necessity for credit score and yield mechanisms to develop atop the Bitcoin protocol. Whereas Bitcoin’s position as a type of cash is commonly lauded, the fact is that for it to perform successfully as a foreign money, it requires a native financial system to help it.

This underscores the significance of Bitcoin-based yield merchandise in fostering the expansion of a strong Bitcoin-centric financial system. Such an ecosystem would leverage Bitcoin as its digital base cash whereas using yield merchandise to drive adoption and utilization.

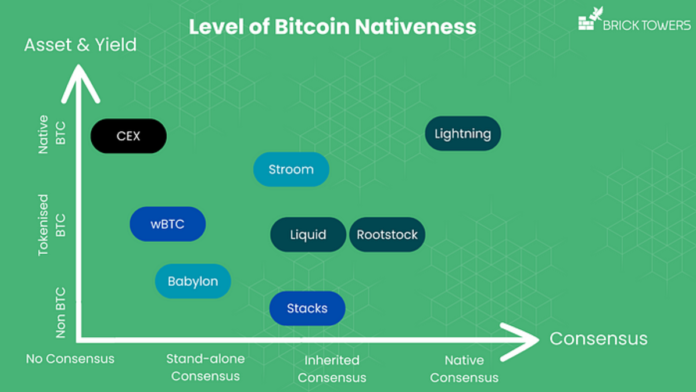

It’s All a Belief Spectrum, Anon

Bitcoin-powered finance will essentially be inbuilt layers. From a system’s perspective, this isn’t a lot completely different from at this time’s monetary system, the place there’s an inherent hierarchy in money-like belongings. To correctly perceive the inevitable trade-offs that include this, it is very important have a high-level framework to tell apart the completely different implementations of Bitcoin residing on completely different layers.

In relation to providing yield on Bitcoin, it’s important to know that choices could be constructed alongside a three-folded belief spectrum. The first points to have a look at are:

- Consensus

- Asset

- Yield

Assessing Bitcoin-like belongings and Bitcoin yield merchandise primarily based on their diploma of Bitcoin nativeness supplies a helpful framework for evaluating their alignment with Bitcoin’s ethos. Property and merchandise scoring larger on this spectrum are sometimes extra trust-minimized, decreasing reliance on intermediaries in favor of clear and resilient code.

This shift mitigates counterparty dangers, as reliance transitions from off-chain intermediaries to code. The code’s transparency enhances resilience in comparison with intermediaries that must be trusted.

It is a development price exploring, and creating choices for a local yield on Bitcoin must be the gold normal and the final word objective of the Bitcoin group.

