The Vanguard Dividend Appreciation ETF is not an revenue ETF, it is a development ETF, which could be higher for long-term traders.

The Vanguard Dividend Appreciation ETF (VIG 0.56%) has a reputation which may confuse some traders. It contains the phrase “dividend,” which makes it appear to be it might be an income-focused trade traded fund (ETF). Nevertheless it additionally contains the phrase “appreciation,” which suggests one thing completely completely different. Ultimately, one thing completely completely different is what you get — however that is not essentially unhealthy when you’ve got a lifetime of investing forward of you. Here is what it’s essential to know.

What does the Vanguard Dividend Appreciation ETF do?

So far as exchange-traded funds go, the Vanguard Dividend Appreciation ETF is pretty easy to know. It tracks the S&P U.S. Dividend Growers Index. That index begins by solely trying on the corporations which have elevated their dividends for no less than 10 years. It then eliminates the highest-yielding 25% of the shares and buys the remainder utilizing a market cap weighting methodology.

Picture supply: Getty Photographs.

Pondering the choice course of by means of highlights just a few key elements. First, this isn’t an income-focused ETF, because it particularly removes the highest-yielding selections from the combination. However that is smart, too, because the highest-yielding shares are additionally prone to be those dealing with monetary problem or those that are typically slow-growing.

Second, by biasing the ETF towards the lowest-yielding shares, the Vanguard Dividend Appreciation ETF is probably going going to be centered on corporations with extra of a development flare. Certainly, the fastest-growing corporations usually have the bottom yields, although they might even have the fastest-growing dividends.

Third, the Vanguard Dividend Appreciation ETF is a development ETF that makes use of dividends to display screen for shares. In spite of everything, attending to a decade of dividend hikes is a fairly spectacular feat. This easy bar possible eliminates a variety of lower-quality funding choices even earlier than the highest-yielding 25% of the eventual candidates will get tossed out.

What are you actually getting with the Vanguard Dividend Appreciation ETF?

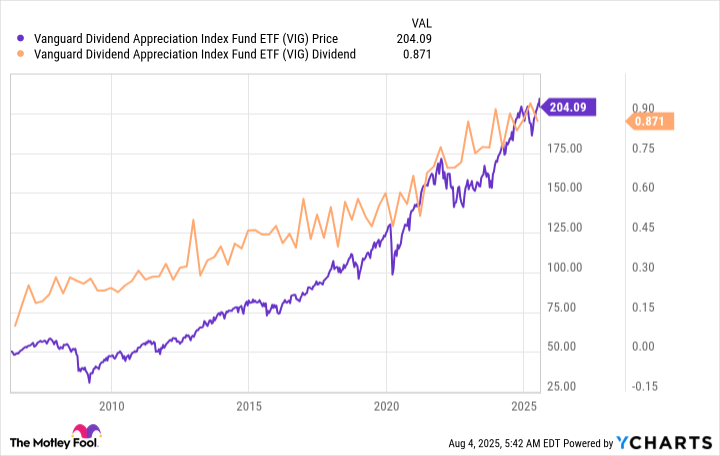

Because the chart above highlights, the Vanguard Dividend Appreciation ETF is delivering a usually rising dividend over time. And it’s delivering a usually rising share value. So it gives revenue development and capital appreciation. That is not a foul mixture, particularly in case you are nonetheless pretty younger and have a very long time earlier than you’ll need to faucet your nest egg. Certainly, when you begin early sufficient and maintain on lengthy sufficient, the dividend development right here may really find yourself offering you with a reasonably substantial revenue stream sooner or later.

You’re additionally getting an easy-to-understand funding, because the index the Vanguard Dividend Appreciation ETF tracks is much from being complicated. The price can also be straightforward to understand, given the expense ratio is a modest 0.05%. Basically, the ETF is not doing a variety of heavy lifting within the inventory choice course of, however you are not paying quite a bit, both.

What you positively don’t get right here, nonetheless, is a big revenue stream right now. The ETF’s dividend yield is round 1.7%. That is increased than the 1.2% you’d acquire from an S&P 500 index (^GSPC 0.78%) clone. However in case you are trying to maximize the revenue you generate out of your portfolio proper now, properly, there are much better selections on the market. This highlights that the phrase “appreciation” is much extra essential with this ETF than the phrase “dividend.”

The Vanguard Dividend Appreciation ETF does what it units out to do

All in, in case you are trying to maximize the revenue you generate right now, shopping for the Vanguard Dividend Appreciation ETF will set you as much as be disillusioned. Nevertheless, when you’ve got a very long time horizon, the combination of capital appreciation and dividend development right here may set you up for a stable end result once you finally retire.

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vanguard Dividend Appreciation ETF. The Motley Idiot has a disclosure coverage.