Shares of Meta Platforms (META 0.73%) have been shifting larger once more in June because the social media large benefited from the broader uptrend within the inventory market, and buyers reacted to Meta’s deal to take a 49% stake in Scale AI, a data-labeling start-up, for $14 billion.

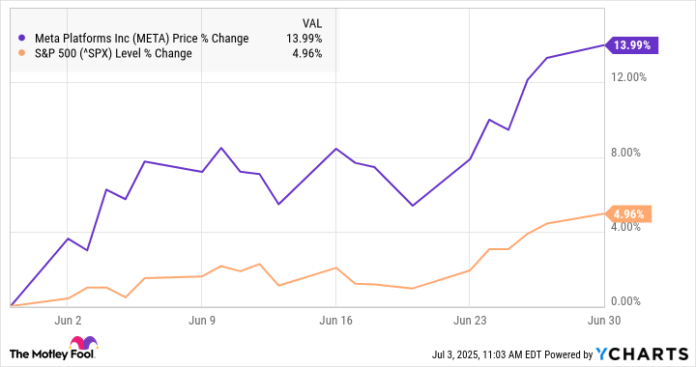

By the tip of the month, Meta inventory had completed up 14%, in accordance with information from S&P International Market Intelligence.

As you possibly can see from the chart, the inventory gained in two separate phases, at first and finish of the month.

Meta pushes deeper into AI

Meta’s ambitions in AI turned clearer final month as the corporate made a splash with the Scale AI deal. The transfer provides the corporate near-50% possession of a promising AI start-up, and likewise brings Scale AI founder Alexandr Wang into the Meta fold. Wang will head up a brand new analysis lab engaged on superintelligence.

Moreover, different information stories emerged about Meta’s poaching AI expertise from OpenAI, and it additionally reportedly tried to purchase Perplexity, the AI search-focused start-up now valued at $14 billion, in addition to Protected Superintelligence, one other AI start-up. Lastly, the corporate is contemplating elevating $29 billion to fund its information heart growth push as a part of its AI ambitions.

Early within the month, Meta additionally signed a 20-year energy buy settlement with Constellation Power, displaying its dedication to securing an sufficient supply of power as AI wants develop.

On the gadget entrance, the corporate additionally launched Oakley Meta glasses, which it known as a brand new class of Efficiency AI glasses, that includes a built-in digicam, open-ear audio system, and water resistance.

In the meantime, the inventory additionally benefited from cooling tensions across the commerce struggle, in addition to stable financial information displaying the job market persevering with to develop and inflation remaining in verify.

Since almost all the corporate’s income comes from digital promoting, the enterprise is delicate to the broader financial system, so indicators of continued progress are good for Meta.

Picture supply: Getty Pictures.

What’s subsequent for Meta?

Meta’s price-to-earnings ratio has risen to twenty-eight following final month’s good points, however that also appears like a good value to pay for a inventory that dominates the social media sector, has an enormous aggressive benefit in digital promoting, and is investing closely into its robust AI division.

We’ll hear from Meta on the finish of the month when it stories second-quarter earnings. Analysts expect one other robust quarter, with income growing 14% to $44.55 billion and earnings per share rising from $5.16 to $5.84. If Meta can preserve that form of progress, the inventory ought to proceed to maneuver larger.

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jeremy Bowman has positions in Meta Platforms. The Motley Idiot has positions in and recommends Constellation Power and Meta Platforms. The Motley Idiot has a disclosure coverage.