Palantir Applied sciences (PLTR -0.22%) went public in September 2020, and shares of the software program platforms and knowledge analytics supplier have jumped a powerful 714% since then as of this writing, although it’s value noting that just about all the inventory’s features have arrived up to now couple of years following the launch of its synthetic intelligence (AI) software program platform in April 2023.

Nonetheless, Palantir inventory has dropped significantly up to now month or so. The inventory shot up remarkably when 2025 started, nevertheless it has dropped 38% from the 52-week excessive it hit on Feb. 18. Palantir’s current slide is due to components outdoors of the corporate’s management. The broader inventory market negativity triggered by the tariff-induced international commerce struggle has led buyers to press the panic button.

The tech-laden Nasdaq Composite index has dropped greater than 20% in 2025 (as of this writing). Fears of an financial slowdown and a possible recession have led buyers to e-book earnings in shares that delivered excellent features up to now couple of years, and Palantir is one among them.

Nonetheless, the software program specialist’s sharp pullback of late might entice growth-oriented buyers into shopping for the inventory, contemplating the potential upside it might ship over the following decade. Let’s take a more in-depth have a look at the catalysts that ought to act as tailwinds for Palantir over the following 10 years.

Booming demand for AI software program will help Palantir zoom larger

Palantir’s development trajectory has began enhancing for the reason that launch of its Synthetic Intelligence Platform (AIP) a few years in the past. The corporate launched AIP for each industrial and authorities prospects with the goal of serving to them construct and deploy AI purposes tailor-made to their operations. This platform has gained immense traction because of the productiveness features that AIP prospects have been attaining, resulting in excellent development in Palantir’s buyer base, in addition to spending by current prospects.

Particularly, Palantir registered a 43% year-over-year enhance in its buyer depend within the fourth quarter of 2024. Even higher, it witnessed a rise within the variety of prospects signing greater offers with the corporate. For instance, the variety of offers value $1 million or extra signed by Palantir final quarter elevated by 25% from the year-ago interval. In the meantime, the rise within the variety of $5 million-plus offers was greater at 57% on a year-over-year foundation.

These numbers make it clear that Palantir is profitable large from the speedy adoption of AI software program, a market that is anticipated to develop at an unimaginable tempo over the following decade. Market analysis supplier Roots Evaluation expects the AI software program market to generate a whopping $5.2 trillion in annual income in 2035, suggesting that Palantir is scratching the floor of a large end-market alternative that might assist it maintain terrific development ranges over the following decade.

It’s value noting that Palantir has been ranked as the highest vendor of AI software program platforms by a number of third-party market analysis businesses reminiscent of IDC, Forrester, and others. This explains why prospects have been flocking to Palantir’s AIP, because the platform has been in a position to ship value and effectivity features. The corporate reported a strong year-over-year enhance of 56% in its complete contract worth in This fall 2024 to $1.8 billion.

This led to a giant leap in Palantir’s income pipeline. The corporate posted a 40% year-over-year enhance in its remaining deal worth (RDV) in This fall to a powerful $5.4 billion. The metric refers back to the complete remaining worth of contracts that Palantir has to meet on the finish of a interval. The expansion in Palantir’s RDV was larger than the 36% income development the corporate clocked throughout the quarter.

So, Palantir is setting itself up for a lot stronger development sooner or later. The corporate ought to profit from the addition of extra prospects, in addition to the elevated spending by current prospects on its choices. These components are contributing towards optimistic unit economics for Palantir, permitting the corporate to file a lot sooner development in earnings as in comparison with income.

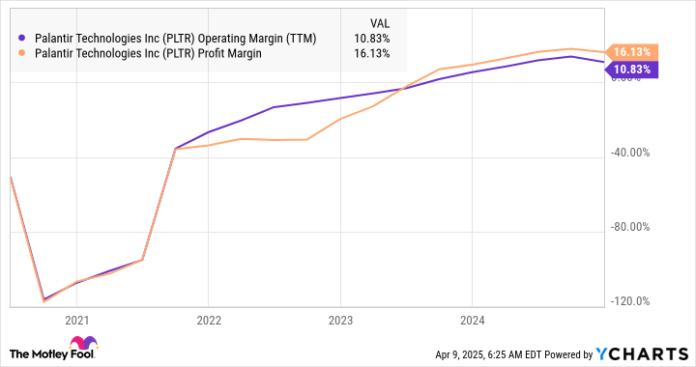

Unit economics is a measure of an organization’s profitability, serving to us perceive how a lot cash it’s making from every buyer. On condition that Palantir has been in a position to signal expanded offers with current prospects, a development that might proceed sooner or later because of the proliferation of AI, its margin profile might proceed enhancing.

The next chart clearly signifies that Palantir’s margins have improved significantly up to now couple of years, and there’s nonetheless extra room for development on this entrance.

PLTR Working Margin (TTM) knowledge by YCharts

Ought to valuation be a priority proper now?

Palantir’s costly valuation is a key motive why buyers have been reserving earnings on this inventory. In spite of everything, shares buying and selling at a premium valuation are at a better danger throughout sell-offs since they’re deemed riskier when in comparison with worth shares. The unhealthy information is that Palantir remains to be buying and selling at 66 instances gross sales and 145 instances ahead earnings regardless of pulling again considerably of late.

So, it will not be stunning to see this AI inventory pulling again additional because of the unfavorable sentiment that is affecting international inventory markets proper now. Nonetheless, if Palantir inventory continues to slip additional and turns into out there at a less expensive valuation, it will be value shopping for, contemplating the large addressable alternative out there within the AI software program market over the following 10 years.

What’s value noting is that Palantir has began rising at a sooner tempo than the speed at which the worldwide AI software program market is predicted to develop over the following decade. Roots Evaluation is forecasting a compound annual development price of virtually 31% for the generative AI software program market via 2035. Palantir’s income development of 36% was a lot sooner than that, whereas the development in its RPO was even higher.

There’s a good likelihood that Palantir will have the ability to maintain wholesome development ranges over the following decade in mild of the productiveness features that AIP is delivering to prospects. So, savvy buyers would do properly to regulate Palantir inventory and contemplate accumulating it if it falls additional because it might change into a strong funding over the following decade.