It is laborious to argue with the sorts of outcomes Eli Lilly (LLY 1.71%) has produced over the previous 5 years. The corporate has been one of many best-performing pharmaceutical giants, with its shares leaving the broader market within the mud.

Some would possibly argue that it is too late for buyers to get in on Eli Lilly, whereas others may really feel that its work within the diabetes and weight problems markets nonetheless makes it a beautiful long-term possibility. Which facet is correct? Let’s work out how Lilly may carry out by the tip of the last decade, and resolve whether or not it is nonetheless price investing within the inventory.

Count on sturdy income development all through

First, let’s think about how Eli Lilly’s latest merchandise will have an effect on its efficiency within the subsequent half-decade. These new medicines embrace Alzheimer’s illness therapy Kisunla, ulcerative colitis treatment Omvoh, and most cancers drug Jaypirca.

In fact, Lilly’s most necessary new merchandise are diabetes therapy Mounjaro and weight administration medication Zepbound, which share the energetic ingredient tirzepatide. In 2024, Eli Lilly’s income elevated by 32% 12 months over 12 months to $45 billion. The tirzepatide franchise contributed about $16.5 billion — regardless of having been available on the market for lower than three years.

Analysts have predicted peak annual gross sales of $25 billion for this compound. They could have been lowballing it. I count on Zepbound and Mounjaro to proceed on their upward trajectory by 2030, though elevated competitors will most likely result in their delivering much less spectacular gross sales development.

Nevertheless, the opposite medicines in Lilly’s new portfolio, which are not but contributing a lot, will rise in prominence. Think about Kisunla, which fills a big want in treating Alzheimer’s illness. Based on some estimates, it may generate about $2.5 billion in income by 2030. Jaypirca and Omvoh also needs to contribute meaningfully by the tip of the last decade.

In different phrases, Eli Lilly’s income ought to proceed rising at an excellent clip. The midpoint of the corporate’s steerage for 2025 implies gross sales development of about 32% for the 12 months, a terrific efficiency for a pharmaceutical big. I would be shocked if its annual top-line development goes decrease than 15% in any 12 months by 2030.

There can be strong pipeline progress

Eli Lilly has a number of thrilling merchandise in its pipeline, a few of that are more likely to earn approval within the subsequent 5 years. Think about two of the corporate’s main candidates in weight reduction: orforglipron and retatrutide. Each medicines are in section 3 research, however not simply as weight reduction administration merchandise: They’re being developed as potential therapies for diabetes, sleep apnea, and several other different circumstances.

What makes them so promising? Think about retatrutide, a triple agonist — it mimics the motion of three hormones: GLP-1, GIP, and GCG. That might be an enchancment on even tirzepatide, which mimics GLP-1 and GIP. Tirzepatide was the primary of its type. Retatrutide nonetheless has to show its price in scientific trials.

The purpose is that Lilly’s pipeline within the more and more aggressive GLP-1 market appears stronger than that of any of its friends not named Novo Nordisk. Based on some estimates, retatrutide may generate $5 billion by 2030, whereas orforglipron would possibly attain $8.3 billion in gross sales by then.

Naturally, different new Lilly merchandise may see the sunshine of day by 2030, and others will progress to late-stage research. That might be the case for the drugmaker’s extremely promising investigational gene remedy for deafness. Moreover, a lot of its present merchandise will seemingly earn label expansions. The lineup ought to look even stronger by the tip of the last decade.

Is the inventory a purchase?

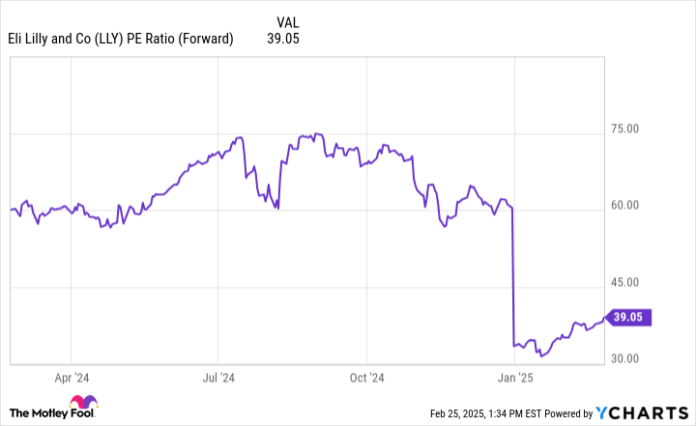

Bears would possibly level out Eli Lilly’s ahead price-to-earnings (P/E) of 39.

LLY PE Ratio (Ahead) information by YCharts.

The healthcare business’s common is 17.7 as of this writing. If Lilly is overvalued proper now, it’d underperform broader equities within the medium time period. Would it not be greatest for buyers to attend for a greater entry level?

My view is that the inventory is pretty valued. Lilly’s income and earnings have been rising a lot quicker than these of most of its equally sized friends within the healthcare business, so it solely is sensible that it has a better ahead P/E.

I count on Eli Lilly to beat the market by the subsequent 5 years. Past that, contemplating its unbelievable revolutionary talents, it’s going to nonetheless be a wonderful inventory.