Cathie Wooden simply purchased one explicit Magnificent Seven inventory at a traditionally low cost value level.

Cathie Wooden leads wealth administration agency Ark Make investments as its CEO and chief funding officer. Monetary information packages and podcasts steadily function Wooden, who usually promotes her long-term funding methods in expertise firms disrupting rising markets.

Though Ark typically focuses its portfolio on smaller, speculative alternatives, Wooden maintains some publicity to megacap shares. Based on Ark’s information, e-commerce and cloud computing behemoth Amazon (AMZN -1.01%) is the thirteenth-largest place throughout your entire portfolio.

Up to now this yr, shares of Amazon have dropped by roughly 18%. These declines do not look like deterring Wooden, although. Between April 4 and April 8, Ark scooped up roughly 104,000 shares of Amazon — unfold throughout the ARK Subsequent Technology Web, ARK Autonomous Know-how & Robotics, ARK Innovation, and ARK Fintech Innovation exchange-traded funds (ETF).

Let’s dig into why Wooden’s resolution to purchase the dip in Amazon inventory seems to be extremely savvy proper now.

Amazon inventory is buying and selling at traditionally low cost ranges

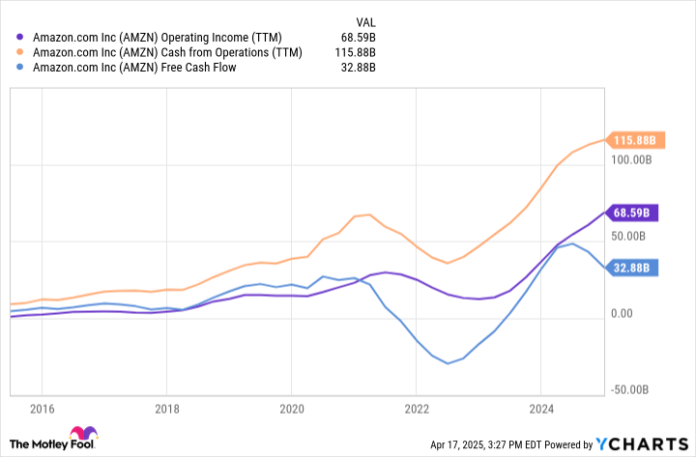

The chart beneath illustrates Amazon’s working earnings, money from operations (CFO), and free money stream progress during the last 10 years. My takeaway from the highest chart is that Amazon has change into a extra environment friendly enterprise from a price and profitability perspective during the last decade.

AMZN Working Earnings (TTM) knowledge by YCharts.

Of observe, my private choice is to have a look at Amazon’s working earnings versus internet earnings as a proxy for its profitability. Whereas internet earnings is a extra fashionable revenue metric, I do not discover it significantly insightful for Amazon. Working earnings is much less impacted from accounting changes, and might shed mild into the precise profitability of sure segments equivalent to Amazon’s e-commerce enterprise versus its cloud computing operation.

Amazon’s capability to generate sturdy, rising working earnings has performed a task within the firm’s constant money stream progress. Taking this a step additional, Amazon has reinvested its extra money into new alternatives, together with growing leisure content material, synthetic intelligence (AI), and strategic acquisitions outdoors of the core e-commerce market. All of those strikes have helped Amazon construct a extra diversified operation, whereas the general enterprise expands revenue margins and continues to generate steadily rising money stream.

Even with these developments, buyers are valuing Amazon at a traditionally steep low cost based mostly on working earnings developments. Because the chart beneath exhibits, the ratio between Amazon’s market cap and working earnings is close to a 10-year low. Whereas it is regular for valuation multiples to normalize over time, my take is that Amazon is not getting a lot credit score for its capability to strengthen the effectivity of its enterprise and establish new alternatives for long-term progress.

Elementary Chart knowledge by YCharts.

Do you have to purchase the dip in Amazon inventory proper now?

In my eyes, the primary drag on Amazon inventory proper now’s uncertainty across the Trump administration’s new tariff insurance policies. Whereas tariffs may end in increased costs (inflation) for consumers, a contrarian may even see this as a possibility for Amazon — as a result of its e-commerce market is best-known for its number of shopper items obtainable at extremely aggressive costs in comparison with conventional retailers equivalent to Walmart, Goal, or Costco Wholesale.

Picture supply: Getty Pictures.

As well as, I do not see Amazon Internet Providers (AWS) experiencing a lot a slowdown over tariff issues. Whereas firms probably will function below extra stringent value controls in the interim, the necessity for cloud infrastructure stays excessive — particularly as demand for AI stays sturdy, regardless of a murky near-term financial image. Provided that AWS is a core supply of Amazon’s revenue margins, I believe the corporate stays in place to proceed producing wholesome money stream ranges regardless of ongoing turbulence within the financial system.

I believe Wooden made a savvy resolution to purchase Amazon at its present value level. I see the dip as a profitable alternative for progress buyers to decrease their value foundation and add to their positions.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, Goal, and Walmart. The Motley Idiot has a disclosure coverage.