Pinpointing robust bargains within the inventory market is essential to success, and the market is stuffed with them proper now. Whereas some could also be involved about tariff results within the brief time period, most of those shares have extremely vibrant long-term outlooks. By shifting your focus from the following few months to the following few years, you’ll be able to ignore a few of right now’s occasions, and it will likely be apparent which shares are nice buys now.

Three corporations which are down greater than 30% from their all-time highs and appear like glorious buys are Nvidia (NVDA 4.11%), Taiwan Semiconductor (TSM 0.57%), and ASML (ASML 0.38%). These three additionally characterize a fantastic image of the AI chip worth chain, and so long as AI continues to be an space the place companies make investments, these three will succeed.

The AI chip worth chain is a profitable space to spend money on

As a fast overview of the provision chain, Nvidia locations Taiwan Semiconductor’s chips in its GPUs (graphics processing models), which have been the first computing unit deployed by the AI hyperscalers. To make these chips, Taiwan Semiconductor wants specialised machines from ASML generally known as excessive ultra-violet (EUV) lithography machines. No firm on the earth has EUV expertise moreover ASML, so its engineering dominance has earned it a technological monopoly.

Because the demand for Nvidia GPUs rises, so does the necessity for extra Taiwan Semi chips. Elevated chip demand requires extra manufacturing capability, which implies extra ASML EUV machines. Once more, this requires AI demand to proceed rising, which appears to be the best way that it is heading.

Nvidia CEO Jensen Huang acknowledged at its 2025 GTC occasion that information middle buildouts will enhance from about $400 billion in 2024 to $1 trillion by 2028. Contemplating that Nvidia’s trailing 12-month complete information middle income was $115 billion, it will get practically a 3rd of all information middle spending. That is an enormous chunk of the market, and if Nvidia can preserve that proportion, it’s going to ship monster development over the following few years.

This additionally jives with what Taiwan Semiconductor’s CEO, C.C. Wei, has been saying. For 2025, they count on income from their AI-related chips to double. Moreover, over the following 5 years, they count on AI-related income to develop at a forty five% compounded annual development charge, which might be an unimaginable achievement.

Whereas buyers can speculate whether or not these projections are legitimate, the fact is that these two CEOs are higher related to the demand than nearly anyone else. Whereas they will nonetheless make errors, the chances of getting this info utterly unsuitable are unlikely. Consequently, buyers must take refuge in the truth that there’s nonetheless an enormous AI buildout happening, and this pattern will likely be unlikely to be disrupted over the following 5 years until a extreme financial collapse happens.

I do not assume that is doubtless, which makes these three shares intriguing contemplating their sale costs.

All three of those shares are far cheaper than they have been priced in current historical past

Whereas these shares was once extremely valued, they are not that manner anymore following the sell-off.

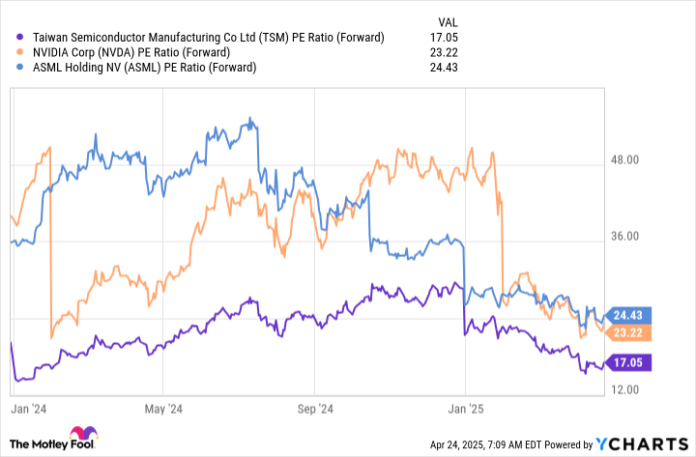

TSM PE Ratio (Ahead) information by YCharts

ASML is the costliest inventory on the listing at 24.4 occasions ahead earnings, however these projections do not embody ASML’s just lately introduced plan to repurchase as much as 10% of its inventory. This might be an enormous increase for the inventory, making it even cheaper than it presently seems.

Nvidia at 23 occasions ahead earnings is a no brainer, as the expansion it is anticipated to attain over the following few years is kind of spectacular.

Lastly, Taiwan Semiconductor is a steal at these ranges as a result of the broader market (as measured by the S&P 500 (^GSPC 0.74%)) trades for 19.8 occasions ahead earnings. TSMC is anticipating market-beating development over the following 5 years, so shopping for it at a reduction to the market is a good funding alternative.

These three could also be hurting, however the long-term outlook continues to be clear. All three of those shares appear like glorious bargains, and buyers ought to scoop them up whereas they’re nonetheless low cost.

Keithen Drury has positions in ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.