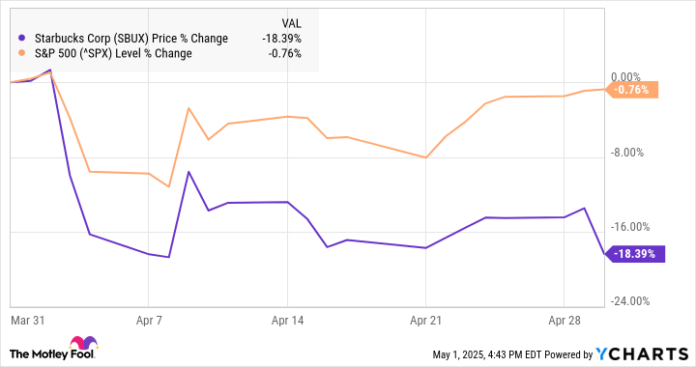

Shares of Starbucks (SBUX 2.35%) took a dive in April as the corporate acquired hit by President Trump’s “Liberation Day” tariffs announcement, after which once more on the finish of the month after it reported underwhelming leads to its fiscal second-quarter earnings report.

In contrast to the remainder of the inventory market, which drifted decrease over the rest of April after Trump put a 90-day pause on some tariffs, Starbucks inventory held comparatively flat, as buyers appeared to consider it was liable to a recession and a commerce warfare with China. The U.S. and China are its No. 1 and No. 2 markets, respectively.

As you possibly can see from the chart, Starbucks adopted the trajectory of the S&P 500 (^GSPC 0.63%)

for a lot of the month, but it surely fell extra sharply at the start and didn’t make the identical restoration on the finish of April. Moreover, Starbucks offered off on the final day of April, as its earnings outcomes underwhelmed.

In accordance with information from S&P World Market Intelligence, the inventory completed the month down 18%.

Starbucks’ struggles proceed

Starbucks’ decline at the start of the month wasn’t an enormous shock, as restaurant spending, particularly at a spot like Starbucks, is discretionary, making the corporate extra susceptible than many of the inventory market to a slowdown.

Tariffs may additionally complicate Starbucks’ enterprise, although the price of importing espresso beans appears manageable. The corporate mentioned on the earnings name that inexperienced espresso beans, that means unroasted, are 10%-15% of its product and distribution prices, and it has hedges construct in to its buying mannequin.

On the information entrance, most of April was uneventful till the earnings report got here out on April 29.

Starbucks missed estimates on each the highest and backside traces, although administration mentioned the turnaround technique was driving a restoration within the enterprise. Comparable gross sales within the quarter fell 1%, and income declined 2%. Nonetheless, that stability got here at a worth, as the corporate invested in further labor to drive the “Again to Starbucks” technique. Adjusted working margin fell 460 foundation factors to eight.2%, and adjusted earnings per share have been down 40% to $0.41.

Picture supply: Getty Photos.

What’s subsequent for Starbucks?

CEO Brian Niccol brings a robust observe file to the enterprise, having come from Chipotle, and he deserves investor persistence because the turnaround strikes alongside.

The macro headwinds may pose a further problem to the restoration, however Niccol’s optimism in regards to the restoration should not be missed.

Jeremy Bowman has positions in Chipotle Mexican Grill and Starbucks. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Idiot recommends the next choices: brief June 2025 $55 calls on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.