19 Jan Bitfinex Alpha | Market Construction Improves however Promote Overhang Persists

Bitcoin momentarily broke above the $94,000–$95,000 resistance zone final week, on robust spot demand, rallying to an intraday excessive of $97,850 on 14 January, its highest stage in over two months. The transfer triggered a significant brief squeeze, with the largest single-day brief liquidations in virtually 100 days, as open curiosity normalised with leveraged longs taking revenue and shorts being pressured out. For the reason that reclaim of the 2025 yearly open and buying and selling greater than 21 % above current lows, there was a transparent enchancment in market construction, even with the value retracing round 6 % from the highs. The breakout, even when non permanent, stays constructive, reflecting decreased leverage overhang and bettering circumstances, offered spot demand persists.

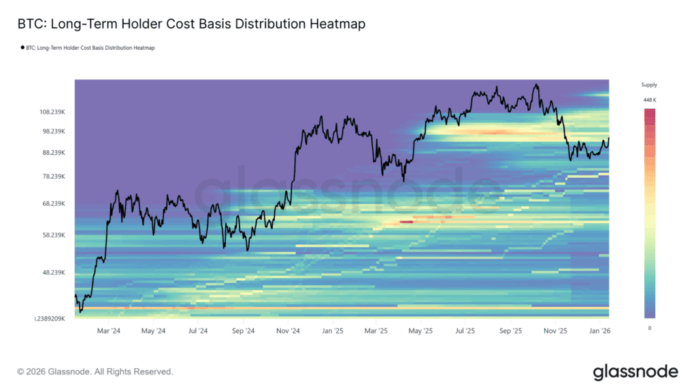

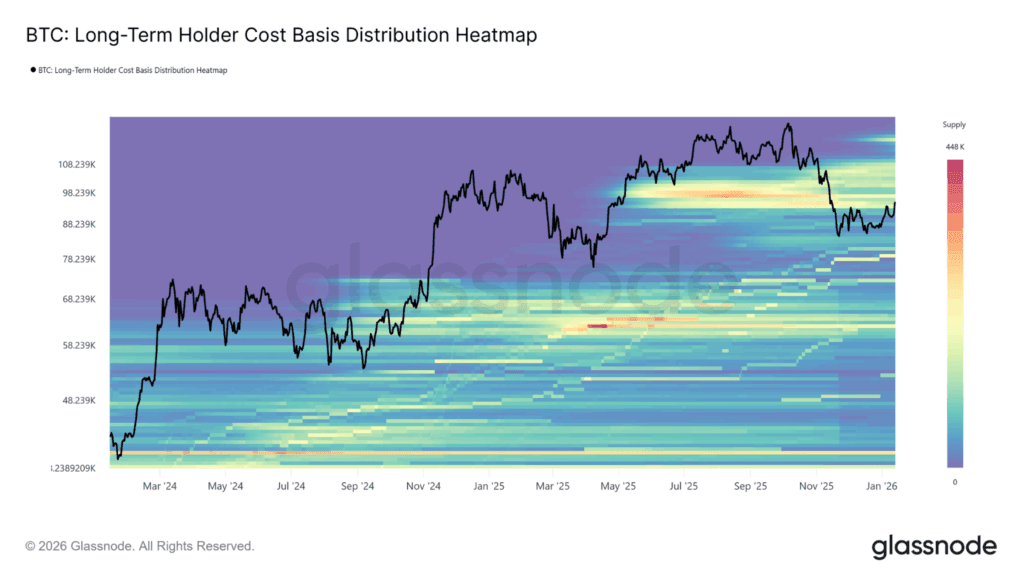

Nevertheless, BTC is advancing right into a dense long-term holder (LTH) provide zone between roughly $93,000 and $110,000, the place earlier restoration makes an attempt stalled. Whereas LTHs stay internet sellers, the tempo of distribution has slowed sharply, with realised income right down to round 12,800 BTC per week from cycle peaks above 100,000 BTC. This moderation, mixed with supportive Q1 seasonality and stronger order-flow dynamics than prior rallies, improves the chance that BTC can take in overhead provide. A sustained transfer by this zone would require additional easing in LTH promote stress, paving the way in which for a extra sturdy restoration and a potential re-test of all-time highs.

Latest financial information factors to an more and more advanced world macro and monetary backdrop, marked by persistent inflation pressures, uneven client resilience, and tightening regulatory oversight.

Within the US, December inflation appeared steady on the floor, however rising meals and housing prices proceed to pressure family budgets, limiting the Federal Reserve’s room to chop rates of interest rapidly.

On the identical time, client spending held up in November, pushed largely by higher-income households, with lower-income teams going through mounting stress from increased important costs, tariffs, and uneven tax advantages as refund season approaches, highlighting rising imbalances beneath headline energy.

Past the US financial system, regulators continued to say larger management over digital asset markets, with Dubai banning privacy-focused tokens, tightening stablecoin guidelines, and shifting duty for token approval to companies. In South Korea, entry to unregistered abroad crypto trade apps by way of Google Play is being blocked, to adjust to home regulatory necessities. Alongside these regulatory shifts, China’s cross-border digital foreign money initiative gained momentum, with transaction volumes on the mBridge platform surpassing $55 billion and home use of the digital yuan increasing quickly, signalling a gradual transfer towards a parallel cost infrastructure that reduces reliance on dollar-based programs. These developments underscore a worldwide setting the place financial resilience is more and more uneven, coverage flexibility is constrained, and each conventional finance and crypto markets are being reshaped by tighter regulation and evolving cost architectures moderately than short-term progress dynamics.