The nuclear vitality inventory is up huge within the final 12 months.

Demand for electrical energy is hovering, and the U.S. needs nuclear vitality to fill this want. By 2050, the federal government needs nuclear energy capability to develop from 100 gigawatts to 400 gigawatts, which might make up an enormous portion of electrical energy demand even when together with the sturdy development from synthetic intelligence (AI) knowledge facilities.

One firm has a brand new (and authorised) nuclear reactor design hoping to disrupt the market: NuScale Energy (SMR 22.11%). The corporate believes it has a small and scalable nuclear reactor design that may be the spine of the expansion in nuclear energy over the following few a long time. Its inventory has soared and is up 300% within the final 12 months, with its market cap now over $10 billion.

The place will NuScale Energy inventory be in 5 years?

The primary authorised small modular reactor design

Forward of the pack, NuScale Energy has the one design for a small modular reactor (SMR) that has been authorised by the Nuclear Regulatory Fee (NRC). This SMR know-how is scalable, therefore the modular title, with the flexibility to attach a number of reactors collectively for various undertaking wants. In 2020, NuScale acquired its first approval from the NRC, with additional approvals in the previous couple of years for various design sorts.

Every SMR has the capability to generate 77 megawatts of energy. If adoption for these designs take maintain, NuScale may find yourself promoting dozens of reactors a 12 months to assist fulfill the deliberate want for elevated electrical energy era. This might imply a whole lot of tens of millions — if not billions — in annual income from reactor gross sales and upkeep contracts.

However it’s all theoretical right now. The corporate has by no means really constructed a nuclear reactor.

Picture supply: Getty Pictures.

No introduced tasks

NuScale Energy’s SMR design has been authorised for years now. So why would not it have any tasks within the pipeline? This may be a very good query for buyers to ask. NuScale is presently exploring a reactor undertaking with a Romanian utility known as RoPower, which is producing a negligible quantity of income for the SMR builder.

Nonetheless, RoPower has nonetheless not dedicated to utilizing a NuScale reactor. This ought to be a flashing warning signal for the viability of the corporate’s enterprise. In actual fact, NuScale Energy did have a undertaking in place in Utah that was canceled in late 2023. Delays and price overruns made the undertaking uneconomical, so the Utah utility canceled its plans with NuScale Energy.

Immediately, NuScale would not have a single buyer to talk of, possible as a result of potential patrons wanting on the Utah undertaking are frightened about comparable price overruns affecting their plans. If NuScale Energy can not win any contracts, it’ll imply no income — not to mention income.

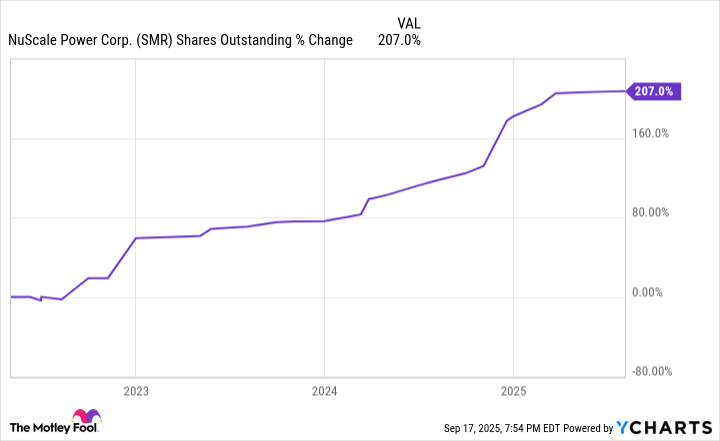

SMR Shares Excellent knowledge by YCharts.

The place will NuScale Energy inventory be in 5 years?

The final 12 months has been type to NuScale Energy shareholders. The inventory now has a market capitalization of $10.3 billion, with share dilution coming down the road that may additional inflate this market valuation. However a market cap of over $10 billion makes zero sense for a corporation that generates zero income. That is very true when NuScale has an authorised reactor design however isn’t profitable any contracts to construct one.

NuScale Energy and different nuclear vitality shares discuss a giant sport. However they do not have a lot in the best way of economic efficiency (nicely, they’ve none, really). 5 years from now, the inventory is prone to be a lot decrease than it’s right now. It is a pre-revenue start-up at an inflated valuation with no confirmed approach to generate income, not to mention a revenue.