Shares of Walgreens Boots Alliance (WBA 2.86%) fell sharply final 12 months as a mix of declining vaccine demand, headwinds on shopper discretionary spending, and misguided acquisitions led to a collection of dismal earnings experiences from the corporate.

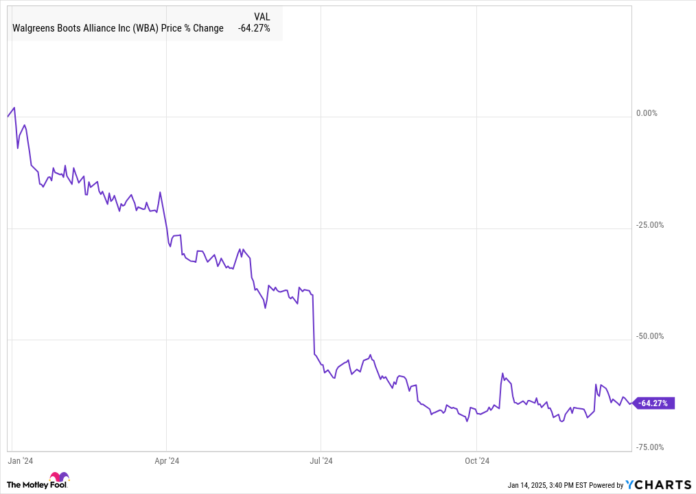

In consequence, Walgreens was compelled to chop its dividend, took a multibillion-dollar impairment cost, and misplaced its place within the Dow Jones Industrial Common (^DJI 0.52%). In line with knowledge from S&P International Market Intelligence, the inventory fell 64% over the course of 2024. As you possibly can see from the chart, the inventory fell steadily over a lot of the 12 months as its prospects continued to say no.

Why Walgreens collapsed

Walgreens fell steadily by means of the primary three quarters of the 12 months as the corporate missed estimates and minimize steerage, and Wall Road’s view of the inventory soured. By the fourth quarter, the inventory appeared to stabilize, however it had but to indicate indicators of restoration.

The lowlights began early for Walgreens, because it mentioned it was chopping its dividend early in January when it reported first-quarter earnings. The corporate slashed its dividend by 48% to $0.25 1 / 4, which it mentioned was a part of a concentrate on right-sizing prices and rising money circulate. It additionally maintained its adjusted earnings per share steerage on the time at $3.20-$3.50.

Within the second-quarter report, out on the finish of March, Walgreens dropped one other bomb on buyers, taking a $5.8 billion goodwill impairment on VillageMD. It acquired the first care and pressing care enterprise as a method to diversify and vertically combine, however it’s turn out to be clear that it vastly overpaid the enterprise. Walgreens paid $5.2 billion in 2021 to extend its stake in VillageMD from 30% to 63%, although its progress technique within the enterprise didn’t pan out. It additionally narrowed its adjusted EPS steerage to $3.20-$3.35 within the quarter.

Walgreens’ worst day of the 12 months got here on June 27, when the inventory fell 22% on one other disappointing earnings report. This time, it slashed its full-year EPS steerage to $2.80-$2.95 as a result of difficult pharmacy trade traits and a weak shopper atmosphere.

Picture supply: Getty Photos.

What’s subsequent for Walgreens?

Virtually all the things that would go flawed for Walgreens final 12 months did, however it confirmed indicators of restoration in its first-quarter earnings report earlier this month. Whereas administration expects adjusted earnings per share of simply $1.40-$1.80 this 12 months, the enterprise has appeared to stabilize, and the highest line is rising.

For dividend buyers, Walgreens is interesting proper now, providing a dividend yield of 10.9%, which ought to be protected if the enterprise has stabilized.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.