Proving that custodial, centralized, altcoin casinos aren’t the one approach to achieve this business, the privacy-focused bitcoin alternate Bull Bitcoin not too long ago went multinational, bootstrapping a staff in France and increasing its companies to the complete eurozone. The transfer comes solely a 12 months after asserting their enlargement into Costa Rica.

“Bull Bitcoin might be the longest-running Bitcoin-only, self-custodial alternate,” Theo Mogenet, Europe Basic Supervisor for Bull Bitcoin, instructed Bitcoin Journal in an interview.

”While you purchase Bitcoin from us, it goes straight to your pockets, we by no means maintain consumer funds—and it displays Francis’s imaginative and prescient of privateness and the cypherpunk ethos.”

https://x.com/Bull Bitcoin_/standing/1881371651251769619

Based in Montreal, Canada, in 2013, Bull Bitcoin’s main declare to fame is its noncustodial alternate mannequin. Relatively than take your fiat and credit score a bitcoin steadiness to your account on their books, Bull Bitcoin forces customers to enter a Bitcoin public deal with earlier than buy. This ensures that when fiat lands on their account, they will shortly pay out the bitcoin to the person’s pockets of alternative.

They’ve additionally been early and lively supporters of the Lightning Community and Liquid Community, and have even built-in PayJoin into their platform, all of which supply vital privateness advantages to their customers.

Lastly, they’ve developed a line of merchandise centered not on buying and selling and hypothesis however on utilizing bitcoin as cash.

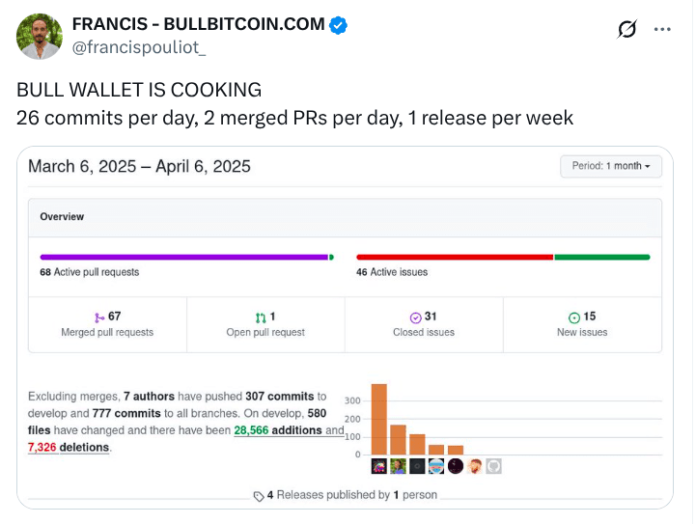

Bull Bitcoin permits customers to pay their month-to-month payments with bitcoin akin to lease, electrical energy, knowledge plans, and as of late even purchase actual property. Additionally they have a Bitcoin pockets app that’s nonetheless in its early levels, however is shortly gathering a robust checklist of options.

One delicate however highly effective distinction between Bull Bitcoin and most different exchanges is their bitcoin-only stance, which rejects promoting altcoins which might be the bread and butter of most exchanges — monetizing the speculative fervor of the crypto markets.

Bull Bitcoin ignores the entire crypto market, focusing solely on bitcoin, which permits it to deploy cutting-edge applied sciences earlier than lots of its opponents. The staff at Bull Bitcoin thereby doesn’t run the compliance danger or carry technical debt that comes naturally with supporting lots of of various altcoins.

The result’s a worthwhile firm with a lean and imply staff that has now gone worldwide.

Privateness is Not a Crime

The ultimate piece to Bull Bitcoin’s success is perhaps its founding story. Began by French-Canadian entrepreneur and Bitcoin Maximalist Francis Pouliot, the corporate has been fully self-funded, receiving no VC cash to this point.

Whereas sticking to the early cypherpunk imaginative and prescient of bitcoin as sovereign cash couldn’t have been simple, it has enabled the corporate to make selections and make use of methods that different exchanges typically keep away from.

Now, they’re getting into the EU in an period the place many different cryptocurrency companies are exiting the union. Corporations like Deribit left Europe years in the past and even giants like Tether are being squeezed out from the European Union as a consequence of regulatory stress. Bull Bitcoin has as an alternative dove in, seeing a possibility to succeed in an underserved market.

On the compliance entrance, Bull Bitcoin has taken a really completely different method than different market individuals. Relatively than over-comply out of an abundance of warning as seen with many crypto exchanges, they’ve caught to the letter of the legislation, and regarded for methods to defend their customers from overzealous regulators or politicians.

“Now we have a variety of expertise coping with the federal government. We come from Canada so we’re used to authorities oversight. The compliance burden of the European Union, though a lot larger than Canada, doesn’t scare us,” Francis Pouliot instructed Bitcoin Journal.

Theo Mogenet added:

“Now we have sure obligations by way of preventing cash laundering — that we can not actually circumvent. However as you talked about, when, for instance, a authorities, be it in Canada or right here in Europe, will ask for a bulk of transactions with none judicial mandate, with none authorized foundation to take action, our coverage is simply to battle again and be sure that we are able to use every bit of laws that’s on the market — to principally push again on the federal government’s demand.”

