Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) continues to face large promoting strain, with costs dropping under the $85,000 mark, marking a 12% decline since final Friday. The latest downturn has fueled panic promoting and heightened worry, main many traders to take a position in regards to the potential begin of a bear market. As uncertainty grips the market, merchants stay cautious about Bitcoin’s subsequent main transfer.

Associated Studying

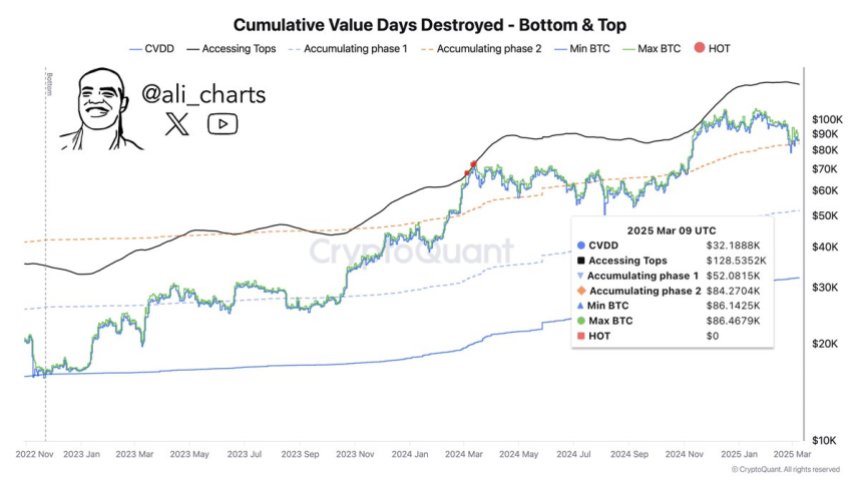

Nevertheless, regardless of the continued sell-off, key on-chain information from CryptoQuant means that Bitcoin could possibly be organising for a restoration rally. The Cumulative Worth Days Destroyed (CVDD) indicator, a metric that tracks long-term holder conduct and capital inflows, means that BTC may quickly enter a brand new uptrend. If Bitcoin stabilizes and reclaims key assist ranges, it may pave the way in which for a rally towards a brand new all-time excessive of $128,000.

With Bitcoin at a essential inflection level, the subsequent few buying and selling periods can be essential in figuring out whether or not BTC can regain momentum or if additional draw back is forward. Traders at the moment are intently watching whether or not promoting strain continues or if long-term holders step in to build up, signaling a possible market rebound.

Bitcoin Insights Give Hope To Bulls

Bitcoin is at a essential juncture, going through a critical threat of continued correction as bearish sentiment grips the market. Many analysts now consider that the Bitcoin bull cycle could also be over, as BTC struggles under $85,000 whereas barely holding above $80,000. With promoting strain intensifying, traders predict one other leg down, doubtlessly pushing BTC into decrease demand zones.

Regardless of the destructive outlook, some analysts argue {that a} restoration continues to be attainable if Bitcoin can reclaim key ranges. Prime analyst Ali Martinez shared insights on X, stating that if BTC reclaims $84,000 as assist, it may open the trail towards a rally to a brand new all-time excessive of $128,000. This implies that whereas the market stays fragile, there may be nonetheless potential for Bitcoin to regain power if bulls step in at essential value factors.

The approaching weeks can be essential in figuring out the power or weak spot of this cycle. If BTC continues to wrestle under key resistance ranges, a deeper correction may observe, reinforcing bearish sentiment. Nevertheless, if bulls handle to push BTC again above $84K, it might point out a shift in momentum, doubtlessly reigniting the uptrend.

Associated Studying

With uncertainty dominating the market, merchants are intently watching BTC’s subsequent transfer, as its means to carry or reclaim assist ranges will decide whether or not this cycle is actually over or if one other rally continues to be on the horizon.

BTC Struggling Beneath $85K

Bitcoin has confronted large promoting strain, with essentially the most important drop occurring on Sunday, when the worth plunged from $86,000 to $80,000, marking a 7% decline in simply hours. This sharp downturn has fueled panic promoting as traders stay unsure about Bitcoin’s short-term course.

For bulls to regain management, BTC should reclaim the $86,000 degree and push above $90,000 to verify a possible restoration rally. A powerful transfer previous these key resistance ranges may restore confidence available in the market, signaling that Bitcoin’s correction part is likely to be nearing its finish.

Nevertheless, failure to interrupt above $86K may maintain Bitcoin below bearish management, rising the danger of one other leg down. If BTC drops under $80,000, it may take a look at the $78,000 low, a degree that, if breached, could result in additional draw back strain.

Associated Studying

With Bitcoin at a essential turning level, the subsequent few buying and selling periods will decide whether or not bulls can reclaim key ranges or if bears will proceed to dominate the market, pushing BTC into deeper correction territory.

Featured picture from Dall-E, chart from TradingView