Nvidia (NVDA 1.92%) and Palantir Applied sciences (PLTR 5.53%) delivered terrific features final yr as shares of each firms shot up remarkably because of the fast-growing demand for his or her synthetic intelligence (AI)-focused {hardware} and software program options. However 2025 is popping out to be totally different for these red-hot progress shares.

Whereas Nvidia inventory has retreated almost 14% in 2025, Palantir has misplaced plenty of floor in latest days after a stable begin to the yr. Nevertheless, it can’t be denied that each firms are on monitor to profit from profitable finish markets. Whereas Nvidia’s latest outcomes counsel that the fast-growing demand for AI {hardware} continues to be a key progress driver for the corporate, Palantir continues to witness an enchancment in its progress profile because of the increasing want for generative AI software program.

Nevertheless, when you had to purchase one among these two AI shares proper now, which one do you have to be placing your cash on? Let’s discover out.

The case for Nvidia

The market has been doubting Nvidia’s skill to maintain its wholesome progress because of a wide range of causes starting from export controls on its AI graphics processing items (GPUs) to a possible slowdown in AI infrastructure spending to threats from different sorts of chips reminiscent of customized processors which are being adopted by tech giants in a bid to decrease their AI bills.

Nevertheless, the corporate’s newest quarterly outcomes make it clear that the demand for its AI chips stays wholesome. Nvidia’s income within the fourth quarter of fiscal 2025 (which ended on Jan. 26) elevated a terrific 78% yr over yr to a file $39.3 billion. Adjusted earnings additionally elevated by a formidable 71% to $0.89 per share. Each numbers have been forward of Wall Road’s expectations.

The steerage signifies that Nvidia is on monitor to maintain its wholesome momentum. It’s anticipating $43 billion in income within the present quarter, which might translate to a 65% enhance from the prior-year interval. Nevertheless, Nvidia may exceed its personal expectations because it ramps up the availability of its newest era Blackwell processors to help the fast-growing buyer demand.

Extra importantly, Blackwell can assist Nvidia preserve its dominant place within the AI chip market because of its versatility. Administration identified on the most recent earnings convention name that “Blackwell addresses the whole AI market from pretraining, post-training to inference throughout cloud, to on-premise, to enterprise.”

Nvidia additional factors out that the arrival of low-cost reasoning fashions reminiscent of DeepSeek’s R1 is prone to enhance computing demand considerably. This bodes effectively for the corporate’s Blackwell structure, which Nvidia claims is able to processing requests 25 instances quicker at a 20 instances decrease value when in comparison with the earlier era H100 processor. As such, it will not be stunning to see Nvidia sustaining its dominant share of round 85% within the AI chip market going ahead.

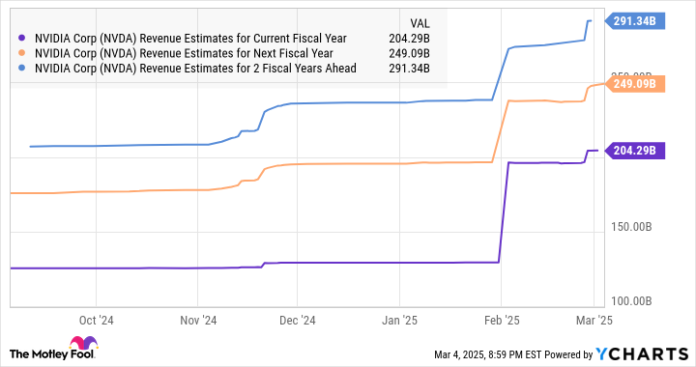

That is additionally in all probability the explanation why analysts have elevated their income progress expectations for the corporate for the present and the subsequent two fiscal years.

NVDA Income Estimates for Present Fiscal 12 months information by YCharts

The corporate’s earnings, in the meantime, are anticipated to extend by 50% within the present fiscal yr regardless of the near-term margin stress it’ll face whereas ramping up the output of its Blackwell processors. Nvidia factors out that its adjusted gross margin will head again to the mid-70% vary later within the fiscal yr from the low-70% vary proper now as soon as Blackwell manufacturing is totally ramped up.

So, do not be shocked to see Nvidia’s earnings rising at a quicker tempo and exceeding analysts’ expectations because the yr progresses.

The case for Palantir Applied sciences

Palantir Applied sciences is among the main distributors of AI software program platforms, a market that is anticipated to grow to be large in the long term. Market analysis agency IDC estimates that the worldwide AI software program platforms market may develop from $28 billion in 2023 to $153 billion in 2028 at an annual fee of greater than 40%.

This fast-growing market is already having a constructive influence on Palantir’s efficiency. The corporate’s income progress accelerated to 29% in 2024 from a 17% enhance witnessed in 2023. Provided that Palantir’s high line got here in at slightly below $2.9 billion final yr, it’s simple to see that the corporate nonetheless has plenty of room for progress sooner or later contemplating the potential dimension of the AI software program platforms market.

What’s value noting right here is that the tempo at which Palantir is now signing new contracts is equaling the tempo at which the AI software program platforms market is predicted to develop, as per IDC. The corporate reported a 40% year-over-year enhance in its remaining deal worth (RDV) within the fourth quarter of 2024 to $5.4 billion.

That was a big enchancment over the 22% year-over-year enhance on this metric within the third quarter. Palantir’s RDV refers back to the whole worth of the corporate’s unfulfilled contracts on the finish of 1 / 4. So, the quicker progress on this metric is proof that the corporate is now signing contracts at a quicker tempo than it’s fulfilling, paving the best way for stronger income and earnings progress sooner or later.

There’s a good probability that Palantir’s income pipeline will proceed to enhance sooner or later as the brand new prospects that the corporate brings on board are inclined to signal greater contracts finally, because of the effectivity features delivered by its Synthetic Intelligence Platform (AIP). Palantir’s total buyer depend was up by 43% yr over yr within the earlier quarter. As these prospects begin deploying Palantir’s AIP into extra areas, the corporate ought to witness an enchancment in its RDV.

Additionally, the upper spending by current prospects is contributing towards an enchancment in Palantir’s margins. Its adjusted working margin elevated by 11 share factors yr over yr final quarter. Not surprisingly, Palantir’s adjusted earnings shot up a formidable 64% in 2024 to $0.41 per share. Analysts expect Palantir to maintain sturdy double-digit earnings progress going ahead, although do not be shocked to see it exceed these expectations because of its fast-improving income pipeline and margin enhancements.

PLTR EPS Estimates for Present Fiscal 12 months information by YCharts

The decision

Whereas Nvidia permits traders to profit from the profitable AI {hardware} market, Palantir permits them to profit from the quickly bettering adoption of generative AI software program. So, each firms may discover a place in a diversified portfolio. Nevertheless, the issue with Palantir is that it trades at an enormous premium when in comparison with Nvidia, an organization that is rising at a quicker tempo.

NVDA PE Ratio information by YCharts

Palantir’s costly valuation has created issues that the inventory could have gotten forward of itself and is among the the reason why it has pulled again considerably of late. Not surprisingly, analysts expect Palantir to ship simply 15% features within the subsequent yr as per its median value goal of $97. Nvidia, alternatively, is predicted to leap 51% over the subsequent 12 months, in line with analysts.

That will not be stunning as Nvidia’s cheaper valuation and the quicker earnings progress that it’s anticipated to ship this yr could lead on the market to reward it with extra upside as in comparison with Palantir, making it simpler for traders to determine which one among these two AI shares is a greater purchase proper now.