Growth into Costa Rica

Bull Bitcoin’s enlargement is just not restricted to Canada and Europe. Lately, Bull Bitcoin began making inroads into Costa Rica, marking their entrance into Latin American markets, an ecosystem typically pushed by peer-to-peer funds and low-tech infrastructure.

Changing into the primary “Bitcoin alternate within the nation,” it shortly built-in with the very talked-about cellular textual content funds service SINPE Móvil, permitting customers to commerce sats for fiat shortly and in a approach the native inhabitants was acquainted with.

The consequence appears to have been a fast enlargement of adoption amongst farmers markets and different produce retailers, which frequently function movies from Francis and the staff, having fun with the Central-American climate.

The transfer to Costa Rica was famously pushed by an escape from the Covid restrictions in Canada, which Francis protested and opposed.

Bull Bitcoin quickly partnered with the Bitcoin Jungle, an open supply grassroots effort much like the Bitcoin Seaside group in El Salvador, which maps and educates Costa Rican locals on how one can profit from bitcoin and leverage it as a cash and ecosystem.

The Burdens of Self-Custody

Bull Bitcoin’s dedication to cypherpunk values has not come with out challenges. Self-custody specifically, whereas eradicating an excellent burden from the corporate by way of compliance and safety danger, calls for a extra educated person base and really responsive assist staff.

Boasting a self-hosted “easy chat system” for buyer assist that even Francis himself will at instances run, the method permits customers quick and dependable entry to a savvy Bitcoiner who may give them a fast turnaround, with out counting on third social gathering platforms.

“In our case, it’s a self-hosted everlasting chat. So it’s operating on our servers. Like no consumer knowledge is shared with outdoors events. And you’ll principally chat with a human, normally like, for instance, in Europe, it might typically be me or Jimmy or buyer assist officer. Typically it’s even Francis that’s answering to purchasers,” mentioned Theo Mogenet about their buyer assist course of.

They’ve processes designed to assist forestall customers from getting scammed as effectively, going so far as to calling their customers when they’re in a buyer assist monitor.

“We are able to even have like a 10-, 15-minute dialog with them to be sure that they know what a Bitcoin pockets is, what the dangers with self-custody are to ensure that they aren’t pressured or pushed by somebody to try this,” Theo defined on the podcast.

Phishing scams are a standard concern for Bitcoin and crypto exchanges, and naive customers get talked into shopping for crypto to ship to scammers, in an effort to relieve stress from varied lies or stress ways.

In addition to their lively assist staff, in 2022 Bull Bitcoin acquired Veriphi, a “white glove service supplier for Bitcoin self custody”. The agency had deep roots within the Bitcoin Quebec scene and developed a variety of expertise with superior self-custody consulting.

At present, this service is built-in into their product line with a devoted web site at bitcoinsupport.com, providing customers a spread of consulting and training packages to maneuver them alongside the journey into bitcoin self-custody with correct steerage.

Self-Hosted Infrastructure: The Fork Conflict

The deal with self-hosted infrastructure didn’t come from a spot of ideology alone, however was a hard-earned lesson from the 2017 Bitcoin fork warfare—the interior battle throughout the Bitcoin business about what path Bitcoin scaling growth ought to take and who obtained to resolve this.

In a 2017 speech, for instance, Francis Pouliot defined the dilemmas the Bitcoin group confronted on the time, the sport concept of financial nodes, and the thesis of Bitcoin consensus that finally emerged victorious.

Confronted with a faction of the Bitcoin group referred to as Bitcoin Limitless that wished to scale Bitcoin by growing the block dimension—a technical possibility rejected by Bitcoin Core builders on the time—Francis Pouliot and the Bull Bitcoin staff led an effort to coach and rally Canadian Bitcoin companies towards the proposed exhausting fork, as seen on this letter of intent from 2017 signed by 16 Canadian companies.

Bull Bitcoin additionally started constructing Cyphernode, a “modular Bitcoin full-node microservices API server structure and utilities toolkit to construct scalable, safe, and featureful apps and companies with out trusted third events.”

This software program suite, launched as open-source software program a 12 months later, allowed Bull Bitcoin and related corporations to take a stand in that schism with software program that they had full management over, enabling them to decide on which model of Bitcoin to sign assist for and which model of Bitcoin to observe within the occasion of a contentious bifurcation of the community.

That software program independence would show helpful towards one other entrance on this tradition warfare: a company alliance of mining swimming pools, knowledge service suppliers, and exchanges that might quickly be part of the fray and pursue a special consensus change to the Bitcoin protocol, generally known as the NY Settlement, which supported a model of Bitcoin referred to as SegWit2x.

The mighty company alliance included giants akin to Blockchain.com, Coinbase, and 50 others, together with mining swimming pools that on paper had greater than 80% of hashing energy behind them, but additionally challenged developer and group consensus.

Each Bitcoin Limitless and the NY Settlement coalition would find yourself dropping this fork warfare to group and developer consensus, who used instruments much like Cyphernode (UASF) and stood behind the backwards-compatible SegWit tender fork, a scaling answer for Bitcoin that maintained consensus with older variations of Bitcoin and would ultimately show victorious.

Bull Bitcoin’s function in defending the decentralization of Bitcoin in 2017, alongside their alignment with cypherpunk values for over a decade, locations them comfortably as legends within the annals of Bitcoin historical past.