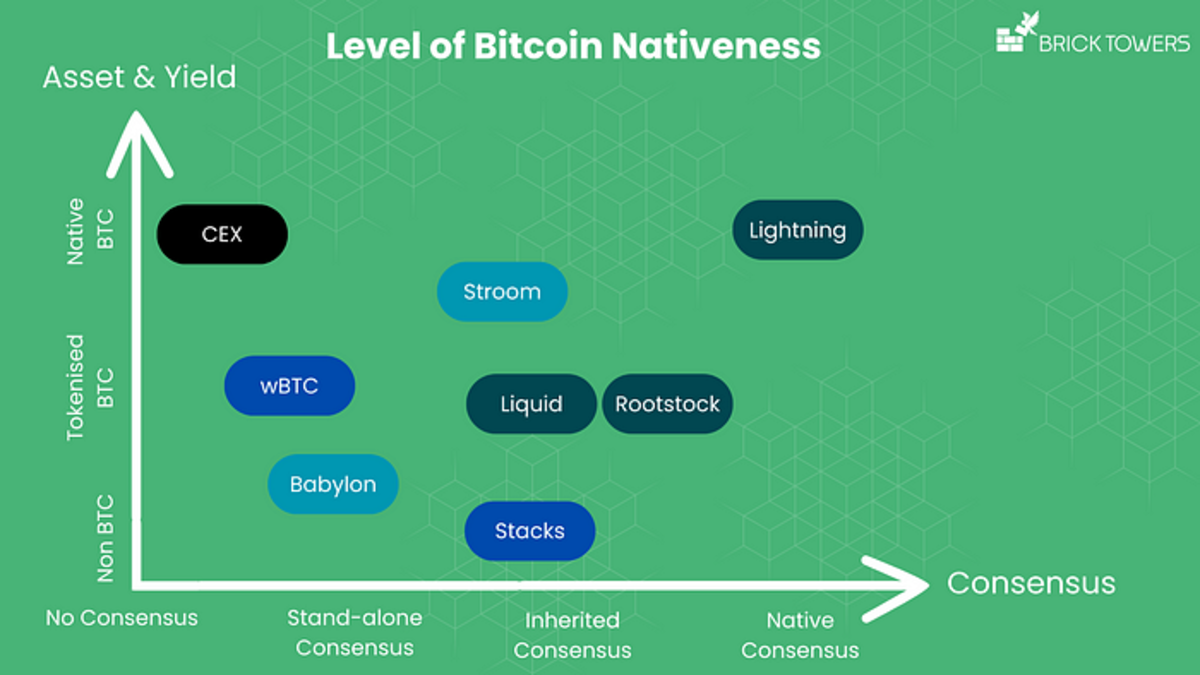

Consensus Angle

This evaluation categorizes Bitcoin yield merchandise primarily based on their alignment with the Bitcoin blockchain’s consensus, distinguishing between 4 classes.

- No Consensus: This class represents centralized platforms the place the bottom infrastructure stays off-chain. Examples embrace centralized platforms like Celsius or BlockFi, which maintain full custody over customers’ belongings, exposing them to counterparty dangers and dependency on intermediaries. Whereas these platforms make the most of Bitcoin, their yield methods are primarily executed off-chain via conventional finance mechanisms. Regardless of being a step in direction of Bitcoin adoption, these platforms stay extremely centralized, resembling conventional monetary establishments, but typically unregulated in distinction.

- Standalone Consensus: On this class, the bottom infrastructure is decentralized, represented by public blockchains akin to Ethereum, BNB Chain, Solana, and others. These blockchains have their very own consensus mechanisms unbiased of Bitcoin’s and aren’t explicitly tied to Bitcoin’s consensus.

- Inherited Consensus: Right here, the bottom infrastructure is decentralized, represented by Bitcoin sidechains or Layer-2 options with distributed consensus. Whereas these sidechains have their very own consensus mechanisms, they purpose to align extra carefully with Bitcoin’s blockchain. Examples embrace federated sidechains like Rootstock, Liquid Community or Stacks.

- Native Consensus: This class depends on Bitcoin’s native consensus mechanism because the underlying safety mannequin. As an alternative of a separate blockchain or sidechain, it makes use of off-chain state channels cryptographically linked to the Bitcoin blockchain. The Lightning Community is a chief instance of this method, providing a excessive stage of trust-minimization by absolutely counting on Bitcoin’s consensus.

The nearer a Bitcoin yield product is to Bitcoin’s native consensus, the extra aligned it’s with Bitcoin and customarily the extra trust-minimized it’s perceived to be. Nonetheless, nuances exist inside the standalone and inherited consensus classes, the place the extent of decentralization and safety of the underlying infrastructure varies.

General, whereas no consensus yields the bottom stage of decentralization and trust-minimization, native consensus is believed to supply the best stage of trust-minimization, though issues of consensus safety and decentralization require additional evaluation.

