Two household-name shares may quickly grow to be extra inexpensive for on a regular basis buyers. One is just about assured to separate its inventory very quickly, and the transfer would additionally match the opposite firm’s administration fashion.

Inventory splits are sometimes misunderstood. They do not change the basic worth of an organization; as a substitute, they enhance the variety of shares accessible, making them extra accessible to a broader vary of buyers.

It is just like peeling and segmenting an orange. The orange stays the identical, however the smaller items are extra handy to devour.

This technical adjustment — a pure train in accounting gymnastics, actually — can generate pleasure out there, because it typically alerts an organization’s sturdy efficiency and development potential. For these searching for to make the most of the thrill round inventory splits, listed here are two excellent investments on the verge of inventory splits proper now.

Key particulars about Chipotle’s upcoming inventory cut up

Let’s begin with the obvious inventory splitter. Chipotle Mexican Grill (CMG 0.04%) proposed a 50-for-1 inventory cut up on March 19, and shareholders will vote on the proposal in Thursday’s annual assembly. The measure is prone to move with an amazing majority.

First, I am unable to recall a single instance of atypical inventory splits getting a thumbs-down within the area of shareholder approvals. Second, this is able to be the primary inventory cut up in Chipotle’s historical past, and the share value is getting fairly wealthy. Presently buying and selling at $3,090 per share, there are solely 4 beefier share costs on the American market in the present day.

Once more, the cut up will not add any worth to Chipotle’s market cap, however it would make the inventory simpler to handle — particularly for retail buyers with modest stock-buying budgets. A few of us must save up for a lot of months earlier than grabbing a single Chipotle share in the present day, and a few of the hottest inventory brokerages have not embraced fractional trades but. However after the advised 50-for-1 cut up, the share value ought to drop to roughly $62 on the morning of June 26.

Chipotle stands out within the restaurant business for a lot of causes. In an period of widespread franchising, Chipotle insists on proudly owning its shops to regulate product high quality and worker relations. Its career-oriented administration fashion jogs my memory of Costco‘s (COST 1.54%), full with beneficiant employee advantages and strong pay scales.

The incoming inventory cut up means that Chipotle’s management anticipate share costs to maintain rising for the foreseeable future. The corporate’s give attention to product high quality and humane worker relations is setting new requirements for the restaurant sector.

I personally cannot eat at Chipotle — cilantro tastes like cleaning soap — however it’s an undeniably nice firm, and the inventory cut up makes it extra accessible.

Why Costco ought to think about a inventory cut up quickly

Talking of Costco, the wholesale retailer ought to think about a inventory cut up these days.

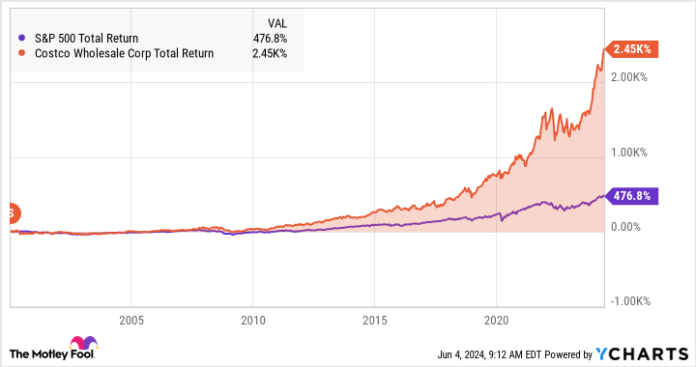

Costco is not a whole stranger to stock-splitting operations — it has simply been some time. Its final inventory cut up was a 2-for-1 affair on Jan. 13, 2000. Costco’s inventory has seen a complete return of two,450% since then, leaving the S&P 500 (SNPINDEX: ^GSPC) index far behind with a mere 477% achieve:

Like Chipotle, Costco is thought for its employee-friendly atmosphere. Its Kirkland choice of store-brand merchandise is commonly indistinguishable from main name-brand choices. The truth is, they’re typically made in the identical factories, by the identical market-leading producers, however packaged with a Kirkland label and bought at a lower cost.

And Costco runs its retail operations close to the break-even line. The corporate is sort of worthwhile anyway, due to its membership procuring system. Annual charges accounted for 1.9% of Costco’s complete income in final month’s third-quarter report, however additionally they generated greater than half of the corporate’s working earnings.

Now, Costco hasn’t introduced a inventory cut up or organized for a shareholder vote on the thought but. However with share costs crossing the $800 mark final week, these stubs are getting a bit unwieldy. It might behoove Costco’s board of administrators to make the inventory extra simply reachable for particular person buyers — together with their very own employees.

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Costco Wholesale. The Motley Idiot has a disclosure coverage.