Inventory splits have been an enormous factor final yr, with many main firms throughout industries launching such operations. Two of essentially the most thrilling have been within the space of synthetic intelligence (AI). Nvidia (NVDA -0.42%), the world’s No. 1 AI chip designer, and Broadcom (AVGO -1.12%), a networking large, accomplished inventory splits in June and July 2024, respectively.

What’s a inventory break up, and why do firms go this route? These operations allow an organization to convey down a hovering inventory worth to extra cheap ranges, making the inventory extra accessible to a broader vary of buyers. Nvidia and Broadcom even stated they selected splits to make it simpler for workers and buyers to get in on their shares, which had surged greater than 200% and about 100%, respectively, in 2023.

Inventory splits do not change the overall market worth of the corporate or something basic, although. They merely contain providing extra shares to present holders in line with the ratio of the break up. So, for instance, in a 10-for-1 inventory break up, if you happen to initially held one share, you’d maintain 10 shares post-split — however the complete worth of your holding would stay the identical.

Due to this, a inventory break up alone is not a cause to purchase or promote a inventory. Nonetheless, it is attention-grabbing to see how inventory break up gamers have carried out a yr after these operations, so let’s check out each Nvidia and Broadcom a yr after their splits.

Picture supply: Getty Photographs.

Nvidia

Nvidia accomplished its 10-for-1 inventory break up on June 7 of final yr, with shares buying and selling on the split-adjusted worth as of June 10. This introduced the shares down from about $1,200 to $120. Since that point, Nvidia inventory has skilled ups and downs, however it’s delivered a achieve of greater than 40%.

As talked about, this operation is not the rationale buyers have flocked to Nvidia over the previous yr (although a cheaper price per share might have made it simpler for some to get in on the expansion story). What has pushed Nvidia’s share worth efficiency is the continued excessive demand for its graphics processing items (GPUs), or AI chips, and associated services.

What additionally helped this AI chief was its sturdy execution of an enormous launch: Nvidia launched its Blackwell structure and chip this previous winter to demand that CEO Jensen Huang referred to as “insane.” The corporate generated $11 billion in income from Blackwell in its very first quarter of commercialization and maintained a gross margin above 70%, guaranteeing excessive profitability on gross sales.

Though buyers nervous about potential headwinds, reminiscent of import tariffs or a lower in AI spending, these issues have eased. Commerce talks have spurred optimism that tariffs might not be as hefty as initially anticipated, and corporations have reiterated their AI funding plans. All of this helped increase Nvidia’s shares in latest weeks, even pushing the corporate to a $4 trillion market cap, making it the primary firm ever to achieve this stage.

Broadcom

Broadcom executed its inventory break up on July 12, and the inventory started buying and selling on July 15 on the new worth. Like Nvidia, the corporate selected a 10-for-1 break up to convey its share worth down — on this case, from about $1,700 to $170. Broadcom inventory has additionally climbed within the double digits for the reason that operation, rising greater than 65%.

And like Nvidia, Broadcom noticed its shares take off due to demand from AI clients. This firm is a networking chief, making hundreds of merchandise utilized in quite a lot of areas — out of your smartphone to main knowledge facilities. However in latest occasions, demand from massive cloud service suppliers to assist their AI improvement has helped income skyrocket.

In the newest quarter, AI income surged 77% to $4.1 billion, and the corporate says it expects this momentum to proceed within the present quarter and thru the following fiscal yr. That is amid demand for each connectivity merchandise and Broadcom’s accelerated processing items (XPUs), a sort of processor for particular AI duties.

The corporate says its networking experience and wide selection of merchandise — from switches and routers to community interface playing cards (NICs), which join computer systems to networks — have been key progress drivers as cloud service suppliers ramp up their AI platforms.

Broadcom inventory adopted the same path to Nvidia, declining in April of this yr as a result of normal tariff issues, however it has additionally rebounded and is on the rise right this moment. The inventory even closed at a report excessive only a few days in the past.

May the post-split success proceed?

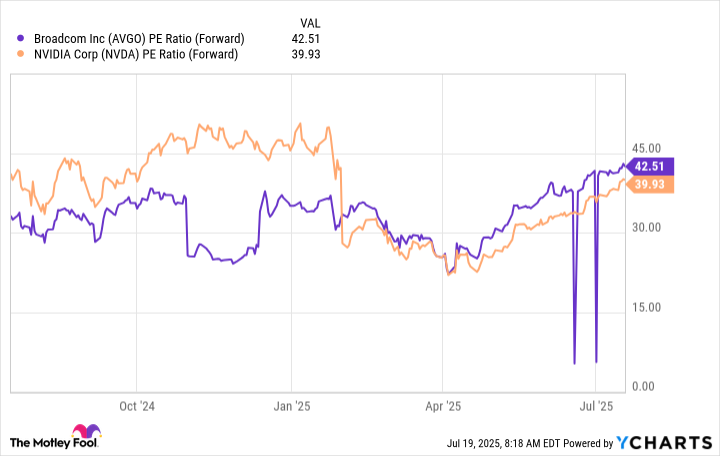

Each Nvidia and Broadcom have accomplished profitable post-split years, scoring double-digit positive factors. Nvidia is barely inexpensive from a valuation standpoint than it was a yr in the past, however Broadcom’s valuation has superior.

AVGO PE Ratio (Ahead) knowledge by YCharts. PE Ratio = price-to-earnings ratio.

Nonetheless, these AI gamers stay fairly priced, contemplating their earnings monitor report and long-term prospects on this progress market. It is unimaginable, after all, to ensure what these shares will do subsequent, however the present setting helps the concept of extra positive factors forward. Much more importantly, Nvidia and Broadcom are effectively positioned to win within the AI market over the long term.