It is no secret anymore. Synthetic intelligence (AI) is driving the very best positive factors available in the market, and several other of the most important firms on the earth right now by market cap are solely there due to AI. Actually, the 5 most precious firms on the earth are all making main inroads into AI, and the one one within the prime 10 that is not is oil firm Saudi Aramco.

For those who’re nonetheless on the sidelines, you may wish to select at the least one AI-driven inventory so as to add to your portfolio. They are not all of the dangerous upstarts you is perhaps imagining. Actually, this checklist solely contains well-established trade giants that largely produce other companies as effectively. That offers traders stability of their inventory picks in addition to publicity to the driving power behind the market’s positive factors right now.

The highest 5, and the highest 10

The most important firms on the earth right now by market cap are:

- Apple (AAPL -2.58%)

- Nvidia (NVDA 0.35%)

- Microsoft (MSFT 0.19%)

- Alphabet (GOOG -0.20%)

- Amazon (AMZN 0.29%)

- Saudi Aramco

- Meta Platforms

- Tesla

- Broadcom

- Taiwan Semiconductor Manufacturing

Practically all of those firms are making strides in creating an AI enterprise. Apple is creating Apple Intelligence, offering its hundreds of thousands of customers by its ecosystem with high-level client AI companies included in its software program. Nvidia has as much as 95% of the worldwide marketplace for graphics processing items (GPUs), the chips that drive generative AI. Microsoft and Amazon each provide groundbreaking generative AI options to cloud computing shoppers, and Alphabet is popping its Google search service, which has 90% of the general search market, into an AI-powered resolution. That is the way forward for web looking out.

As for the final 4, Meta and Tesla are each utilizing AI as a part of their companies, somewhat than creating AI options. For instance, Meta is utilizing AI as a part of its digital actuality enterprise, and Tesla makes use of AI to energy a lot of the expertise it makes use of in electrical autos. Broadcom is a serious participant within the infrastructure that makes AI work, and Taiwan Semiconductor manufactures a lot of the world’s GPUs and different chips.

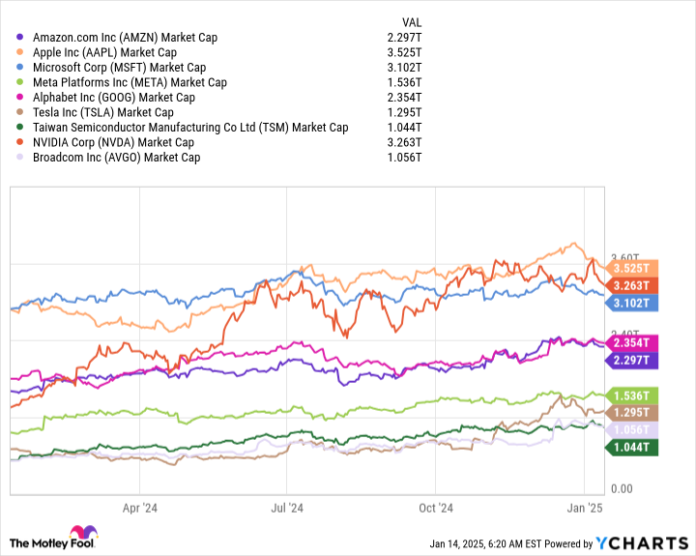

Here is a visible illustration of the highest 10 shares and their current market cap developments.

AMZN Market Cap knowledge by YCharts

What about different huge firms?

What I discover fascinating is that as you progress previous the highest 10, the following 10 are nearly fully non-AI firms. On this stage, the checklist consists of:

- Berkshire Hathaway

- Eli Lilly

- Walmart

- JPMorgan Chase

- Visa

- Tencent

- Mastercard

- ExxonMobil

- United HealthGroup

- Oracle

Why traders ought to listen

It is essential to notice that the mixed market cap of the second tier is about $6 trillion, lower than a 3rd of the highest tier, which has a mixed market cap of greater than $19 trillion. The primary group is not simply larger; it is a lot larger. And I am going to exit on a limb to say that the hole goes to widen this yr.

Picture supply: Getty Photos.

The AI alternative is solely monumental, and even with the mixed tailwinds of moderating inflation and decrease rates of interest, monetary and retail shares will not be capable of catch it. The AI market is anticipated to extend at a compound annual progress charge (CAGR) of 27.67% by 2030 in response to Statista, and the AI shares on this checklist are going to be a number of the fundamental beneficiaries.

I am going to finish with a cautionary notice that whereas traders ought to positively listen and put money into AI responsibly, they should not put all of their financial savings into AI shares. It is at the least as essential to scale back your threat by diversification, and for those who personal some strong, dependable worth shares, you will be extra assured about placing your progress {dollars} to be just right for you with AI shares.

JPMorgan Chase is an promoting companion of Motley Idiot Cash. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jennifer Saibil has positions in Apple. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, JPMorgan Chase, Mastercard, Meta Platforms, Microsoft, Nvidia, Oracle, Taiwan Semiconductor Manufacturing, Tencent, Tesla, Visa, and Walmart. The Motley Idiot recommends Broadcom and UnitedHealth Group and recommends the next choices: lengthy January 2025 $370 calls on Mastercard, lengthy January 2026 $395 calls on Microsoft, brief January 2025 $380 calls on Mastercard, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.