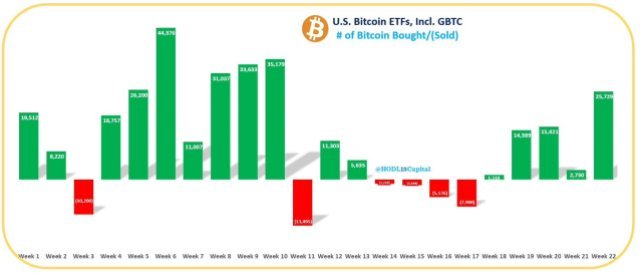

Amid a broader wave of elevated adoption and acceptance of Bitcoin, the biggest cryptocurrency asset, United States BTC Spot Trade-Traded Funds (ETFs) prior to now week acquired a considerable quantity of BTC roughly 25,729.

This improvement is in step with present patterns wherein vital monetary establishments and companies have begun to simply accept the asset, thereby strengthening its standing throughout the worldwide monetary system.

Bitcoin Spot ETFs Accumulation Matching Practically Two Months’ Mining Manufacturing

In style buying and selling platform and analyst TOBTC reported the event on the X (previously Twitter) platform on Monday. In response to the platform, contemplating the present mining price of roughly 3.125 BTC for every block, this monumental stockpile is equal to roughly two months’ value of newly mined Bitcoin, with inflows reaching over $1.83 billion.

The rise in ETF holdings is indicative of traders’ rising religion in Bitcoin’s long-term value and talent to behave as a hedge towards risky financial situations. It additionally illustrates how BTC is turning into extra extensively accepted and built-in into conventional monetary merchandise, bridging the divide between standard finance and the creating digital asset market.

Moreover, TOBTC famous that the acquisition represents the biggest weekly buy since March, when Bitcoin hit its present all-time excessive, and is sort of equal to the entire quantity of the crypto asset bought in Might. Following the launch of the merchandise in January, 11 authorised ETFs have had internet inflows of a whopping $15.69 billion, regardless of giant withdrawals from Grayscale Funding’s fund.

Blackrock Bitcoin ETF (IBIT) presently has the biggest BTC holdings for a spot BTC ETF. Up to now, the largest asset administration firm on the planet, Blackrock has collected an astounding 304,976 BTC, valued at roughly $21 billion for his or her trade fund. This monumental funding demonstrates BlackRock‘s perception within the long-term prospects of the digital asset and the increasing institutional curiosity in cryptocurrencies.

Given the corporate’s substantial holdings, they could assist BTC acquire extra traction and recognition in most people because the cryptocurrency trade develops. As well as, with the assist of such a prestigious monetary agency, the crypto asset seems to have a brilliant future.

A Main Focus In Digital Asset Funding

You will need to observe that BTC has turn out to be a major participant in the complete digital asset funding merchandise market. Inflows into digital asset funding merchandise reached $2 billion, elevating the entire for the final 5 weeks of inflows to $4.3 billion.

Additionally, ETP buying and selling volumes elevated to about $12.8 billion for the week, which is a 55% upsurge over the earlier week. In the meantime, with $1.97 billion in inflows for the week, Bitcoin was as soon as once more the primary focus.

TOBTC additionally underscored that Ethereum witnessed a $69 million internet inflows through the interval, marking its strongest week since March. That is almost definitely as a result of surprising resolution to allow spot Ethereum ETFs by the US Securities and Trade Fee (SEC).

Featured picture from iStock, chart from Tradingview.com