These firms are buying and selling at higher valuations than AMD and are doubtlessly higher choices to put money into AI chips.

The unreal intelligence (AI) market took over Wall Road final yr exhibits no indicators of letting up. Traders have been captivated by the huge potential of the expertise, in addition to the hovering earnings development from the businesses driving it.

Chipmakers have confirmed to be a few of the finest methods to put money into the world. These firms are creating the {hardware} that makes the AI market attainable, with chip demand skyrocketing over the past yr.

As a number one chipmaker, Superior Micro Units‘ (AMD 0.09%) has seen its share value improve by 31% over the past 12 months. Nevertheless, a rising inventory value and a enterprise that has but to see a major return on its funding in AI has made AMD’s shares overpriced for now.

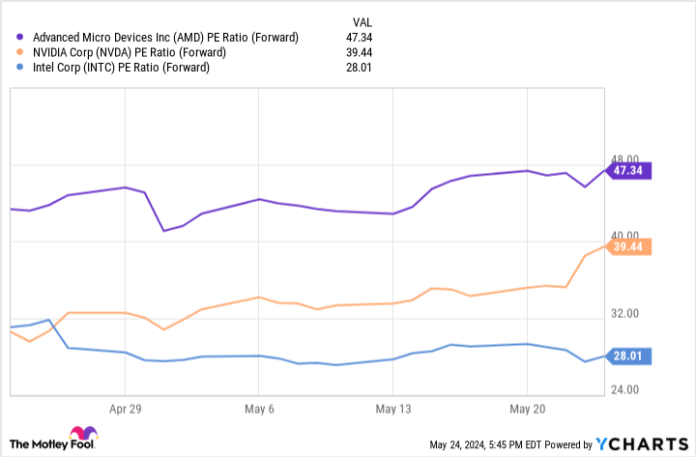

Information by YCharts

This chart makes use of ahead price-to-earnings (P/E) ratios to match the valuations of the three most outstanding names in chips. Every of those firms has rising ventures in AI and will get pleasure from main positive aspects within the coming years because the market develops. But AMD’s ahead P/E — the very best among the many three firms — signifies its inventory is providing the least worth, with the opposite two wanting like extra engaging choices to put money into AI.

So overlook AMD and think about shopping for these two synthetic intelligence shares now.

1. Intel

With repeated hits to Intel‘s (INTC 2.19%) enterprise having introduced its share value down about 46% since 2021, the corporate is undoubtedly a long-term play. Nevertheless, its ahead P/E of 28 may make it one of many best-valued shares in AI, suggesting now is a wonderful time to put money into its rising enterprise.

Current headwinds have pressured Intel to rethink its enterprise mannequin. The corporate has transitioned to a foundry mannequin, starting building on chip manufacturing crops all through the U.S. Intel is among the greatest recipients of the CHIPS Act, which goals to broaden the U.S.’s chip capability as tech firms search to rely much less on Taiwan Semiconductor Manufacturing Firm. It’s going to take time and important funding, however this transfer may enhance Intel’s income for years.

Intel’s concentrate on manufacturing is promising, because the semiconductor foundry market is projected to quickly double in dimension. Based on Allied Market Analysis, the trade hit $107 billion in spending in 2022 and is anticipated to realize greater than $231 billion by 2032. In the meantime, Intel has already signed tech behemoth Microsoft as a chip shopper.

Furthermore, Intel believes its foundry enterprise may lead to a profitable place in AI. CEO Pat Gelsinger mentioned in mid-Might that the corporate expects its Columbus, Ohio, plant to be “the AI programs fab for the nation.” Manufacturing may set Intel other than different chipmakers in AI over the long run, with firms like AMD specializing in design over manufacturing.

Within the first quarter of 2024, Intel’s AI and information heart section logged $184 million in working revenue, significantly enhancing on the damaging $69 million it posted within the year-ago quarter. In the meantime, Intel Foundry working revenue elevated by 8% yr over yr.

It’s going to require endurance, however Intel is on a development path you will not need to miss. The corporate has important potential in AI, and may very well be a greater possibility than AMD within the coming years.

2. Nvidia

Regardless of inventory value development of 173% over the past yr in comparison with AMD’s 31%, Nvidia’s decrease ahead P/E signifies its inventory is a greater worth. That is primarily due to Nvidia’s hovering monetary development over the past 12 months.

In Q1 2025 (which ended April 2024), Nvidia posted income development of 262% yr over yr, with working revenue climbing 690%. The corporate profited from a 427% rise in income from its information heart section, reflecting a spike in AI graphics processing unit (GPU) gross sales.

Shares of Nvidia have popped 12% since its earnings launch on Might 22, and seem primed for extra. The corporate’s years of dominance in GPUs allowed it to get a head begin in AI, with its lead unlikely to dissipate any time quickly.

Intel has neatly discovered its area of interest in manufacturing, setting itself other than Nvidia. Nevertheless, AMD may have a tricky time going up towards the likes of Nvidia in AI chips.

Along with large potential in AI, Nvidia has turn into the go-to chip provider for numerous different industries.

As an illustration, Nvidia CFO Colette Kress has mentioned she expects automotive to be the “largest enterprise vertical inside [the] Information Heart [segment] this yr.” Self-driving expertise is advancing rapidly, with CEO Jensen Huang calling Tesla‘s autonomous tech probably the most superior system out proper now. Tesla’s expertise is powered by Nvidia’s chips, with demand solely more likely to proceed to rise because the automotive trade develops.

Nvidia simply delivered one other quarter of stellar earnings, suggesting it may proceed on its present development trajectory for years. Its inventory is value contemplating proper now earlier than it is too late.

Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.