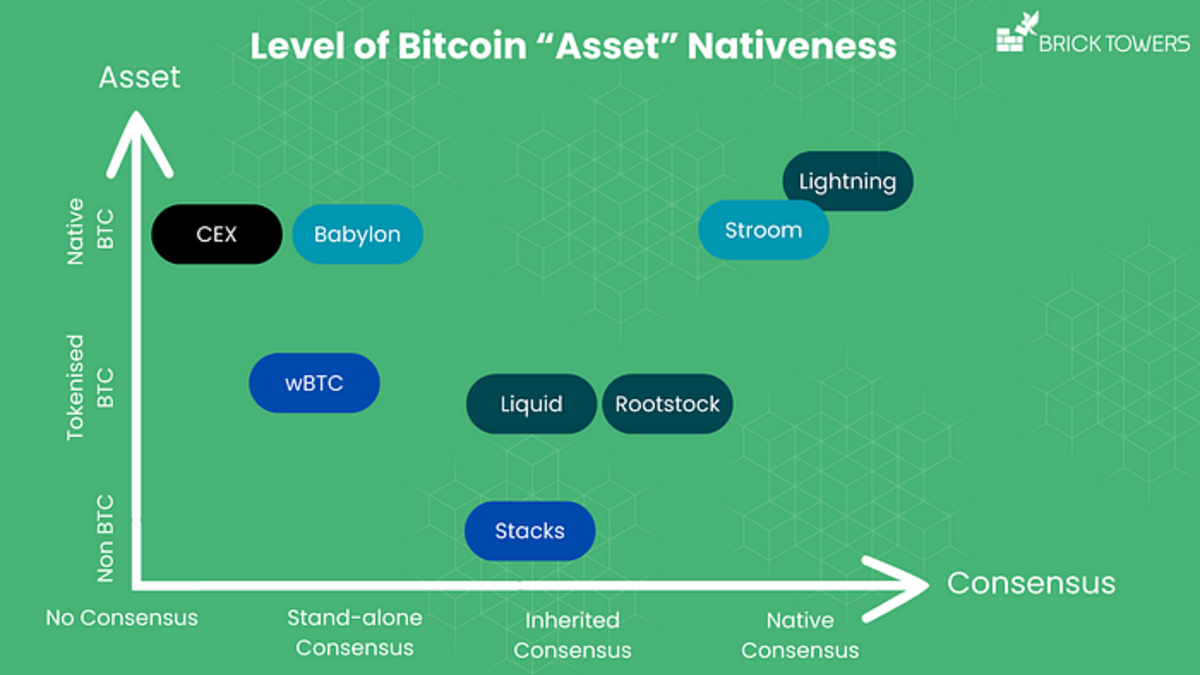

Asset Angle

When contemplating the asset utilized by Bitcoin yield merchandise, alignment with Bitcoin (BTC) could be categorized into three major teams.

- Non-BTC: This class consists of options that use belongings apart from BTC, which leads to a low stage of alignment with Bitcoin. An instance is Stack’s stacking possibility, the place Stack’s native coin STX is used to generate a yield in BTC.

- Tokenized BTC: Right here, the asset used is a tokenized model of BTC, rising alignment with Bitcoin in comparison with non-BTC belongings. Tokenized BTC could be discovered on public blockchains like Ethereum (WBTC, renBTC, tBTC), BNB Chain (wBTC), Solana (tBTC), and others. Moreover, tokenized BTC is hosted on Bitcoin sidechains with inherited consensus mechanisms, akin to sBTC, XBTC, aBTC, L-BTC, and RBTC.

- Native BTC: This class options belongings which might be on-chain Bitcoin (BTC) with none tokenized variations concerned, providing the best stage of alignment with Bitcoin. Varied CEX options and Babylon’s Bitcoin staking protocol make the most of BTC straight. Babylon goals to scale Bitcoin’s safety by adapting Proof-of-Stake mechanisms for Bitcoin staking. Moreover, initiatives like Stroom Community leverage the Lightning Community to allow Liquid Staking, the place customers can earn Lightning Community income by depositing BTC and minting wrapped tokens like stBTC and bstBTC on EVM-based blockchains to be used within the wider DeFi ecosystem.

