Tesla traders appear to need to maintain CEO Elon Musk completely satisfied.

Tesla (TSLA 2.92%) inventory is gaining in Thursday’s each day buying and selling session. The electrical car (EV) innovator’s share worth was up 3% as of three:45 p.m. ET, in response to information from S&P International Market Intelligence.

Tesla inventory is gaining floor following indications that CEO Elon Musk’s newest compensation package deal is more likely to be accredited. After the market closed yesterday, Musk indicated that shareholders had been poised to provide the inexperienced mild for a hotly contested pay package deal valued at roughly $56 billion. He additionally indicated that shareholders had been voting in favor of transferring the corporate’s place of incorporation from Delaware to Texas. Wall Road is outwardly feeling bullish about each information gadgets.

Musk’s massive payday strikes nearer to actuality, however there is a catch

In 2018, Tesla board members accredited a performance-based compensation package deal that might doubtlessly award Musk with as a lot as $56 billion price of firm inventory. However a Delaware decide struck down the pay package deal this January on the grounds that the corporate’s board had not proven that the compensation was truthful or offered proof that that they had engaged in significant negotiations in regards to the CEO’s pay. Shareholders have been voting on whether or not to reauthorize the deal.

Whereas many of the votes on Musk’s pay package deal had been submitted yesterday, a small the rest will likely be submitted later immediately. The pay package deal seems more likely to move, however some authorized consultants suppose that the Tesla CEO’s compensation will as soon as once more wind up being challenged in court docket.

What comes subsequent for Musk and Tesla inventory?

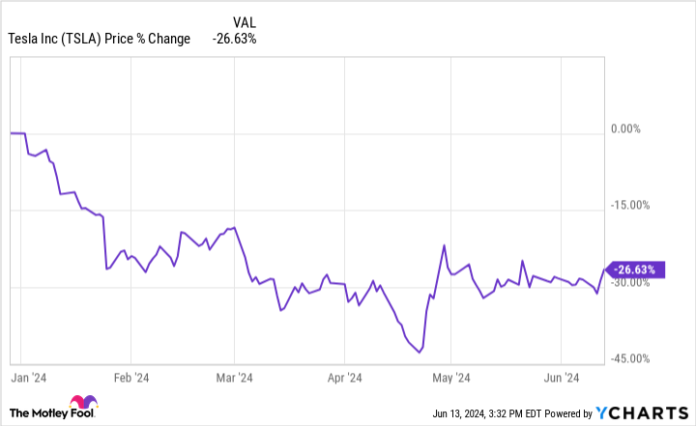

There is no doubt that Musk’s management has been instrumental in Tesla’s unbelievable rise and inventory efficiency. However, the EV firm has been going through some important challenges these days. Additional complicating the query of Musk’s compensation, Tesla inventory has seen massive sell-offs this yr regardless of an general bullish backdrop that has powered explosive positive aspects for a lot of tech shares.

Valued at roughly 72 instances this yr’s anticipated earnings, Tesla continues to commerce at extremely growth-dependent multiples regardless of considerably sluggish efficiency for the enterprise. With the corporate going through strain from the rise of Chinese language EV makers and different gamers within the area, it could be arduous to justify the corporate’s valuation when viewing it via the lens of a conventional vehicle maker. However Musk has continued to take a position closely in innovation initiatives, and a few traders are prepared to assign a premium to the inventory primarily based on his imaginative and prescient and the corporate’s monitor document of disruption.

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.