11 Feb Rationalization Of The Present Market Dynamics

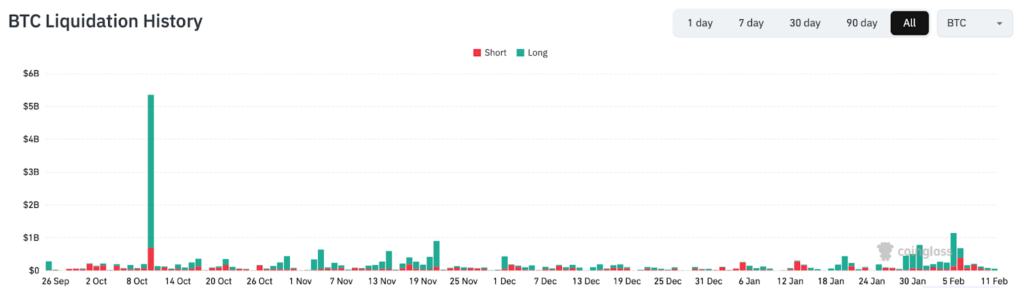

For the reason that break under our 10/10 lows, which marked the biggest liquidation occasion in crypto historical past, the market has been in a downtrending part.

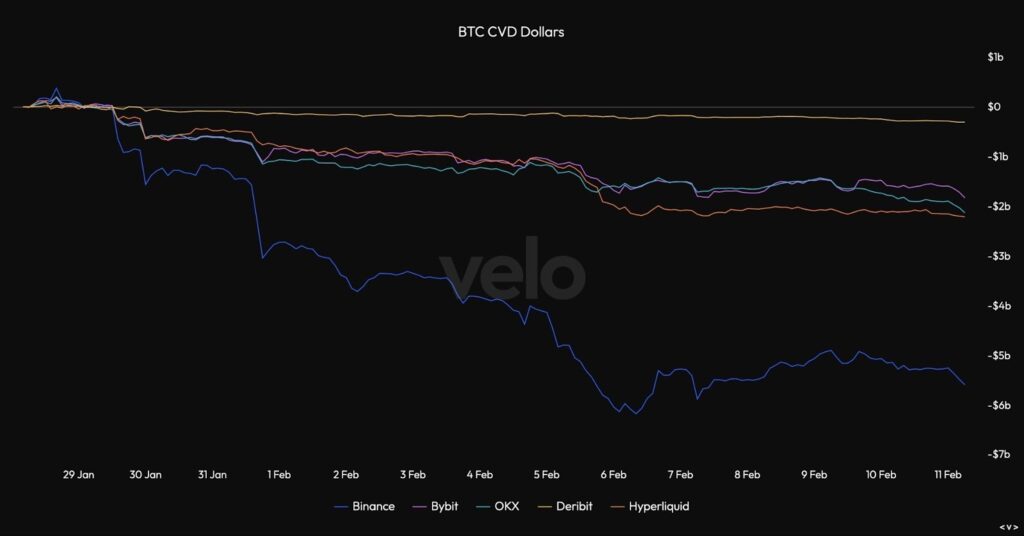

The newest leg down was not pushed by liquidations however quite by aggressive spot promoting. The spot quantity delta metric highlights that the identical entity (or a gaggle of entities) have been distributing provide significantly throughout peak US periods throughout UTC 6:00 – UTC 10:00 and UTC 13:00 – UTC 16:00. A majority of the distribution got here between January thirty first to February fifth and has since stabilised. This promoting strain additionally correlates with routine deposits onto exchanges

