Tobacco corporations was once among the many darlings of the inventory market. With rising money flows every 12 months, they made long-term shareholders some huge cash. However that has modified lately.

Over the past 10 years, British American Tobacco (BTI 1.07%) — one of many largest tobacco/nicotine corporations on the planet — has produced a complete return of destructive 6%, whereas the S&P 500 is up 231%. This contains the sturdy dividend funds it distributes to shareholders each quarter.

Immediately, its dividend yield has risen to only beneath 10%. With expertise shares pushing to new all-time highs, this forgotten tobacco big appears to be like more and more undervalued. Is British American Tobacco an revenue investor’s dream proper now?

The smokeable enterprise is declining, however money flows are sturdy

British American Tobacco owns a few of the longest-standing world cigarette manufacturers. These embody Dunhill, Newport, and Camel. Whereas these manufacturers have maintained market share inside the cigarette sector for many years, the general price of smoking is declining across the globe, which is affecting cargo volumes. To counteract the influence of these quantity declines on its financials, British American Tobacco has constantly raised the costs on packs of cigarettes.

You possibly can see the outcomes of that technique within the firm’s consolidated financials. British American Tobacco’s income is definitely up 5.7% over the past 5 years, regardless of the declining use of cigarettes worldwide. Over the following 5 years, the corporate expects to generate over $50 billion in free money stream. For an organization with a market cap of simply $68 billion, this reveals the potential discounted valuation British American Tobacco trades at proper now.

However these value hikes cannot drive money stream perpetually, proper? Finally, most individuals are going to quit smoking cigarettes. That is the place its new expertise merchandise are available in.

Progress can come from new nicotine merchandise

Virtually everyone seems to be conscious of the well being harms brought on by cigarette smoking. So is the chief workforce at British American Tobacco. That’s the reason they’ve been working to construct and purchase different nicotine merchandise to exchange cigarettes among the many grownup inhabitants. These embody nicotine pouches, e-vapor, and heat-not-burn cigarette units. These merchandise might have fewer dangerous well being results in comparison with cigarettes.

Shareholders ought to profit, too. The corporate’s “new classes” section grew income by 21% on an natural fixed forex foundation in 2023 and may hit $5 billion in annual income quickly. In fact, since it is a world firm, this can be affected by overseas forex alternate charges. This section lastly reached profitability final 12 months, driving a optimistic contribution revenue for British American Tobacco for the primary time ever.

Over the following 10 years and past, these new merchandise may drive quantity progress for the corporate and hopefully make up for the eventual revenue declines that may arrive within the cigarette enterprise.

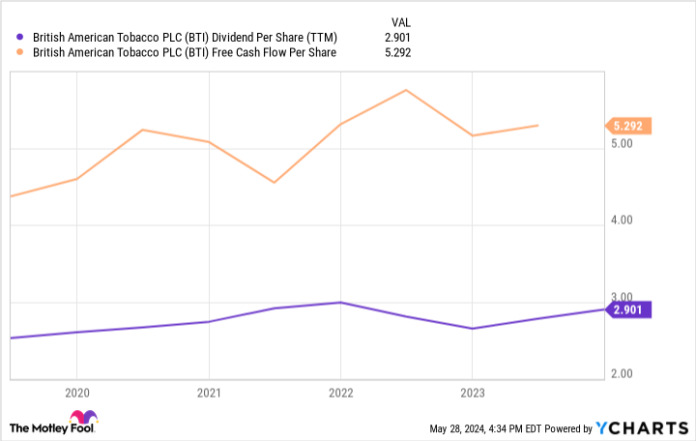

BTI Dividend Per Share (TTM) knowledge by YCharts.

Is the dividend sustainable?

Quantity progress from new merchandise is nice. However revenue traders care about one factor above all else: dividend funds. At at present’s share costs, British American Tobacco has a dividend yield approaching 10%. This makes it one of many highest-yielding shares on the planet, which can make some traders skeptical in regards to the payout’s sustainability.

Once you have a look at the numbers, it’s clear that British American Tobacco really has loads of room to take care of its dividend funds at their present stage, and can seemingly be capable of develop them within the coming years. Its free money stream — which is what corporations deploy to cowl their dividends — was $5.30 per share over the past 12 months. Its dividend is presently simply $2.90 per share.

Even when the cigarette enterprise does worse than anticipated over the following few years, British American Tobacco has loads of room to take care of its present dividend payout, so revenue traders can relaxation straightforward proudly owning this cash-generating nicotine big.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot recommends British American Tobacco P.l.c. and recommends the next choices: lengthy January 2026 $40 calls on British American Tobacco and brief January 2026 $40 places on British American Tobacco. The Motley Idiot has a disclosure coverage.