Tesla missed expectations in its newest quarter, and the inventory is down massive this yr.

Electrical car (EV) and know-how firm Tesla (TSLA -1.69%) is likely one of the largest companies on this planet, with its valuation proper round $1 trillion at present. And that is even because the inventory is down 21% this yr as of July 30.

Investor sentiment has grow to be more and more bearish on the enterprise, and its newest earnings numbers did not do something to assist that. With its current outcomes trying unimpressive, the inventory could once more come underneath stress within the days and weeks to return.

May now be a superb time so as to add Tesla to your portfolio?

Picture supply: Getty Photos.

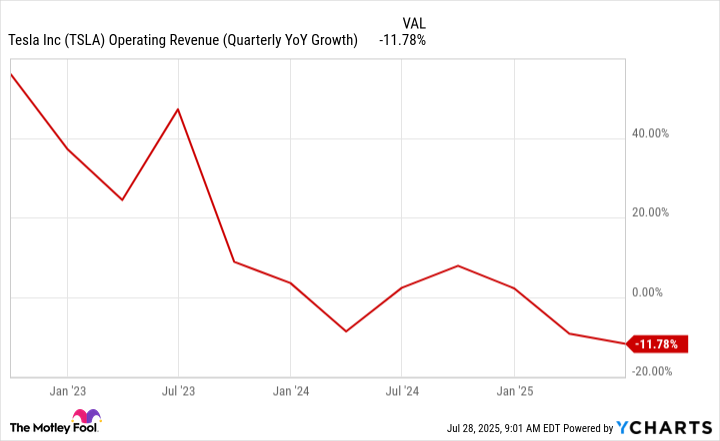

Tesla’s issues summed up in a single chart

Buyers have lengthy been enthusiastic about Tesla’s prospects and CEO Elon Musk’s imaginative and prescient. From EVs to robots, the corporate has been evolving right into a a lot bigger enterprise through the years. And should you’re a believer in its potential, it is onerous to not like Tesla as a long-term funding.

However there’s additionally no denying that its progress faces query marks, particularly as extra rivals emerge within the EV market, notably from China, the place decrease costs can squeeze Tesla’s margins. The next chart reveals that the menace is not only a hypothetical one, both. Tesla’s progress charge has fallen drastically lately.

TSLA Working Income (Quarterly YoY Development) knowledge by YCharts

Not solely was quarterly income totaling $22.5 billion down by 12% within the firm’s most up-to-date quarter (which resulted in June), however the firm’s web revenue additionally fell by 16% to $1.2 billion. Tesla’s outcomes got here in wanting what analysts had been anticipating on each the highest and backside strains, resulting in a drop in its share worth after the earnings report.

Huge guarantees and a giant valuation

Tesla’s current outcomes weren’t nice, however the carrot for traders is what could lie forward for the enterprise. These had been a number of the rosier — if obscure — projections for the enterprise from Tesla’s current earnings name:

- Unsupervised full self-driving shall be obtainable in “sure geographies” by the top of the yr.

- Autonomous ride-hailing providers shall be obtainable “in most likely half the inhabitants of the U.S.,” additionally by the top of this yr.

- The Optimus model three humanoid robotic shall be in manufacturing subsequent yr and “will probably be the most important product ever,” in accordance with Musk, who’s identified for daring predictions.

Any one in all these three claims changing into true might assist rally Tesla’s inventory, which arguably wants a catalyst proper now. The issue, nevertheless, is that prime expectations are additionally baked into the inventory, because it trades at round 160 occasions its analyst-estimated future earnings.

The bar is excessive for Tesla, and if it falls wanting its guarantees, that might result in an extra decline for the inventory, particularly provided that its current outcomes have not precisely been stellar.

Do you have to purchase Tesla inventory at present?

Tesla has been an thrilling progress inventory to personal for years, and it has generated improbable returns for traders. Though it hasn’t been doing nice lately, the inventory remains to be up over 200% in 5 years. If Musk’s imaginative and prescient for his firm comes true, investing in Tesla inventory might find yourself being actually sensible.

Nevertheless, with the inventory buying and selling at such a excessive premium, I would maintain off on investing in it. Whenever you’re paying such a excessive worth, you are leaving your self with little to no margin of security ought to issues not go as deliberate. Tesla’s a superb inventory to placed on a watch record, however I would not rush out to purchase it proper now.