Stable returns have come even with bumps within the street.

Is now the fitting time to purchase shares? It is a query that is been requested numerous instances, and each time I area it, my reply is similar: “Sure!”

Which may appear loopy, however I guarantee you, it is not. This is why: Over the long run, investing in a benchmark inventory index just like the S&P 500 (^GSPC 0.40%) has all the time confirmed to be a successful technique — even when somebody’s timing is horrible.

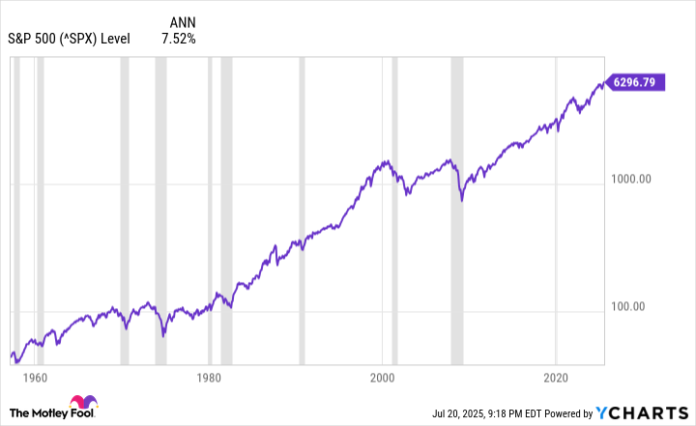

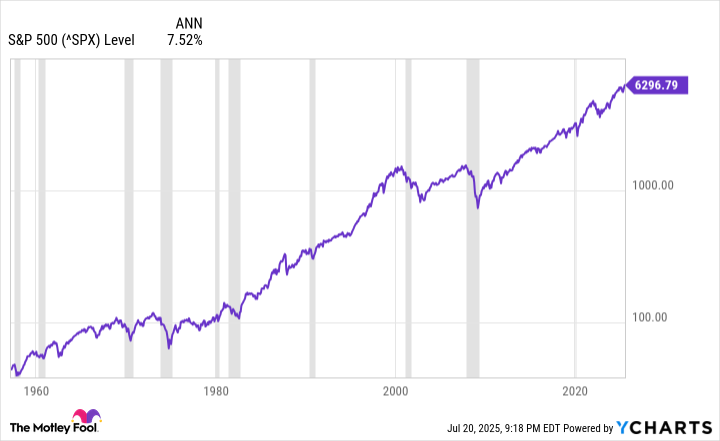

Nonetheless do not consider me? Then check out this chart:

This is the S&P 500 courting again to 1957, when the index expanded to 500 corporations and purchased its present title. Since then, it has elevated by an astounding 14,000%. That works out to a compound annual development fee (CAGR) of seven.5% — and that is earlier than accounting for dividend funds.

Throughout that stretch, there have been many corrections, a number of bear markets, and 10 full-blown recessions. And but, irrespective of when somebody purchased, they might have made cash — if they’d stayed invested out there.

Picture supply: Getty Photographs.

There is a lesson right here: Timing the market is folly. Many fortunes have been made by folks claiming to know when the fitting time to purchase — or promote. However far more cash has been left on the desk by traders making an attempt to time the highest or the underside.

The perfect recommendation is the best: Keep away from making an attempt to foretell worth actions within the quick time period. As a substitute, save what you possibly can and make investments for the long run. Ignore the headlines — notably when the market goes down. And each time you’ve got doubts, look on the chart above and keep in mind: Keep affected person, maintain your shares for the long run, and you will come out a winner.

Jake Lerch has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.