Because it stands, the premier cryptocurrency maintains its broader bearish construction, with its worth struggling to beat the $68,000 resistance over the previous few days. Nevertheless, an attention-grabbing on-chain growth means that the Bitcoin worth may doubtless see a reduction quickly, however solely after a sure situation has been met.

Realized Income Present Warning Sample That Precedes Outlined Strikes

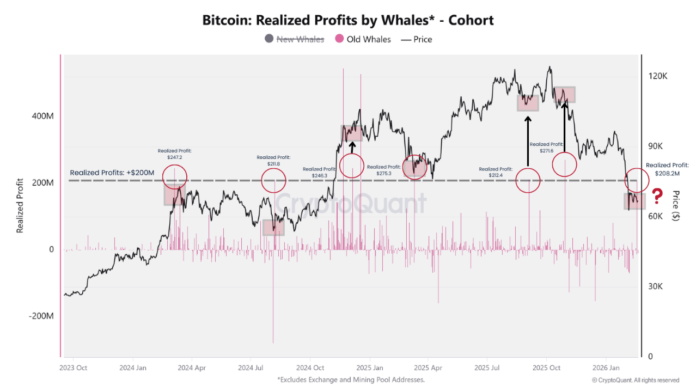

In a current Quicktake submit on CryptoQuant, on-chain analyst MorenoDV revealed that Bitcoin whales have realized greater than $208 million in earnings. As proven by the Realized Revenue By Whales metric, this occasion — the place over $200 million is taken as revenue by members of this cohort — marks the seventh such incidence over the previous two years.

Associated Studying

Notably, these spikes in profits-taken haven’t occurred with none affect on worth; as an alternative, they’ve typically been adopted by market turbulence, which has additionally principally preceded the formation of native bottoms. This implies that large-scale promoting from seasoned holders tends to introduce non permanent liquidity imbalances.

After the availability created by these whales is absorbed, it typically results in worth stabilization. Apparently, this stability has typically preceded bullish reversals within the Bitcoin worth. Nevertheless, there have additionally been a couple of situations the place such profit-taking amongst this investor cohort coincided with the institution of native tops.

Nonetheless, MorenoDV defined that this profit-taking habits among the many Bitcoin whales sometimes alerts conviction, due to the behavioral consistency of this investor class. As such, these massive buyers hardly ever promote impulsively, however once they do, “it alerts conviction about near-term worth exhaustion or strategic repositioning.”

Therefore, if historical past is something to go by, the analyst defined that the Bitcoin market stands a excessive likelihood of experiencing turbulence within the near-term. Nevertheless, this additionally comes with the inference that the Bitcoin worth is nearer to a neighborhood exhaustion level than to the begin of a bearish market cycle.

If institutional flows, and even mid-sized holders, start accumulating at present ranges, the market may interpret this as a wholesome rotation, which may in flip translate into bullish momentum. Alternatively, if demand ought to stay inadequate or if extra market individuals promote their holdings, draw back stress might be amplified, thereby pushing costs additional south.

Bitcoin Value At A Look

On the time of writing, the worth of BTC stands at round $67,960, reflecting no important motion previously 24 hours.

Associated Studying

Featured picture by Dall.E, chart from TradingView