Buyers are falling out of affection with the athleisure chief.

Lululemon (LULU 3.46%) was as soon as a market darling. It’s now one of many worst-performing shares of 2025. Shares are off near 50% to this point in 2025 on rising fears of competitors and macroeconomic headwinds in its athleisure class, with shares down over 60% from all-time highs. After a bustling few years with informal athletic clothes on the rise throughout the early days of the pandemic, shoppers at the moment are flipping to new classes.

And but, there are nonetheless plenty of issues to love about Lululemon’s enterprise. With the inventory buying and selling at considered one of its most cost-effective ranges ever, is Lululemon inventory about to go parabolic for buyers who purchase right now?

Sluggish North America progress

From the third quarter of 2020 to the fourth quarter of 2023, Lululemon’s trailing-12-month income in North America greater than doubled from $3.5 billion to $7.6 billion. Since then, its trailing-12-month income has barely budged, hitting $8 billion over the past 12 months. Buyers should not liking this income progress slowdown within the core North American market. Final quarter, Americas income elevated simply 4% year-over-year in fixed forex.

Whereas a slowdown ought to by no means be celebrated, it is very important take every part inside a correct context. The whole athleisure class that Lululemon serves has struggled in recent times, particularly within the Americas. Competitor Nike noticed income drop 11% 12 months over 12 months final quarter, whereas Athleta slipped 6% (geographical income was not disclosed, however the model is principally centered in North America). This places Lululemon’s gradual 4% income progress in a greater mild.

Regardless of macroeconomic headwinds for the athleisure class, Lululemon has been in a position to develop market share and nonetheless develop in North America.

Picture supply: Getty Photos.

Room for worldwide growth

North America is the ugliest a part of Lululemon’s enterprise, however worldwide is firing on all cylinders. Complete worldwide income grew 20% year-over-year in fixed forex phrases final quarter, with China mainland income up 22% even with Chinese language shoppers going through a spending recession for the previous few years after the nation’s housing bubble burst.

Lululemon is simply starting to faucet the East Asian market, which is the biggest spending area on the planet on luxurious and premium attire. Now, it’s starting to develop in Europe. For instance, it simply opened a flagship 5,700-square-foot retailer in Milan’s buying district to showcase its merchandise to European customers. Different areas outdoors of China and North America make up only a sliver of Lululemon’s income, giving it an enormous runway to develop in Europe.

Even when progress in North America is sluggish for a number of years, different geographies will help Lululemon preserve chugging alongside for buyers.

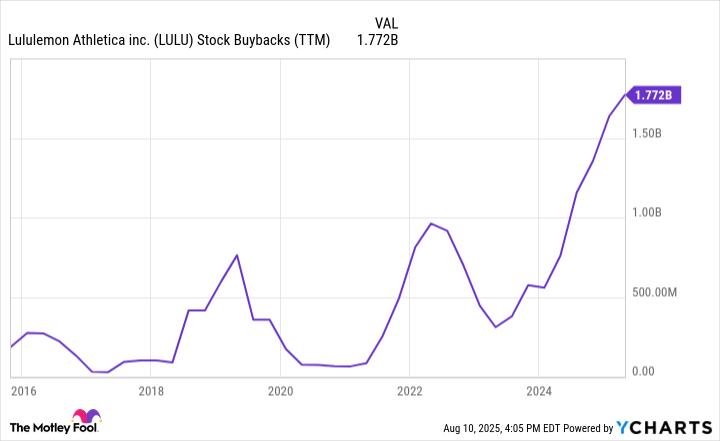

LULU Inventory Buybacks (TTM) knowledge by YCharts

Is Lululemon inventory about to go parabolic?

After this latest drawdown, Lululemon has a market cap of $22.7 billion. This provides the inventory a trailing price-to-earnings ratio (P/E) of below 13, its lowest stage in 10 years. If income can continue to grow and revenue margins stay sturdy (the metric has steadily expanded within the final 10 years), then Lululemon inventory seems to be exceedingly low-cost at these ranges.

The cherry on prime is administration’s elevated spending on inventory buybacks, which hit $1.77 billion over the past 12 months. At this fee, Lululemon is near repurchasing 10% of its excellent inventory per 12 months, which might be an enormous enhance to earnings per share (EPS) progress.

Attire is a fickle trade, however Lululemon has proven resilience by thick and skinny and now trades at a comparatively low-cost earnings ratio. Mixed with its aggressive buyback program, I feel the inventory has an opportunity to zoom parabolic for buyers.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Lululemon Athletica Inc. and Nike. The Motley Idiot has a disclosure coverage.