Nvidia has emerged as some of the precious firms on the planet due to the AI motion, however the firm’s long-term development seems to be questionable.

Megacap know-how shares have been among the largest and longest-standing beneficiaries of the substitute intelligence (AI) revolution. Whereas development shares within the tech sector have skilled no less than some type of motion since AI emerged as a megatrend, these positive aspects have been fleeting for many firms — resulting in extended durations of outsize volatility.

However for large tech, the positive aspects have been fairly regular during the last couple of years. The corporate that has loved essentially the most upside thus far is semiconductor powerhouse Nvidia, which has seen its market worth rise by trillions — making it one of many most useful firms on the planet.

Whereas proudly owning Nvidia inventory has helped some traders notice unprecedented positive aspects and wealth, I see a special member of the “Magnificent Seven” as the higher long-term alternative. Let’s discover the dynamics between Nvidia and Amazon (AMZN -2.61%) and assess why the e-commerce and cloud computing darling could possibly be the extra precious firm by subsequent decade.

Why Amazon’s development seems to be poised to speed up

Over the past twenty years Amazon has prolonged far past its e-commerce market. At present, the corporate operates throughout cloud computing infrastructure, promoting, streaming and leisure, logistics, grocery supply, subscription companies, and extra. By diversifying its ecosystem, Amazon has acquired a profitable mixture of retail and company customers.

For a few years now, Amazon has quietly been pouring billions into various AI-related initiatives because it begins to construct the subsequent part of its enterprise. A few of the higher-priority strikes the corporate has made consists of investing $8 billion right into a start-up referred to as Anthropic, which has develop into an integral part of the corporate’s cloud computing platform, Amazon Internet Companies (AWS).

Amazon has additionally been specializing in constructing AI information facilities, its personal line of customized silicon chipsets, and doubling down on robotics automation processes for its success facilities.

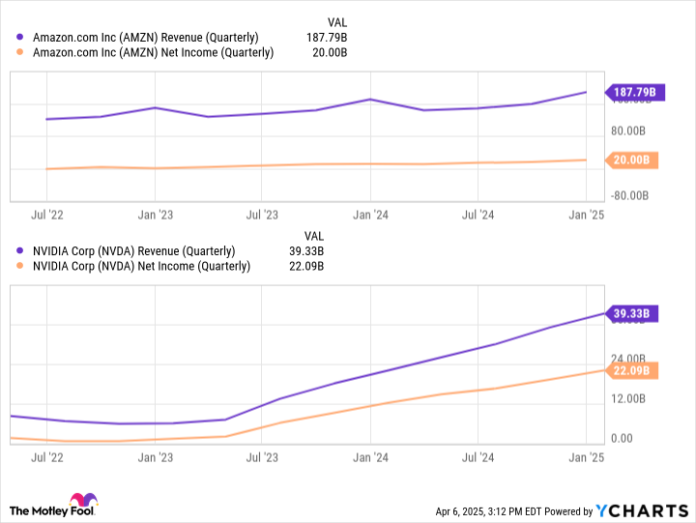

AMZN Income (Quarterly) information by YCharts

Should you have a look at the income and revenue developments above, you may be questioning why Amazon is making these investments within the first place. Nicely, simply take a look at the disparity between Nvidia’s development and Amazon’s. It is clear that the slopes of Nvidia’s income and revenue traces are far steeper than Amazon’s.

With that mentioned, I might warning traders towards dismissing Amazon’s potential. Income and working earnings in AWS have been accelerating significantly for the reason that Anthropic partnership commenced a few years in the past. As well as, Nvidia sells among the most necessary items of {hardware} and software program wanted to develop AI. In different phrases, Nvidia has been having fun with quicker positive aspects in comparison with its friends as a result of firms want their merchandise. Amazon, against this, has spent the final two years constructing new services which have but to completely scale.

For these causes, I believe Amazon is within the early days of a brand new interval of exponential development. Beneath, I will element why Nvidia could also be observing a substantial slowdown over the subsequent a number of years.

Why Nvidia’s development might start to stall

The first tailwind fueling Nvidia’s enterprise for the final couple of years is demand for compute and networking tools for information facilities. Corporations investing in AI infrastructure rely closely on chipsets referred to as graphics processing models (GPUs), which is a chunk of {hardware} that Nvidia makes a speciality of designing.

For some time, Nvidia had the posh of nearly no direct competitors. This supplied the corporate with an unlimited bargaining chip within the type of pricing energy — primarily charging a premium for its GPUs as firms all world wide lined as much as purchase them.

Though the launch of Nvidia’s latest GPU structure, Blackwell, is off to a robust begin, I’m starting to query how for much longer the corporate’s pricing energy goes to final. Superior Micro Units has lastly launched its personal line of competing GPUs, the MI300 accelerators. Though AMD’s information heart GPU enterprise is way slower than that of Nvidia, it’s rising at a quick clip whereas sustaining profitability. As well as, AMD is ready to compete with Nvidia with regards to worth — which has helped the corporate appeal to the likes of Oracle, Meta Platforms, and Microsoft as early adopters of the MI300 structure.

Past direct competitors, different hyperscalers corresponding to Microsoft and Alphabet are becoming a member of Amazon in creating their customized silicon chips. With the addition of extra chipsets coming to market, Nvidia faces the danger that companies start to see GPUs as a commoditized piece of {hardware}.

In consequence, Nvidia could also be pressured to loosen its pricing construction with a purpose to stay aggressive within the GPU realm — a dynamic that may seemingly start to point out some significant deceleration throughout gross sales and revenue margins.

Picture supply: Getty Photos.

Having a look at valuation disparity

The chart under illustrates the price-to-earnings (P/E) ratio for Amazon and Nvidia during the last three years. It is fascinating that the continued sell-off within the Nasdaq has converged each firms’ P/E multiples to primarily the identical worth (hovering proper round 30). In different phrases, though Nvidia’s market cap of $2.3 trillion is way increased than Amazon’s $1.8 trillion, each companies are valued equally on a P/E foundation.

NVDA PE Ratio information by YCharts

Whereas I do assume every inventory is poised for a rebound, I believe traders could start to use some extra scrutiny over Nvidia. The corporate has been scorching scorching for the final two years and the momentum was absolutely going to stall out in some unspecified time in the future.

Now as extra competitors begins to enter Nvidia’s core market, the corporate goes to need to put money into different areas of the AI panorama with a purpose to proceed successful over enthusiasm from development traders. In contrast, Amazon has already been making various investments — a lot of which have but to scale and absolutely bear fruit.

For these causes, I believe Amazon is the higher purchase and maintain than Nvidia proper now, as I believe the corporate is positioned to speed up each gross sales and earnings for years to return — therefore commanding a premium a number of over its friends down the highway.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.