By now, Nvidia has change into a family title. The synthetic intelligence (AI) chip inventory dominates the marketplace for GPUs, the chips that make AI fashions like ChatGPT run, and has ridden the AI increase to change into essentially the most beneficial firm on the planet.

Nevertheless, some traders are already on the lookout for the following massive factor in know-how, and appear to have settled on quantum computing, a revolutionary know-how that makes use of qubits, or quantum bits, to course of info. By doing so, these computer systems are capable of carry out advanced calculations exponentially quicker than conventional computer systems, that means they may have the same disruptive impact as AI.

Picture supply: Getty Pictures.

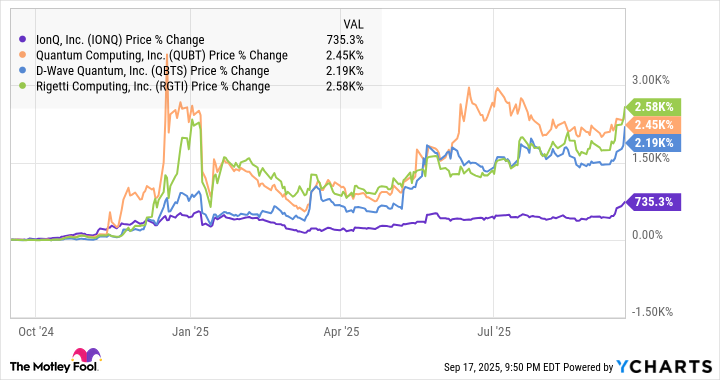

Quantum shares have gotten buzzy this 12 months, and shares like IonQ (IONQ 5.63%) have surged. As you may see from the chart under, IonQ and its friends have skyrocketed over the past 12 months in a rally that started final December with Alphabet‘s announcement of a breakthrough with its Willow quantum chip.

IonQ is the largest of the 4 pure-play quantum shares, now buying and selling at a market cap of $19.4 billion. Although the corporate nonetheless has little or no income, it has been constructing vital momentum and exhibiting extra proof that it and quantum computing extra typically can go mainstream. Let’s take a more in-depth have a look at the place IonQ stands at the moment and the place it may go within the subsequent decade.

IonQ at the moment

IonQ reported $20.7 million in income within the second quarter, up 82% from the quarter a 12 months in the past. That is nonetheless tiny for an organization with a market cap of almost $20 billion, however there are indicators of a shiny future for IonQ.

Within the second quarter, the corporate mentioned a collaborative analysis program between it, AstraZeneca, Amazon Internet Companies (AWS), and Nvidia achieved greater than 20 occasions enchancment in end-to-end time-to-solution utilizing a quantum-accelerated computational chemistry workflow for drug discovery. That is sturdy proof of the potential of the know-how.

The corporate additionally cast partnerships all over the world within the second quarter, together with in South Korea, Japan, and Sweden, and introduced an growth within the Asia-Pacific area in collaboration with Emergence Quantum, an Australian firm.

Lastly, IonQ has been rising by way of a string of acquisitions, beefing up its capabilities in quantum computing. These embody Lightsynq and Capella within the second quarter, and Oxford Ionics and Vector Atomic, which hasn’t closed but, in September.

Simply on Wednesday, the corporate signed a memorandum of understanding with the U.S. Division of Power to advance quantum applied sciences in area, exhibiting the federal authorities is getting extra concerned in quantum.

Will it beat Nvidia over the following decade?

There is a ton of uncertainty in quantum computing over the following decade. The know-how appears promising, however IonQ’s progress forecast nonetheless appears comparatively modest because it expects full-year income of $82 million to $100 million. It may nonetheless be a number of years earlier than it reaches $1 billion.

Evaluating IonQ’s prospects to Nvidia’s is troublesome as a result of Nvidia is at a a lot completely different stage of its life cycle. As essentially the most beneficial firm on the planet, the ceiling for Nvidia’s progress is far decrease than IonQ. At a price-to-earnings ratio of roughly 40, a 10x for Nvidia over the following decade would imply reaching $40 trillion in market cap and $1 trillion in revenue if it maintained its valuation.

Presently, there are not any corporations with $1 trillion in income, not to mention $1 trillion in revenue, and the S&P 500‘s present market cap is about $55 trillion. Taking a look at it that means, a 10x return for Nvidia will likely be troublesome, if not unrealistic, over the following decade.

With higher upside potential and the potential disruption from quantum computing, IonQ may outperform Nvidia, however it’s a lot riskier than the AI chief.

For tech-minded progress traders, proudly owning each shares could be one of the best strategy. It’s going to additionally provide you with publicity to the highest names in AI and quantum computing.

Jeremy Bowman has positions in Amazon and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Idiot recommends AstraZeneca Plc. The Motley Idiot has a disclosure coverage.