It won’t be too late to put money into these spectacular development shares.

The Nice Recession ended practically 15 years in the past. Shopping for shares towards the top of an financial slowdown can result in some oversize returns down the highway since that often means you are shopping for them at decreased costs, when optimism within the markets may nonetheless be a bit muted.

If you happen to invested $25,000 on the finish of the Nice Recession in any of the shares on this record, your funding would now be value greater than $1 million. Nvidia (NVDA -0.46%), Netflix (NFLX -1.56%), and Regeneron Prescribed drugs (REGN -1.02%) have been among the many finest and brightest shares over the previous 15 years.

This is how a lot a $25,000 funding in these shares would have grown over that point, and why they nonetheless may be good buys.

Nvidia: $8.2 million

Nvidia generated some unbelievable life-changing returns in 15 years, turning a $25,000 funding right into a mammoth $8.2 million in the present day. Prior to now yr and a half, the inventory has gone parabolic because of the pleasure surrounding synthetic intelligence (AI) and the necessity for its chips to assist develop chatbots and next-gen applied sciences.

However what’s notable is that even earlier than the latest surge in its share worth, Nvidia nonetheless would have been a millionaire-making funding. If you happen to invested $25,000 within the inventory in June 2009 and held on till not less than 2022, you continue to could be sitting on greater than $2.6 million.

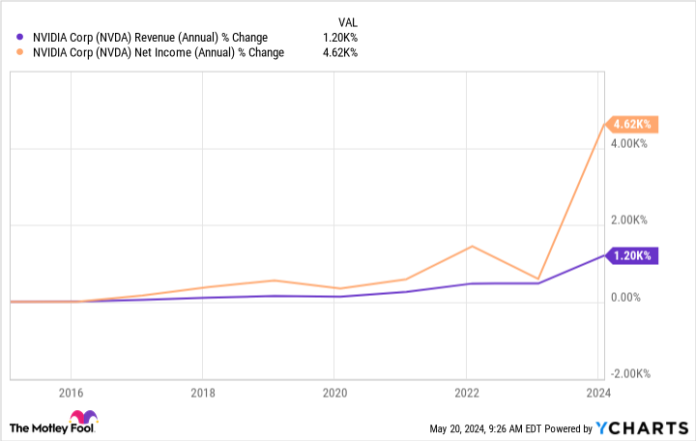

The corporate’s chips have successfully grow to be the usual in computing, and whereas AI has actually ramped up Nvidia’s development, it was a prime development inventory even earlier than then. Prior to now 10 years, the one factor extra spectacular than the top-line development has been that its backside line has accelerated even sooner:

NVDA income (annual) information by YCharts.

Nvidia can nonetheless make for a great purchase though its market cap is already round $2.3 trillion. Given the alternatives in AI and the essential position Nvidia performs in its development, it won’t be too late to speculate on this tech big.

Netflix: $2.6 million

In 2009, Netflix was nonetheless largely a DVD rental firm. The large information by the top of that yr was that almost half of its subscribers have been watching on-line streaming.

At present, that is the principle motive folks subscribe to Netflix: to look at on-line, both from a pc or a cellular machine. Investing in Netflix in 2009 would have concerned some danger as a result of the corporate was on no account a certain factor, nor have been its financials as sturdy as they’re in the present day.

These days, Netflix has grow to be the instance of how you can create a worthwhile streaming enterprise. Whereas customers won’t be thrilled with its price will increase and crackdown on password sharing, these strikes allowed the corporate to create a sustainable and worthwhile operation.

Final yr, Netflix reported web revenue of $5.4 billion on income of $33.7 billion, for a revenue margin of 16%. Many different streaming companies, in the meantime, nonetheless battle with producing any revenue in any respect.

It’s nonetheless a frontrunner within the streaming business with slightly below 270 million paid subscribers. Though its future returns could possibly be extra modest, this will nonetheless be a great development inventory to purchase and maintain.

Regeneron Prescribed drugs: $1.4 million

Regeneron Prescribed drugs has additionally been a prime development inventory to personal over the previous 15 years. A $25,000 funding again then could be value somewhat below $1.4 million in the present day.

As with Netflix, Regeneron was a far riskier inventory in 2009. It was unprofitable and was extremely depending on collaboration income. At $314 million, that accounted for 83% of Regeneron’s prime line.

At present, the enterprise is broader and its income in simply the primary three months of this yr ($3.1 billion) simply eclipses its 2009 tally. Whereas collaboration income nonetheless represents a large portion of Regeneron’s enterprise, the proportion is down to simply 40% as the corporate’s eye illness medicine Eylea is a extremely profitable blockbuster drug, with $1.4 billion in income simply this previous quarter.

The corporate nonetheless has greater than 35 product candidates in growth, so there may nonetheless be much more development on the horizon. And with the corporate producing sturdy free money stream of practically $4 billion within the trailing 12 months, Regeneron is in an awesome place to proceed investing in rising its operations. This can be a inventory that also has the potential to generate sturdy returns.