Nvidia‘s (NVDA 2.63%) inventory is not low cost all that always, and any time it has offered off over the previous few years has been an unbelievable shopping for alternative. Proper now, Nvidia remains to be nicely off of its all-time excessive due to the scare attributable to DeepSeek’s revolutionary synthetic intelligence (AI) mannequin, which was reportedly skilled extra cheaply than most U.S. fashions. The prevailing worry is that not as a lot computing energy is required to coach AI fashions as as soon as thought, which might hurt Nvidia’s enterprise.

Whereas there’s some advantage to this considering, I do not assume it is correct, because the spending projections from a few of Nvidia’s greatest purchasers preserve rising. In consequence, I feel historical past will repeat itself, making proper now a implausible shopping for alternative for Nvidia’s inventory.

Nvidia’s income will dramatically rise once more in 2025

Nvidia has been dominant over the previous few years as a result of it’s powering a big chunk of the AI improvements. Its graphics processing models (GPUs) can course of calculations in parallel, which makes them much more helpful for intense workloads like coaching an AI mannequin. Moreover, when firms purchase a GPU, they do not purchase only one or two; they purchase 1000’s and join them in clusters, additional amplifying their computing energy. Nvidia’s GPUs have grow to be the highest choose for anybody within the AI discipline, as its outcomes again it up.

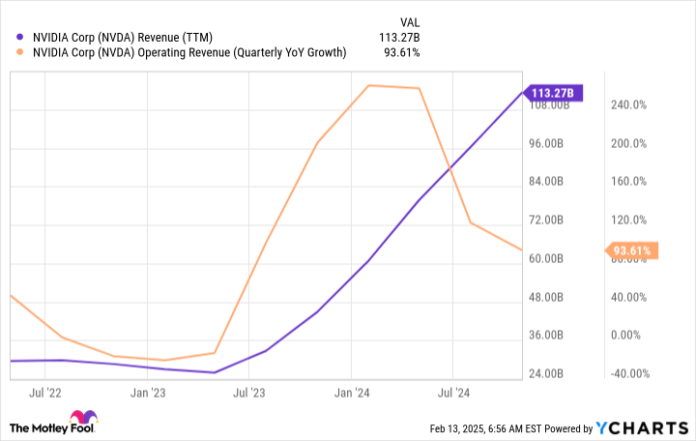

Nvidia has reported stellar income development quarter after quarter, driving the inventory to new heights.

NVDA Income (TTM) information by YCharts

Whereas it is true Nvidia’s income development is slowing, 94% development is nothing to be upset with. As Nvidia turns into a bigger enterprise, its development fee will naturally gradual, because it turns into tougher to develop the bigger you get. Nonetheless, that is not stopping Nvidia from posting jaw-dropping development numbers: Wall Avenue analysts count on 72% development for Q3 FY 2025 and 52% development to $196 billion for FY 2026.

Nonetheless, these numbers have been referred to as into query after DeepSeek introduced a extra environment friendly option to prepare its generative AI mannequin. Whereas these effectivity features are actual, and plenty of firms are working to combine them into their fashions, they do not change the truth that much more computing infrastructure is required to deal with all these AI workloads. This has led to lots of Nvidia’s largest purchasers stating that their capital expenditures for 2025 will likely be a lot larger than in earlier years.

Meta Platforms (META 1.11%) said that it’s going to spend $60 billion to $65 billion on capital expenditures this yr. Alphabet‘s (GOOG -0.54%) (GOOGL -0.49%) is even larger at $75 billion. Amazon (AMZN -0.73%) tops the charts with round $100 billion in capital expenditures anticipated for 2025. It is clear that there will likely be an unprecedented stage of spending in 2025.

META Capital Expenditures (TTM) information by YCharts

This bodes nicely for Nvidia’s enterprise, as these firms are amongst its greatest purchasers. Clearly, Nvidia’s enterprise will stay sturdy over the subsequent yr and certain nicely previous that. Mixed with Nvidia’s inventory being on sale, I would say the longer term seems to be vivid for each the inventory and the corporate.

Nvidia’s inventory has carried out nicely for traders who purchased at related valuation ranges

The final time Nvidia’s inventory was this low cost by way of its trailing price-to-earnings (P/E) metric was in August 2024. Since then, the inventory has risen round 25%, even with the DeepSeek-induced sell-off.

NVDA PE Ratio information by YCharts

You need to go even additional again to seek out when Nvidia’s inventory was buying and selling underneath 30 occasions ahead earnings. That was in Could 2024, and the inventory has risen practically 60% from that stage.

These are unbelievable returns, and any investor can be happy with a inventory like that of their portfolio.

Historical past is on Nvidia’s aspect, and the inventory seems to be traditionally low cost. Lots of Nvidia’s largest purchasers have said that AI spending goes to maintain rising, which bodes nicely for the inventory and the corporate. In consequence, Nvidia’s inventory seems to be like a robust purchase proper now.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet, Amazon, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Idiot has a disclosure coverage.