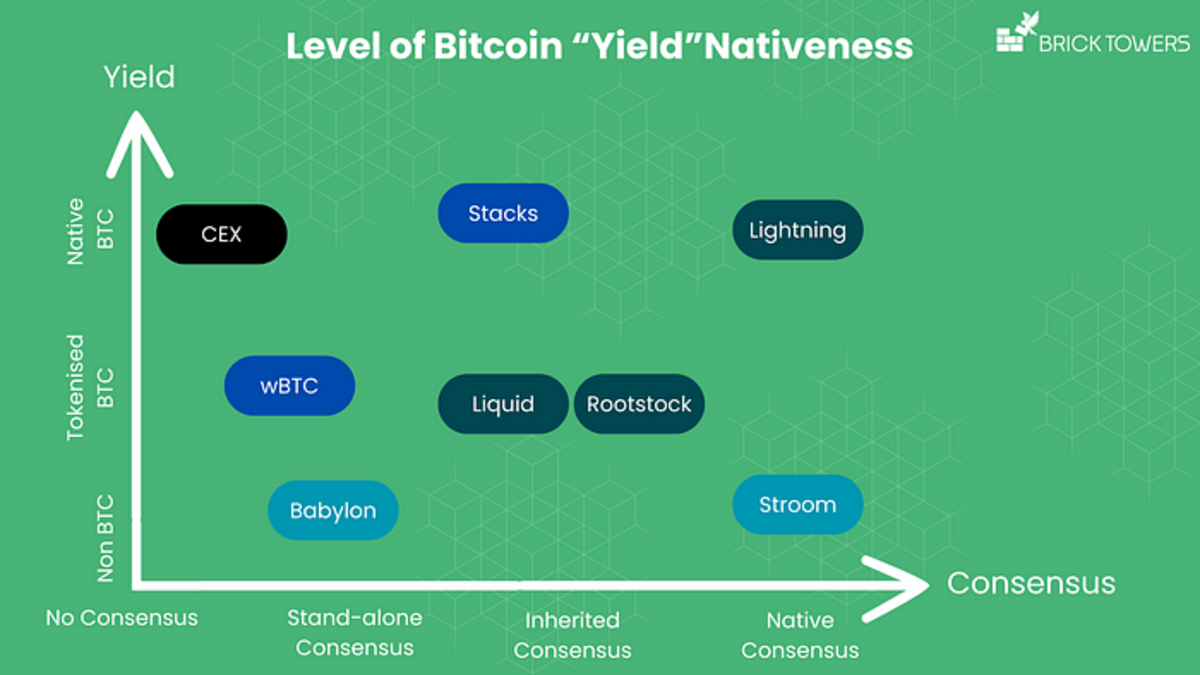

Yield Angle

When analyzing the yield facet of Bitcoin yield merchandise, the query of Bitcoin alignment additionally arises, resulting in related categorizations as with the asset facet: non-BTC, tokenized BTC, and native BTC.

- Non-BTC Yield: Babylon affords yields within the native asset of the Proof-of-Stake (PoS) blockchain, enhancing the blockchain’s safety via Babylon’s staking mechanism.

- Tokenized BTC Yield: Stroom Community supplies yields within the type of lnBTC tokens. Sovryn, working on Rootstock, facilitates lending and borrowing on Bitcoin utilizing tokenized BTC (RBTC) as yield. On the Liquid Community, the Blockstream Mining Notice (BMN) affords yields in BTC or L-BTC at maturity, offering certified buyers entry to Bitcoin hashrate via an EU-compliant safety token in USDT.

- Native BTC Yield: Stacks affords numerous choices, together with yields paid out in tokenized BTC for some yield functions using sBTC. Nonetheless, for Stacks’ stacking possibility, yields accrue in native BTC. Equally, centralized yield merchandise supplied by sure CEXs ship native BTC as yield to customers.

Bitcoin’s Gold Normal: Native All of the Means Via

Considering the perfect Bitcoin-based yield product, the gold normal product would mix the next three attributes: Native Bitcoin consensus, native Bitcoin asset and native Bitcoin yield. Such a product would mimic near-perfect Bitcoin alignment.

As of now, such options are solely simply being constructed. One such venture in lively improvement is Brick Towers. Their imaginative and prescient for the perfect Bitcoin-based yield product embodies near-perfect Bitcoin alignment by incorporating native Bitcoin consensus, asset, and yield. With a deal with Bitcoin as a long-term financial savings resolution, Brick Towers goals to offer clients with a trust-minimized and native method to using Bitcoin.

Their deliberate resolution revolves round producing a local yield in Bitcoin, leveraging Brick Towers’ automation service for different nodes inside the Lightning Community. Via an optimization algorithm fixing for financial utility, capital is strategically deployed to fulfill the liquidity calls for of different community members, optimizing capital effectivity whereas minimizing counterparty dangers.

This method not solely fosters the expansion of the Lightning Community but additionally enhances Bitcoin’s utility as an asset, all whereas offering clients with a seamless and safe technique of incomes yield on their Bitcoin holdings. Importantly, Brick Towers’ resolution avoids the usage of wrapped cash, additional decreasing counterparty dangers and reinforcing their dedication to Bitcoin’s native ecosystem.

This text was researched and written by Pascal Hügli in collaboration with Brick Towers. Hügli is a devoted Bitcoin analyst and researcher, deeply immersed in all aspects of the Bitcoin ecosystem. He has been finding out the event of a correct and strong Bitcoin-based monetary system for years. This text has initially been revealed in an extended type model right here.

It is a visitor publish by Pascal Hügli. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.