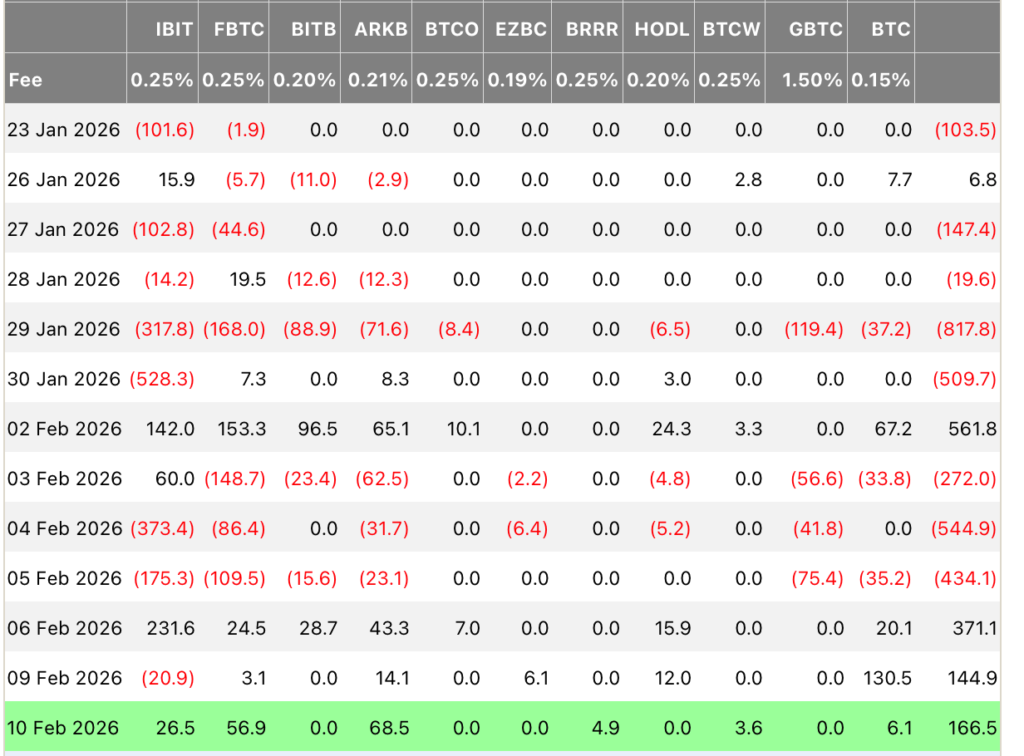

Promoting strain has additionally been exacerbated with heavy US Bitcoin ETF outflows throughout the identical interval. ETFs have been internet sellers since October, with cumulative flows since launch peaking in late October at 62,700 BTC and sits at the moment at 54,300 BTC, with some sporadic inflows, however an general development of constant outflows throughout all suppliers, exhibiting reducing urge for food for crypto publicity from the ETF cohort.

In current days nevertheless, promoting strain from ETFs has begun to abate.

Spot Bitcoin ETFs attracted $371M on Friday, adopted by $145M on Monday. This brings complete inflows over the 2 days to $516M. The streak snaps a month-long redemption interval that started in mid-January. If ETF flows and constant aggressive promoting strain stabilises, we anticipate the value to stabilise too and kind an accumulative vary between key on-chain ranges mentioned under.

Ahead Steerage And Key Ranges To Watch

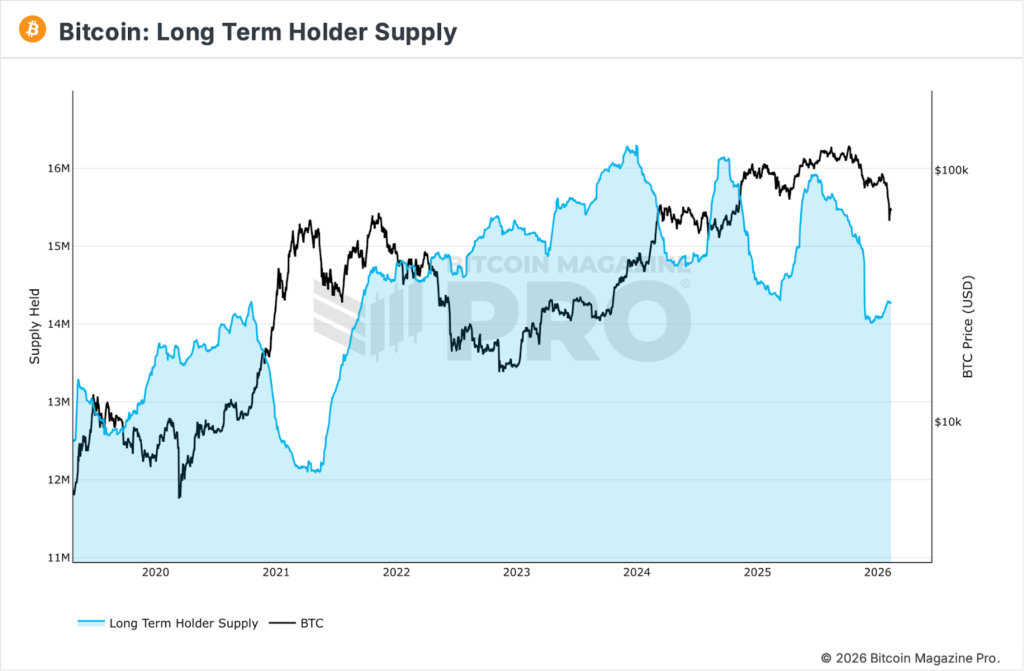

Lengthy-term holder provide is lastly transferring larger, signalling early indicators of accumulation.

Beforehand this metric continued to fall as whales and long-term holders, usually overlapping cohorts of traders, distributed their holdings transferring 13.5% decrease between July-December 2025. Presently the metric has moved to 14.3 million BTC after bottoming in mid December.

