We’re now in an financial surroundings that takes a lot of the wind out of most development shares’ sails.

The previous a number of years have been super ones for development shares. Worth shares? Not a lot. Low rates of interest and a booming financial system clearly aren’t an issue for a lot of the corporations thought-about worth names. It is simply that this type of financial situation is right for development corporations…low-cost capital, and loads of demand.

The tables could also be turning. That’s to say, excessive borrowing prices and a slower financial system favor the cash-cow corporations you may regularly discover represented by worth shares. And it is a dynamic that might final for years.

With that because the backdrop, here is a rundown of three worth shares that might simply outperform most others between now and 2030.

Hercules Capital

Hercules Capital (HTGC 1.02%) is not a typical for-profit company. Fairly, it is a enterprise improvement firm (or BDC), which means it supplies capital to up-and-coming outfits that want money to capitalize on a possibility. This money could be supplied in alternate for an fairness stake within the group borrowing it. For Hercules Capital, although, these funds are often provided within the type of a mortgage. Given the above-average threat of those loans, they’re often made at above-average rates of interest. That is how Hercules can afford its trailing-12-month dividend payout of $1.92 per share — it is simply passing alongside a bit of the curiosity revenue it is amassing on all of the capital it is loaned out.

To explain Hercules as a mere lender, nevertheless, nonetheless does not do it justice. It is a specialist, targeted on the areas of life sciences (biopharma), expertise, renewable power, and software program corporations that supply subscription-based entry to their software program. By limiting its portfolio of debtors to a slim vary of enterprise traces, it is higher outfitted to serve them by additionally providing its personal experience.

Buyers protecting their fingers on the heart beat of the enterprise improvement firm enviornment in all probability already know that just a few too lots of them have been unreliable of late. The short, steep development in rates of interest has put bearish strain on lots of their shares, since that is how the market adjustments their dividend yields to prevailing, risk-adjusted ranges. Increased rates of interest additionally imply enterprise improvement corporations’ personal value of capital is up, whereas the wobbly financial system is creating measurable will increase in mortgage defaults.

On stability, although, the surroundings could me extra helpful than problematic for BDCs. Increasingly more typical lenders are much less and fewer in making such speculative loans to small and mid-sized corporations. That is steering would-be debtors to BDC gamers like Hercules Capital, that are exhibiting a stunning diploma of resilience anyway. That is a giant purpose Hercules Capital shares have carried out so nicely lately whereas different, comparable shares have not. Hercules Capital shares just lately hit a file excessive, the truth is.

No, it is not a worth inventory within the conventional sense of the time period. But it trades and performs like one, providing newcomers an opportunity to plug in whereas the dividend yield stands at 10%, and whereas shares are priced at lower than 10 instances their previous and projected earnings.

Albemarle

Chances are you’ll be extra acquainted with Albemarle (ALB -0.96%) than you notice. The chemical firm is within the lithium enterprise, which is used within the batteries present in most electrical autos. It additionally provides bromine (one other sort of salt) utilized in extra industrial purposes like hearth security options and mercury remediation. Then there’s its chemical catalyst enterprise Ketjen.

An thrilling enterprise? Nope. Not even somewhat bit. However an organization does not must be thrilling to be rewarding for buyers. It simply must be able to producing income that may be constantly transformed into web revenue.

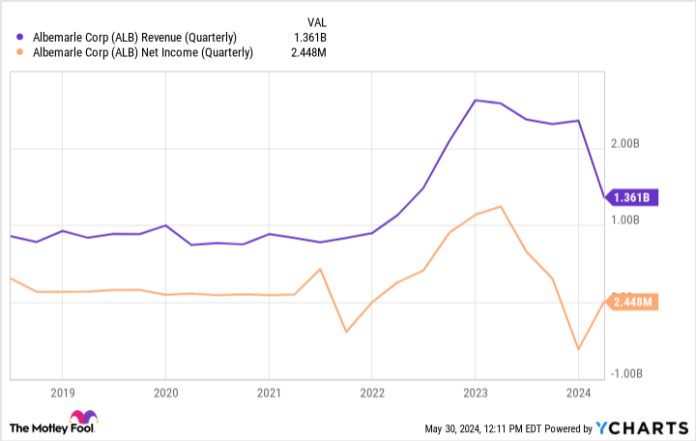

Anybody who’s stored an in depth eye on Albemarle since 2021 seemingly is aware of it has been a bit inconsistent currently. Gross sales in addition to earnings soared between the latter half of 2022 and the early half of 2023, however the boon did not final. Its high and backside traces are each shrinking quite dramatically.

ALB Income (Quarterly) information by YCharts

That is a type of instances, nevertheless, the place it pays to take a step again and perceive what’s occurring.

This huge swell and subsequent contraction? It is fully the results of an enormous rise and fall within the value of lithium. As you may recall, EV-driven demand was hovering, whereas on the similar time the provision chain’s disruption ensuing from the COVID-19 pandemic was lastly being totally realized. Lithium provides did lastly meet up with demand, resulting in easing costs that dragged Albemarle’s gross sales and earnings decrease with them.

Besides, the sellers could have overshot their goal. Albemarle inventory is now valued at a modest 18 instances subsequent yr’s projected per-share earnings. That is not filth low-cost. However, in gentle of Morningstar analyst Seth Goldstein’s prediction that lithium costs might be 70% increased than they’re now by 2030, there’s each purpose to consider Albemarle’s backside line will proceed rising past subsequent yr. Bolstering this bullish argument is consulting agency McKinsey’s expectation that demand for lithium — no matter its value — is set to develop at an annualized tempo of greater than 30% by 2030.

Berkshire Hathaway

Final however not least, add Berkshire Hathaway (BRK.A 1.57%) (BRK.B 1.42%) to your listing of worth shares that might outperform most others over the course of the approaching 5 years. Berkshire shares ought to commerce and carry out like a worth inventory at a time when worth shares are discovering favor from buyers.

Berkshire Hathaway is in fact Warren Buffett’s proverbial brainchild. It was launched again in 1965 when the textile firm of the identical identify acquired an insurance coverage enterprise. Buffett merely by no means stopped including these exterior entities to the combination. At the moment Berkshire holds stakes in just a few dozen publicly traded outfits together with Apple, Financial institution of America, and Coca-Cola. Most all of those shares are thought-about worth shares, too, thus making Berkshire Hathaway the worth play Buffett intends it to be.

These holdings aren’t even half the story, nevertheless. Almost two-thirds of Berkshire’s worth is definitely derived by the wholly owned personal (not publicly traded) corporations held by the conglomerate. Pilot Journey Facilities, Dairy Queen, flooring firm Shaw Industries, Duracell batteries, and Geico Insurance coverage are only a sampling of the a number of dozen privately owned companies in Berkshire Hathaway’s portfolio. These are nice cash-generating manufacturers, offering the lion’s share of the $37.4 billion price of working revenue Berkshire reported for 2023, up 21% from 2022’s backside line.

What’s Buffett doing with this money? Nothing, actually. In reality, he is finished so little with this working revenue of late that Berkshire’s now sitting on a record-breaking money hoard of $189 billion. He merely cannot discover any alternative he likes at a value he likes.

This does not change the truth that Berkshire Hathaway stays one of many market’s greatest and most dependable choices for buyers searching for extra publicity to worth shares. You are entrusting your funding to one of many most confirmed (if not the most confirmed) worth buyers of all time. It might actually shine in an financial surroundings that is ideally fitted to worth names.