The nuclear power start-up’s inventory has gone on an unimaginable run over the previous 12 months. Can it proceed to ship for traders?

The worldwide power panorama is being redrawn, with nuclear energy entrance and heart. Lately, quite a few nations have signed the Declaration to Triple Nuclear Capability by 2050. Main banks and institutional traders are lining up behind this shift, viewing nuclear as a vital part for decarbonization and power safety.

Realizing this imaginative and prescient requires an unlimited growth of infrastructure, from gas provide chains to grid-ready reactor websites. That is the place next-generation applied sciences like small modular reactors (SMRs) are available in, promising sooner, safer, and extra versatile deployment.

Oklo (OKLO 0.80%), with its compact, fast-spectrum reactor design, stands out as a possible front-runner, and traders have piled into the inventory in response. With an enormous potential runway for development, is Oklo inventory a millionaire maker? Let’s dive into the enterprise and the long-term outlook for the upstart nuclear energy firm.

Oklo’s long-term alternative

World electrical energy manufacturing is projected to extend by over 78% by 2050, pushed by the electrification of buildings, transportation, and trade, and elevated consumption from information facilities. That is the place Oklo’s long-term alternative lies.

Oklo’s Aurora powerhouses seem nicely suited to mission-critical synthetic intelligence (AI) workloads and information facilities. These powerhouses make the most of metal-fueled quick reactor know-how, which is predicated on the design of the Experimental Breeder Reactor-II, which operated for 30 years on the Argonne Nationwide Laboratory till it was shutdown in 1994. The powerhouses are initially designed to provide 15 MWe and 75 MWe of electrical energy, with plans to develop to 100 MWe and better.

Oklo employs a construct, personal, and function enterprise mannequin. As a substitute of promoting the facility vegetation themselves, Oklo sells the output, electrical energy, and warmth on to prospects beneath long-term energy buy agreements (PPAs). This technique is designed to supply recurring income and seize profitability from improved operational effectivity.

Picture supply: Getty Photos.

Oklo has secured a buyer pipeline, primarily via non-binding agreements, totaling over 14 gigawatts (GW) in potential capability. This exhibits sturdy market curiosity, notably from the information heart and protection sectors.

Pay attention to the place Oklo is in its enterprise lifecycle

Oklo’s know-how is designed to handle the problem of nuclear waste. Even after use, nuclear gas waste holds over 95% of its preliminary power potential. Accessing this power reserve is estimated to be the equal of roughly 1.2 trillion barrels of oil equal within the U.S., practically 5 instances the oil reserves of Saudi Arabia. By pursuing nuclear gas recycling, Oklo can convert spent gas into usable gas for its reactors, making a structural provide chain and value benefit.

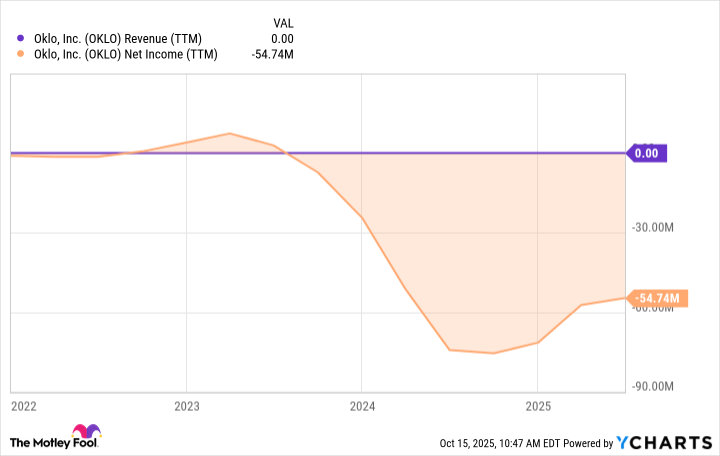

With that stated, it’ll take time for Oklo to construct up a buyer base and function commercially at scale. The corporate is in its early levels, has had a historical past of economic losses, and can proceed to lose cash till its powerhouses turn into operational. It would not anticipate its first Aurora powerhouse on the Idaho Nationwide Laboratory to turn into operational till late 2027 or early 2028.

OKLO Income (TTM) information by YCharts.

One other issue to contemplate is that Oklo requires a home provide chain for high-assay low-enriched uranium (HALEU), which is at the moment unavailable at scale. Though Oklo has secured gas for its first industrial facility, future large-scale deployment will depend on constructing provide capability. Moreover, whereas Oklo is actively creating capabilities for its industrial gas recycling facility, this facility is focused for deployment by the early 2030s.

The excellent news for traders is that the Trump administration has designated civil nuclear power as a nationwide and financial safety precedence, resulting in a coordinated federal push to speed up deployment. Latest government orders and laws, such because the ADVANCE Act, intention to streamline regulatory evaluations, reform reactor testing, and strengthen home gas provide chains.

Is Oklo a millionaire-maker inventory?

Oklo is chasing an enormous market alternative. In accordance with the Worldwide Power Company, beneath present insurance policies, whole SMR capability may attain 40 GW by 2050. Nonetheless, the company notes that “the potential is way higher” and will attain 120 GW with coverage assist and streamlined rules.

Should you make investments $10,000 in Oklo in the present day, and the inventory returns 25% yearly for the following 20 years (a really aggressive return that assumes many issues go proper), it would be value $867,000 sooner or later. Oklo could ship long run, however it’s additionally a risk that it fails to achieve a management place within the SMR house the place competitors is heating up.

Oklo is an intriguing inventory that has seen an unimaginable 1,927% enhance over the previous 12 months. Given this run-up, the inventory’s upside seems extra restricted in the present day. If traders wish to take an opportunity, they need to allocate a tiny share of their portfolio to it. However bear in mind that it is an early stage start-up with no industrial operations for a number of years, and its current run-up makes it a really high-risk inventory for these shopping for in the present day.