Usually, LTH provide is a number one metric to cost, as accumulation begins through the latter finish of downtrends. In current historical past, this metric reaching new highs has proved to be a 3-4 month main indicator in relation to cost.

If this continues to extend on the present tempo, we’d see a repeat of June 2023 or September 2024-like worth motion as soon as our present vary resolves in direction of the upside.

From a mid-term valuation standpoint, Bitcoin is changing into more and more boxed inside a well-defined structural hall.

On the upside, the True Market Imply (~$78.2k) has flipped into overhead resistance following repeated failures to reclaim it on each day by day and weekly timeframes. This degree beforehand acted as a requirement anchor throughout consolidation phases, however after the breakdown, it now represents a zone the place prior assist might transition into provide.

On the draw back, the Realised Worth (~$55k) continues to outline the deeper worth boundary of the present cycle. Traditionally, this metric which displays the mixture value foundation of the community has served as the extent the place long-term capital meaningfully re-engages throughout prolonged corrective phases. Strikes towards the Realised Worth sometimes coincide with late-stage deleveraging, capitulation amongst weaker cohorts, and the gradual re-accumulation by stronger arms.

So long as worth stays trapped between these two structural anchors, the market is more likely to oscillate inside a large however definable valuation band, with upside makes an attempt capped close to cost-basis resistance and deeper draw back attracting longer-horizon patrons.

From a derivatives standpoint, we consider spot market dynamics are much more essential at the moment as perpetual market open curiosity is down from an ATH of $92.4 billion to $44,7 billion. Funding charges are largely impartial or unfavorable for main crypto property and in consequence, the liquidations that occurred on February 5, which was the biggest one-day decline in over 3 years (-14.04 p.c), brought on a comparatively muted quantity of liquidations.

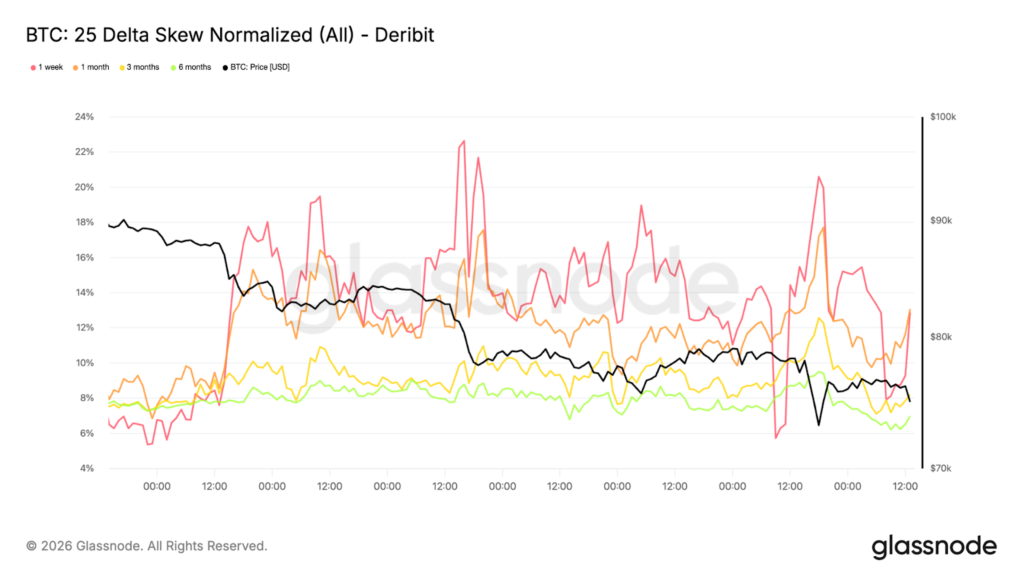

Choices positioning continues to bolster the market’s defensive posture. Draw back skew has steepened as soon as once more, reflecting a renewed bid for protecting places relative to calls. Even with worth holding above the $73k area, contributors are prioritising hedging in opposition to additional hole threat quite than positioning for a significant reduction rally.

Stream dynamics affirm this bias. As an alternative of rotating into upside publicity, choices exercise stays concentrated in draw back safety buildings. This retains the implied likelihood distribution skewed towards unfavorable outcomes and aligns with the persistent firmness in front-end volatility.

A pronounced draw back skew will not be merely a volatility characteristic; it’s a sign of behavioural desire. Merchants are demonstrating a willingness to pay elevated premiums for insurance coverage quite than specific directional optimism. Till name demand begins to construct and skew normalises, positioning stays asymmetrically defensive, with threat perceived to lie predominantly to the draw back quite than in a sustained restoration state of affairs.