ASML and AMD are pivotal gamers within the booming AI market, serving to each to see robust gross sales to this point this 12 months.

Synthetic intelligence (AI) stays a scorching space to spend money on, as seen in Nvidia‘s share value, which is up over 30% this 12 months via Aug. 6. Two AI companies to think about are ASML Holding (ASML 1.33%) and Superior Micro Gadgets (AMD 0.17%), since they supply key {hardware} to the trade.

The previous makes cutting-edge lithography machines, that are mandatory for producing the superior microchips that energy AI techniques. AMD, one among Nvidia’s prime rivals, sells AI chips to cloud computing firms akin to Microsoft.

ASML and AMD are each robust companies. However figuring out which is a greater AI funding is not easy. So let’s consider them in additional element.

Picture supply: Getty Photographs.

A glance into ASML

ASML’s lithography tools is crucial for manufacturing AI microchips as a result of the know-how calls for immense computing energy. This necessitates shrinking chip elements to minuscule dimensions. As an illustration, a microchip the scale of your fingernail accommodates billions of transistors. ASML’s machines help this.

Though the Dutch firm performs an essential function in AI, its inventory has struggled in 2025, remaining basically flat via Aug. 6. A part of it’s because administration anticipates financial uncertainty forward because of components akin to President Donald Trump’s aggressive tariff insurance policies.

Even so, ASML expects 2025 gross sales to rise 15% over 2024’s 28.3 billion euros ($33 billion). That is important since 2024’s income represents solely a 2.6% year-over-year improve. And to this point this 12 months, the corporate is doing nicely.

Via two quarters, income stood at $18 billion, up from the prior 12 months’s $13.4 billion. Working revenue rose to $5.8 billion from 2024’s $3.7 billion. This sturdy progress resulted in web revenue of $5.4 billion, a powerful improve over the earlier 12 months’s $3.3 billion.

The superb first-half outcomes have been tempered by a third-quarter income forecast between $8.6 billion and $9.2 billion. This outlook, when in comparison with the prior 12 months’s gross sales of $8.9 billion, suggests the present pattern of robust year-over-year progress could also be slowing down, which contributed to ASML’s tepid inventory efficiency.

How AMD is faring

Like rival Nvidia, AMD inventory is having a stellar 12 months. Shares are up 35% in 2025 via Aug. 6. This efficiency is comprehensible following the corporate’s second-quarter earnings outcomes. The quarter’s income reached a report $7.7 billion, a 32% year-over-year improve.

CEO Lisa Su stated, “We’re seeing sturdy demand throughout our computing and AI product portfolio and are nicely positioned to ship important progress within the second half of the 12 months.” In that second half, AMD expects income of $8.7 billion, a powerful improve over the earlier 12 months’s $6.8 billion.

Regardless of the gross sales progress, AMD exited the second quarter with an working lack of $134 million in comparison with working revenue of $269 million within the earlier 12 months. The substantial drop was as a consequence of new U.S. authorities restrictions launched earlier this 12 months on the sale of AI chips to China. Because of this, AMD couldn’t promote chips it had meant for Chinese language prospects, forcing the corporate to jot down off that stock by $800 million.

But this makes its second-quarter gross sales progress all of the extra spectacular. Within the quarter, web revenue was $872 million, up 229% 12 months over 12 months. Consequently, diluted earnings per share soared 238% to $0.54 in a boon to shareholders.

AMD is working to get authorities approval to promote AI chips to China once more. When that OK is obtained, the corporate is able to ship extra outsize gross sales progress.

Deciding between ASML and AMD

AMD’s excellent efficiency, its anticipated third-quarter income progress, and an eventual return of gross sales to China level to it being the superior AI inventory versus ASML.

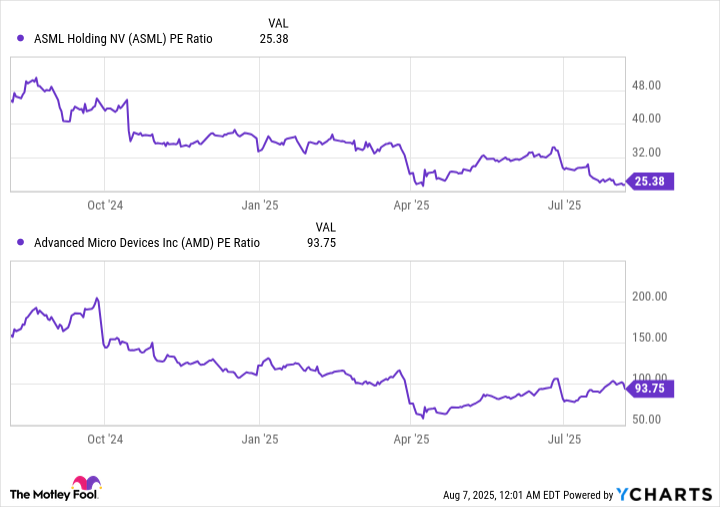

Nonetheless, an essential consideration is share value valuation. The price-to-earnings ratio (P/E) tells you the way a lot buyers are keen to pay for a greenback’s price of earnings primarily based on the trailing 12 months.

Information by YCharts.

The highest chart exhibits ASML’s P/E ratio has declined over the previous 12 months, indicating its inventory’s valuation has improved. In comparison with AMD’s just lately rising earnings a number of, as seen within the backside chart, ASML shares appear like a cut price.

ASML’s short-term gross sales could sluggish because of the present macroeconomic uncertainty, however over the long term, it is prone to profit from the rise of AI. The corporate sees the know-how as a big probability for progress in semiconductors, just like earlier alternatives like PCs, the web, and smartphones.

Business forecasts help ASML’s perspective. The AI sector is projected to develop from $244 billion in 2025 to $1 trillion by 2031. Whereas this market progress is a tailwind for each firms, ASML’s engaging valuation makes it appear like the extra compelling AI inventory to purchase proper now.

Robert Izquierdo has positions in ASML, Superior Micro Gadgets, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends ASML, Superior Micro Gadgets, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.