Nike (NKE 0.46%) and Deckers Out of doors (DECK 2.42%) are two shares which were struggling this 12 months. The previous is down 24%, whereas the latter has nosedived a whopping 46%. These firms depend on discretionary spending, which suggests they’ll each be susceptible to a slowdown within the financial system this 12 months, particularly as tariffs add prices for customers.

Whereas neither of those shares is a very protected purchase proper now, which one would be the higher choice for contrarian traders to contemplate for his or her portfolios?

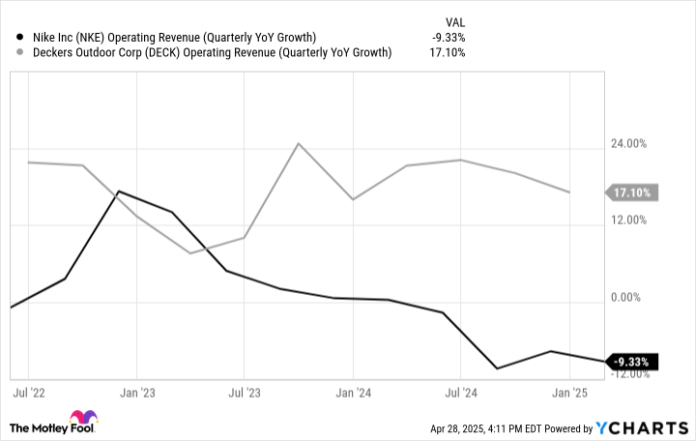

Deckers has been a much better development inventory

Nike is the behemoth within the footwear trade and has the benefit of being the bigger, rather more recognizable firm. However that hasn’t been translating into higher development in recent times. Deckers has been rising by double digits for a number of quarters, whereas Nike is struggling to maintain its prime line from falling.

NKE Working Income (Quarterly YoY Progress) knowledge by YCharts

Slightly than focusing totally on efficiency akin to Nike, Deckers’ manufacturers cater to a extra numerous buyer market, which might work to its benefit and make it simpler for its enterprise to develop. And with its annual gross sales being near one-tenth of Nike’s ($5 billion versus round $50 billion), the size of income it might want to generate to take care of a excessive development fee can even not must be as vital; being the smaller enterprise can have its benefits.

Their valuations are comparable

Each shares have seen their valuations come down sharply this 12 months, and there was extra of a niche between them previously, however now they’re hovering round comparable price-to-earnings (P/E) multiples.

NKE PE Ratio knowledge by YCharts

Nike is buying and selling at solely a barely greater valuation than Deckers, regardless of it commanding a a lot bigger presence and possessing a a lot stronger model.

Which firm has a brighter future?

Deckers is producing some glorious development proper now, and whereas it might face challenges on account of tariffs and slowing financial situations, its long-term trajectory nonetheless seems to be promising given the various completely different product strains it has and classes it is in, together with boots, slippers, athletic, mountain climbing, and way of life footwear.

Nike, in the meantime, is within the midst of a transition, one that appears to be each lengthy and unsure. Whereas administration could consider reconnecting with retailers and launching new improvements might help reinvigorate the model, I concern the larger situation is affordability. In recent times, quick style has been rising in recognition, and with customers prioritizing cheaper choices, it might be tough for Nike to stay aggressive. It has a robust model, however its merchandise are additionally costly, and I am skeptical about whether or not it will probably get again to producing excessive development numbers once more.

Deckers seems to be just like the much better choice right this moment

Deckers has a greater development fee and is buying and selling at a decrease P/E ratio than Nike, with out all the issues and query marks that include a turnaround technique. At this stage, Deckers seems to be to be the safer shoe inventory to personal, regardless of its mammoth decline in worth this 12 months. Whereas there may be danger right here, should you’re keen to be affected person, this might be a great long-term purchase.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Deckers Out of doors and Nike. The Motley Idiot has a disclosure coverage.