The US Federal Reserve prepares to announce its newest resolution on rates of interest. This extremely anticipated occasion has the potential to behave as a strong catalyst for the Bitcoin market, with many analysts and buyers speculating {that a} fee minimize might set off a big breakout.

How A Charge Reduce May Unleash The Subsequent Bitcoin Bull Run

The worldwide monetary neighborhood is coming into a vital week. In accordance with a submit on X by crypto commentator Thomas Lauder, in 7 days, the US Federal Reserve will determine whether or not to chop greenback rates of interest, a transfer that would have far-reaching results on each conventional finance and crypto markets.

This fee minimize might give a powerful enhance to the value of Bitcoin and different monetary property. Lauder explains {that a} Federal Reserve rate of interest minimize would have a direct affect on monetary markets by decreasing the price of borrowing and injecting liquidity into the market, a dynamic that has traditionally benefited Bitcoin and different threat property.

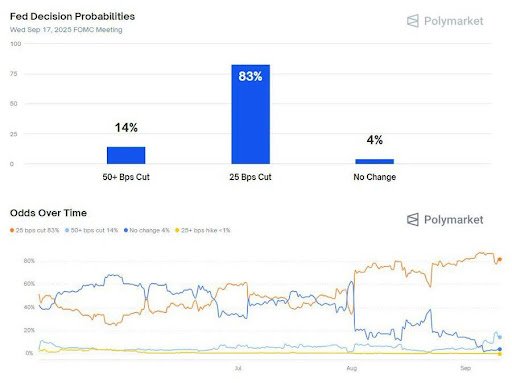

The market’s anticipation is excessive, as evidenced by predictions on Polymarket, the place 83% of bettors are forecasting a 25 foundation level minimize, and one other 14% are betting on a good bigger discount. Within the meantime, the market operators are positioning themselves forward of the information. Because of this, Lauder predicts that Bitcoin will expertise days of excessive volatility main as much as the announcement.

Why Firms Are Accumulating Bitcoin Relentlessly

Whereas the opposite analyst believes that the approaching days will probably see excessive volatility for BTC because the Fed proclaims the rate of interest minimize, notable institutional accumulation continues to be ongoing. MikeWMunz has defined why sure corporations are accumulating Bitcoin at a feverish tempo at the same time as their share costs stall. These corporations aren’t weak in lettuce fingers, and they’re able to delaying the dopamine hits for when it’s acceptable.

Nonetheless, many of those corporations are set to be included within the largest indexes, guaranteeing they obtain regular passive flows as Bitcoin executes its subsequent parabolic transfer upward. MikeWMunz describes this as a lightning in a bottle, which is an ideal second of technique, market mechanics, and timing.

Moreover, he identified that the shortsighted views and lack of imaginative and prescient of many buyers stop them from understanding this inevitable final result. The groundwork and basis for a brand new monetary period is being constructed proper now, and the shortage of endurance and incapability to see this larger image is what holds again many buyers from realizing the total potential of this shift. “This doesn’t apply to the leaders of those corporations, who’re pioneering the ships of their respective markets,” he talked about.”