Wedbush Securities analyst Dan Ives sees two cratering AI shares as compelling alternatives proper now.

For the final two years, each the S&P 500 and Nasdaq Composite posted positive factors properly in extra of 20%. This scorching sizzling momentum initially carried into 2025 too, however extra lately, the markets have began to take a breather.

First it was DeepSeek, a Chinese language synthetic intelligence (AI) start-up that introduced shockwaves after it claimed to have constructed extremely refined fashions utilizing older structure in comparison with what massive tech firms within the U.S. have deployed.

Following on the heels of the DeepSeek drama got here a sequence of tariffs instituted by the brand new Trump administration. Given the implications tariffs can have on commerce negotiations and geopolitics, buyers have been cautious of how these new insurance policies will affect financial progress.

As shares proceed sliding off a cliff, it may be troublesome to discern which dips could also be shopping for alternatives hiding in plain sight. In line with Dan Ives, who leads expertise analysis at Wedbush Securities, two AI behemoths specifically are buying and selling within the “candy spot” proper now.

Let’s discover what firms Ives lately known as out as compelling alternatives and assess why scooping up shares proper now may show to be a savvy determination for long-term buyers.

1. Palantir Applied sciences

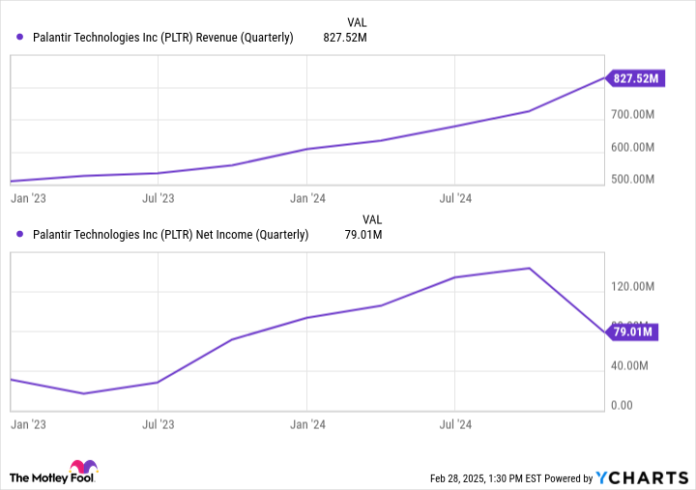

The primary firm on Ives’ listing is Palantir Applied sciences (PLTR -1.77%), a developer of enterprise software program options offered to each the personal and public sectors. For the reason that firm launched its Synthetic Intelligence Platform (AIP) suite in 2023, Palantir has witnessed an acceleration throughout each its high line and profitability profile.

PLTR Income (Quarterly) information by YCharts

The profitable launch of AIP has helped Palantir land on the radar of extra institutional buyers, and as such, the corporate has earned extra protection amongst Wall Avenue analysis analysts. Whereas that is all excellent news for Palantir’s enterprise, buyers have had little in the way in which of optimum shopping for alternatives.

The explanation I say it’s because Palantir inventory gained 340% final yr — making it the highest performer within the S&P 500. And whereas shares had gained as a lot as 65% this yr, the inventory has lately dropped by a substantial margin.

A mix of insider promoting in addition to adjustments to the Pentagon’s finances are the main culprits driving Palantir’s sell-off proper now. Regardless of these components, Ives sees Palantir’s present valuation ranges as a profit — and I agree. Shares are actually down greater than 30% from all-time highs, but nothing concrete has really modified within the firm’s long-term progress prospects.

Whereas Palantir has emerged as an costly title to personal amongst AI progress shares, dips of this magnitude are few and much between. The corporate is doing a pleasant job laying the groundwork for turning into an integral a part of the AI software program ecosystem, and in my eyes it is now time to scoop up shares as the corporate’s valuation normalizes a bit.

Picture supply: Getty Photographs.

2. Nvidia

It in all probability should not come as a shock that Ives known as out chip chief Nvidia (NVDA -8.69%) as title to personal proper now. For the previous few years, it has been nearly not possible to lose cash proudly owning Nvidia inventory. Corporations all all over the world have been pounding the door to purchase as a lot of the corporate’s graphics processing items (GPUs) as they’ll.

In truth, most of the firm’s “Magnificent Seven” cohorts, together with Meta Platforms, Microsoft, Alphabet, Tesla, and Amazon, often shout out to Nvidia throughout their earnings calls — signaling to buyers simply how integral the corporate’s {hardware} and software program is to the broader generative AI motion.

Nonetheless, when DeepSeek made its grand entrance into the AI realm in late January, Nvidia inventory began to slip. The driving pressure behind the sell-off was that DeepSeek claimed to have used older, much less succesful GPUs from Nvidia to construct its fashions — inflicting some buyers to fret if the corporate’s newer fashions, Hopper and Blackwell, had been definitely worth the price ticket.

Over the previous few weeks, firms have been reporting earnings outcomes for the fourth quarter and full yr of calendar 2024. If the large tech firms I referenced above advised us something, it is that funding in AI infrastructure is not going away. The reported $325 billion of AI capital expenditures allotted for 2025 alone ought to function a bellwether for Nvidia as the corporate scales its new Blackwell chipware and begins specializing in an excellent newer structure known as Rubin.

NVDA PE Ratio (Ahead) information by YCharts

Regardless of Nvidia’s continuation of spectacular information middle progress, underscored by its market-leading GPU empire, shares are buying and selling at ranges incongruent with a high-octane progress inventory.

Proper now, Nvidia’s ahead price-to-earnings (P/E) a number of of 26.7 is its lowest degree in a few yr. To me, that is an extremely uncommon alternative to scoop up shares of Nvidia because it trades at a significant low cost to historic ranges — particularly while you layer on the corporate’s present progress charges and its trajectory given robust secular tailwinds.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.